- France

- /

- Capital Markets

- /

- ENXTPA:VIL

3 Dividend Stocks Offering Up To 3.3% Yield For Steady Income

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by inflation concerns and economic uncertainties, investors are seeking stability amidst the volatility. With U.S. equities experiencing declines and small-cap stocks underperforming, dividend stocks offering steady income can be an attractive option for those looking to balance their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.45% | ★★★★★★ |

| MISC Berhad (KLSE:MISC) | 5.10% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.08% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 2003 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme, is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and Asia-Pacific with a market cap of €749.42 million.

Operations: VIEL & Cie generates revenue through three primary segments: Professional Intermediation (€1.05 billion), Stock Exchange Online (€71.02 million), and Contribution from Holdings (€3.63 million).

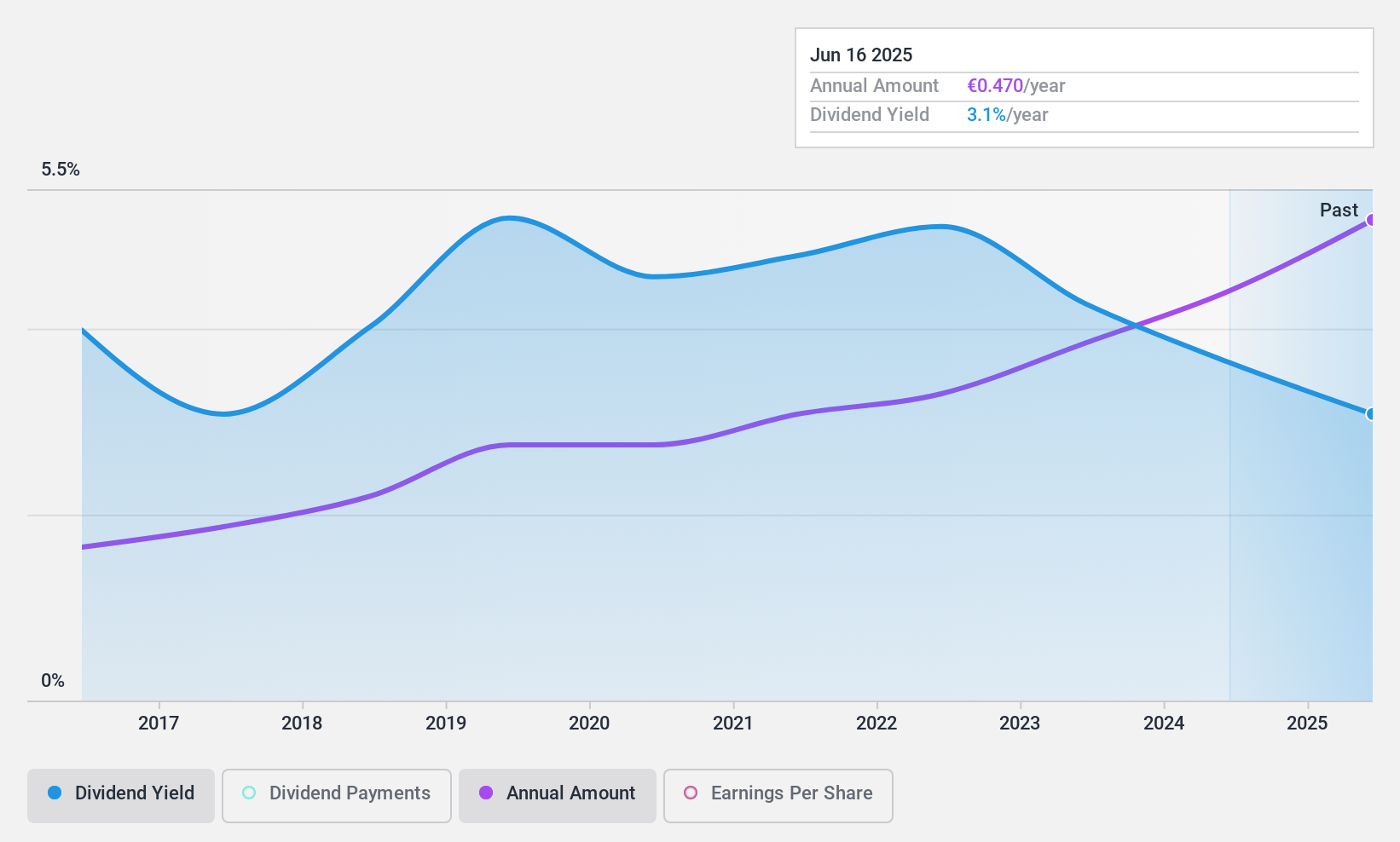

Dividend Yield: 3.4%

VIEL & Cie société anonyme has consistently provided reliable dividends over the past decade, with stable and growing payments supported by a low payout ratio of 22.4%. The dividend yield stands at 3.36%, below the top tier in France, but is well-covered by both earnings and cash flows, indicating sustainability. Despite trading at 35.7% below its estimated fair value, its dividend yield may not be as attractive compared to higher-yielding peers in the market.

- Click here to discover the nuances of VIEL & Cie société anonyme with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, VIEL & Cie société anonyme's share price might be too pessimistic.

I.B.I. Investment House (TASE:IBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: I.B.I Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management and a market cap of ₪2.34 billion.

Operations: I.B.I Investment House Ltd.'s revenue segments include Trading, Depository, and Execution Services (₪307.77 million), Alternative Investment Management (₪152.92 million), Equity Management and Operation Services (₪142.95 million), Pension and Financial Agencies (₪89.46 million), Investments for Own Account (₪16.16 million), and Issues and Underwriting (₪6.68 million).

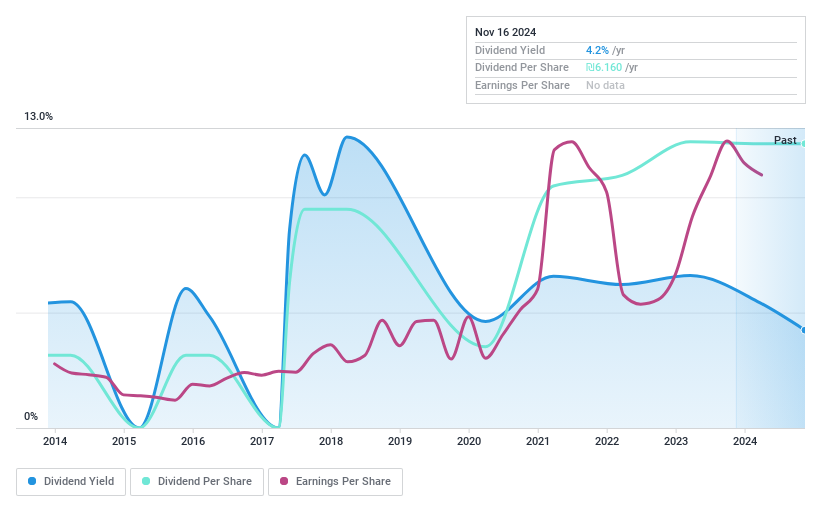

Dividend Yield: 3.4%

I.B.I. Investment House's dividend payments are well-covered by earnings and cash flows, with payout ratios of 48.9% and 48.1%, respectively, suggesting sustainability. However, the dividends have been volatile over the past decade despite some growth. The current yield of 3.37% is lower than top-tier payers in Israel but offers potential value as the stock trades at a discount to its estimated fair value by 10.8%. Recent earnings showed increased revenue but decreased net income year-over-year.

- Navigate through the intricacies of I.B.I. Investment House with our comprehensive dividend report here.

- Our valuation report here indicates I.B.I. Investment House may be undervalued.

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE offers information technology solutions in Germany and internationally, with a market capitalization of €373.25 million.

Operations: DATAGROUP SE generates revenue through its provision of IT solutions both within Germany and on an international scale.

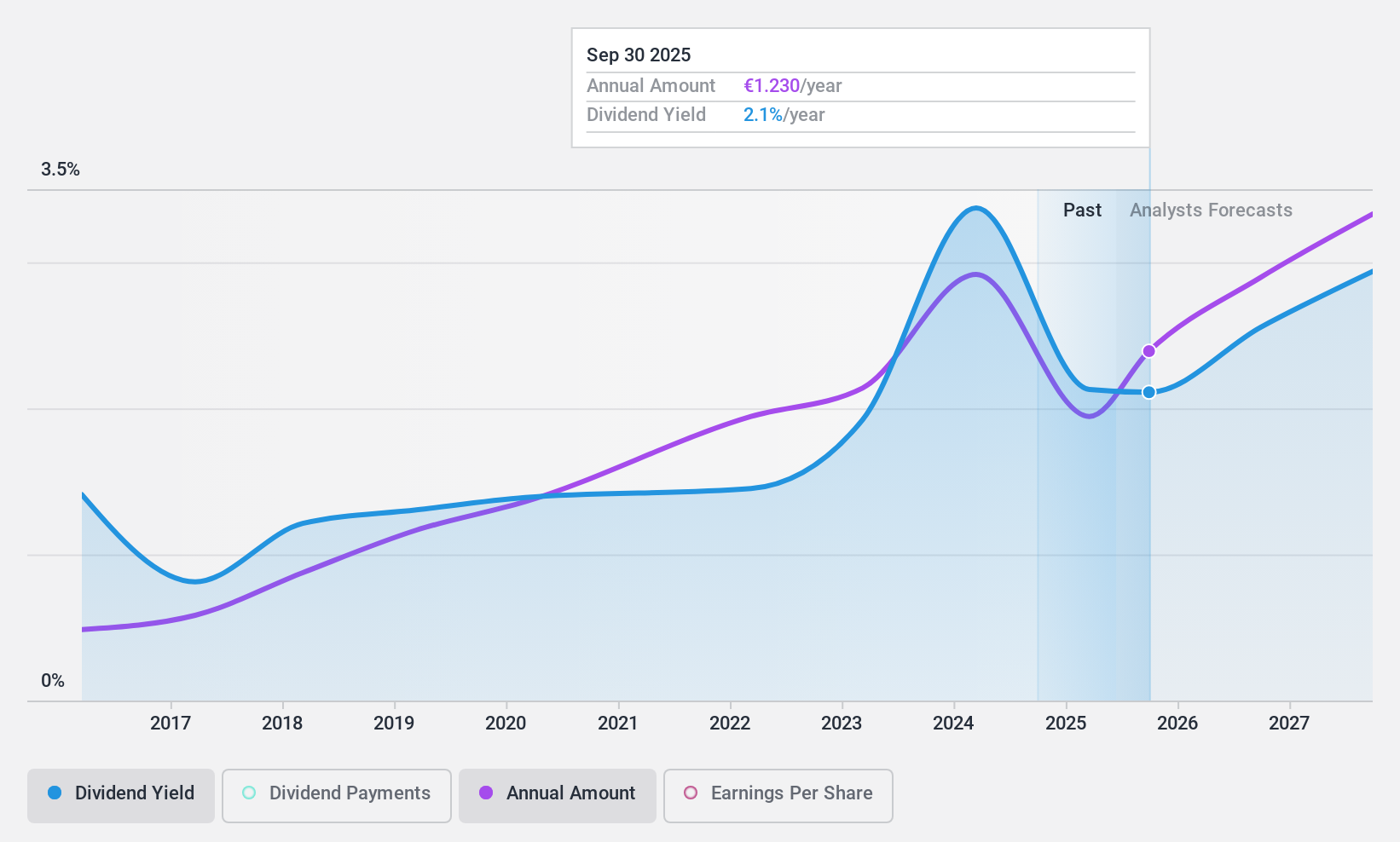

Dividend Yield: 3.3%

DATAGROUP's dividend yield of 3.35% is below the top 25% of German payers, but its dividends are well-covered by earnings and cash flows, with payout ratios of 48.1% and 32.6%, respectively. Despite a volatile dividend history over the past decade, there has been some growth in payments. The stock trades at a significant discount to estimated fair value, though it carries high debt levels. Recent earnings showed increased revenue but reduced net income year-over-year.

- Dive into the specifics of DATAGROUP here with our thorough dividend report.

- According our valuation report, there's an indication that DATAGROUP's share price might be on the cheaper side.

Make It Happen

- Get an in-depth perspective on all 2003 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Solid track record with excellent balance sheet and pays a dividend.