Cliq Digital (ETR:CLIQ) Will Pay A Larger Dividend Than Last Year At €1.79

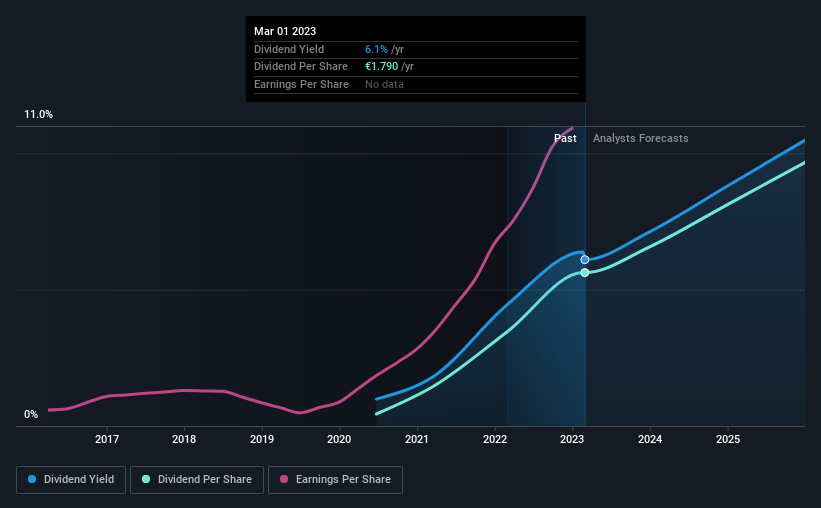

Cliq Digital AG's (ETR:CLIQ) dividend will be increasing from last year's payment of the same period to €1.79 on 13th of April. This will take the dividend yield to an attractive 6.1%, providing a nice boost to shareholder returns.

View our latest analysis for Cliq Digital

Cliq Digital's Earnings Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, Cliq Digital was quite comfortably covering its dividend with earnings and it was paying more than 75% of its free cash flow to shareholders. The company is clearly earning enough to pay this type of dividend, but it is definitely focused on returning cash to shareholders, rather than growing the business.

Over the next year, EPS is forecast to expand by 72.0%. If the dividend continues along recent trends, we estimate the payout ratio will be 23%, which is in the range that makes us comfortable with the sustainability of the dividend.

Cliq Digital Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. Since 2020, the annual payment back then was €0.14, compared to the most recent full-year payment of €1.79. This implies that the company grew its distributions at a yearly rate of about 134% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Cliq Digital has been growing its earnings per share at 53% a year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While Cliq Digital is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Cliq Digital (of which 1 is concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CLIQ

Cliq Digital

An online performance marketing company, sells digital products and bundled-content subscriptions to consumers in North America, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)