3 European Stocks Estimated To Be Up To 35.5% Below Intrinsic Value

Reviewed by Simply Wall St

The European markets have recently reached record levels, buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs. With major indices like Germany’s DAX and France’s CAC 40 showing significant gains, investors are increasingly looking for opportunities in undervalued stocks that may offer potential growth as market conditions evolve. Identifying such stocks often involves assessing their intrinsic value relative to current market prices, especially in an environment where economic indicators suggest a cautiously optimistic outlook.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Spindox (BIT:SPN) | €12.75 | €24.73 | 48.4% |

| SBO (WBAG:SBO) | €27.10 | €53.20 | 49.1% |

| Robit Oyj (HLSE:ROBIT) | €1.15 | €2.20 | 47.8% |

| Profoto Holding (OM:PRFO) | SEK17.80 | SEK35.08 | 49.3% |

| Lingotes Especiales (BME:LGT) | €5.75 | €11.22 | 48.7% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.375 | €0.72 | 47.8% |

| Echo Investment (WSE:ECH) | PLN5.58 | PLN10.71 | 47.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.39 | €6.63 | 48.9% |

| Atea (OB:ATEA) | NOK146.00 | NOK282.33 | 48.3% |

| Allegro.eu (WSE:ALE) | PLN33.495 | PLN66.20 | 49.4% |

We'll examine a selection from our screener results.

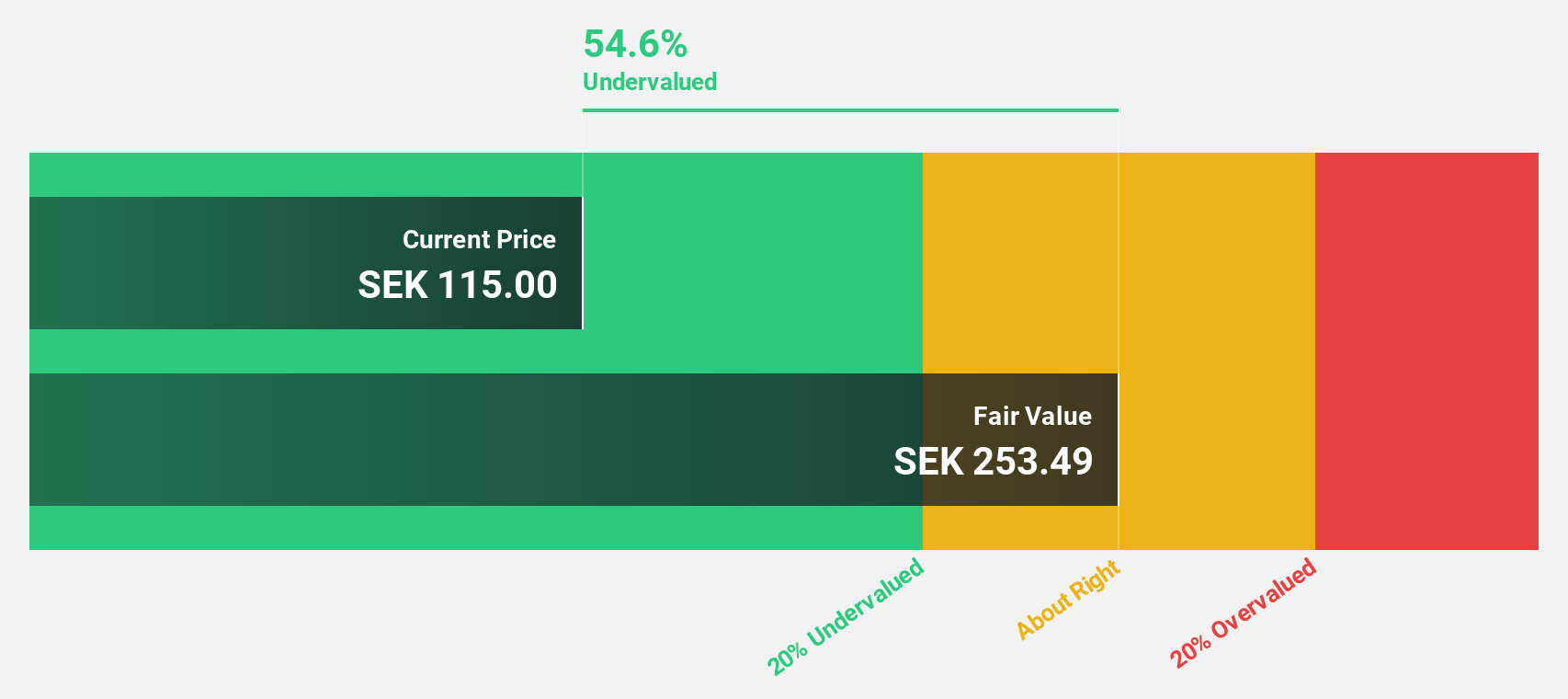

Ependion (OM:EPEN)

Overview: Ependion AB, with a market cap of SEK3.93 billion, offers digital solutions for secure control, management, visualization, and data communication in industrial applications through its subsidiaries.

Operations: The company's revenue is primarily derived from its Westermo segment, which generated SEK1.29 billion, and the Beijer Electronics segment (including Korenix), contributing SEK890.26 million.

Estimated Discount To Fair Value: 35.5%

Ependion is trading at SEK122.2, significantly below its estimated fair value of SEK189.38, reflecting an undervaluation based on discounted cash flow analysis. Despite recent declines in sales and net income for the second quarter and first half of 2025, Ependion's earnings are forecast to grow at 35.1% annually over the next three years, outpacing the Swedish market average growth rate of 16.4%, positioning it as a potentially attractive investment opportunity for those focused on cash flow valuation metrics.

- The analysis detailed in our Ependion growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Ependion's balance sheet health report.

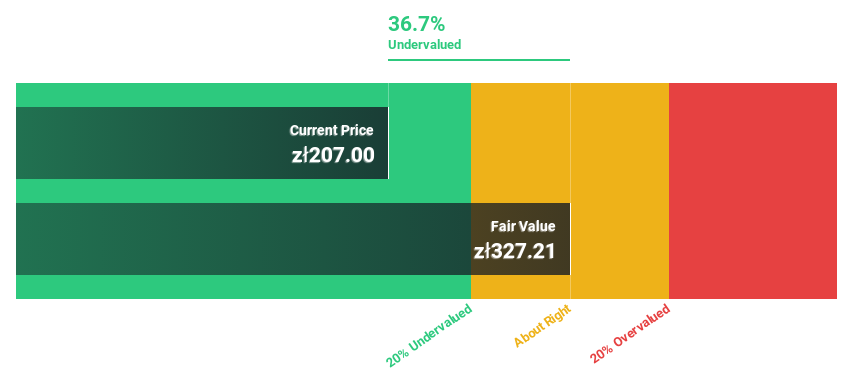

Synektik Spólka Akcyjna (WSE:SNT)

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland, with a market cap of PLN2.18 billion.

Operations: The company's revenue segments include PLN57.92 billion from Diagnostic and IT Equipment and PLN4.67 billion from the Production of Radio Pharmaceuticals.

Estimated Discount To Fair Value: 17.9%

Synektik Spólka Akcyjna's recent earnings report shows a rise in revenue to PLN 154.24 million for the third quarter, with net income increasing to PLN 23.71 million. The stock trades at PLN 255.6, undervalued by approximately 17.9% compared to its estimated fair value of PLN 311.31 based on discounted cash flow analysis. Although the dividend yield of 3.23% is not well covered by free cash flows, earnings are expected to grow significantly faster than the Polish market average over the next three years, driven by high-quality non-cash earnings and a projected return on equity of nearly half in three years' time.

- Insights from our recent growth report point to a promising forecast for Synektik Spólka Akcyjna's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Synektik Spólka Akcyjna.

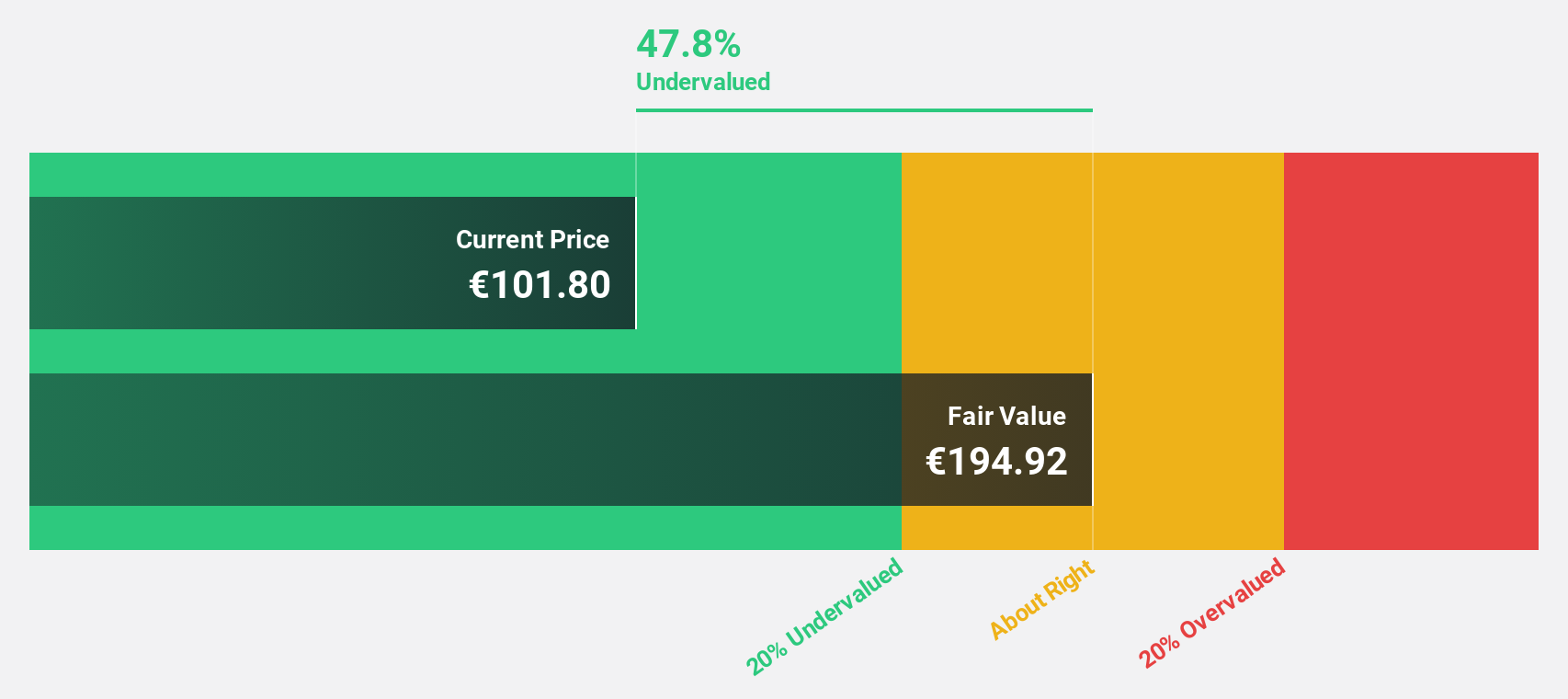

innoscripta (XTRA:1INN)

Overview: innoscripta SE offers software-as-a-service solutions for managing R&D tax incentives and project management consulting in Germany, with a market cap of €1.17 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling €85.92 million.

Estimated Discount To Fair Value: 19.4%

Innoscripta SE is trading at €117.4, undervalued by 19.4% compared to its estimated fair value of €145.69, based on discounted cash flow analysis. Earnings are forecasted to grow significantly at 27.9% annually over the next three years, outpacing the German market's growth rate of 16.5%. Revenue is also expected to rise by 24.7% per year, surpassing market expectations and contributing to a very high projected return on equity in three years' time (65%).

- Our earnings growth report unveils the potential for significant increases in innoscripta's future results.

- Navigate through the intricacies of innoscripta with our comprehensive financial health report here.

Where To Now?

- Explore the 208 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ependion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPEN

Ependion

Provides digital solutions for secure control, management, visualization, and data communication for industrial applications.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives