- Germany

- /

- Semiconductors

- /

- DB:CTNK

There Are Some Holes In centrotherm international's (FRA:CTNK) Solid Earnings Release

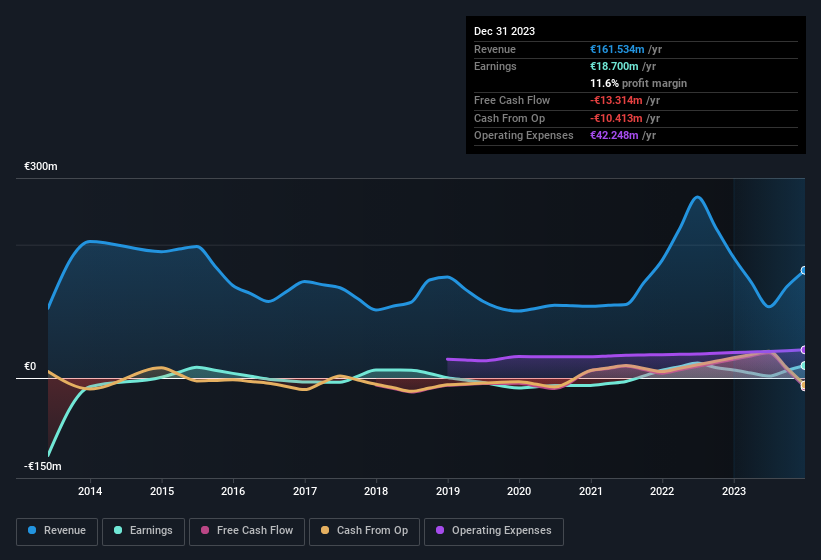

centrotherm international AG (FRA:CTNK) posted some decent earnings, but shareholders didn't react strongly. We think that they might be concerned about some underlying details that our analysis found.

See our latest analysis for centrotherm international

A Closer Look At centrotherm international's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

centrotherm international has an accrual ratio of 1.10 for the year to December 2023. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of €18.7m, a look at free cash flow indicates it actually burnt through €13m in the last year. We saw that FCF was €28m a year ago though, so centrotherm international has at least been able to generate positive FCF in the past. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation. This would partially explain why the accrual ratio was so poor. The good news for shareholders is that centrotherm international's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of centrotherm international.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that centrotherm international profited from a tax benefit which contributed €3.2m to profit. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On centrotherm international's Profit Performance

This year, centrotherm international couldn't match its profit with cashflow. If the tax benefit is not repeated, then profit would drop next year, all else being equal. For the reasons mentioned above, we think that a perfunctory glance at centrotherm international's statutory profits might make it look better than it really is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For instance, we've identified 3 warning signs for centrotherm international (1 can't be ignored) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if centrotherm international might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:CTNK

centrotherm international

Provides production equipment and solutions for the photovoltaic, semiconductor, and microelectronic industries worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives