- Germany

- /

- Specialty Stores

- /

- XTRA:CEC

Ceconomy’s (XTRA:CEC) Index Exit: Could Shifting Investor Demand Change Its Strategic Path?

Reviewed by Sasha Jovanovic

- Ceconomy AG was recently removed from the Germany Small DAX (Total Return) Index, changing its status among tracked German equities.

- This exclusion may affect its visibility and demand from funds that track the index, influencing the company’s relationship with institutional investors.

- We’ll explore how Ceconomy's index removal may impact its investment case, especially regarding its profile among index-oriented investors.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ceconomy Investment Narrative Recap

To be a shareholder in Ceconomy right now, one needs to believe in the company’s ability to expand its omnichannel capabilities and unlock value from digital and service segments, despite pressures from online competitors and weak consumer sentiment in Germany. The company’s removal from the Germany Small DAX (Total Return) Index is unlikely to affect near-term catalysts, with the proposed JD.com acquisition remaining the central focus; however, reduced index visibility could influence future institutional demand. The largest risk, sustained cost inflation, remains unchanged and is not directly impacted by this index event.

Among recent developments, the acquisition proposal by JD.com stands out as the most relevant. The delisting plans tied to this potential transaction could further affect share liquidity and investor access, especially for index-driven funds. Any delays or uncertainties around the completion of this deal would directly influence Ceconomy’s near-term valuation and strategic outlook.

By contrast, investors also need to be aware of persistent margin pressures and what they could mean if...

Read the full narrative on Ceconomy (it's free!)

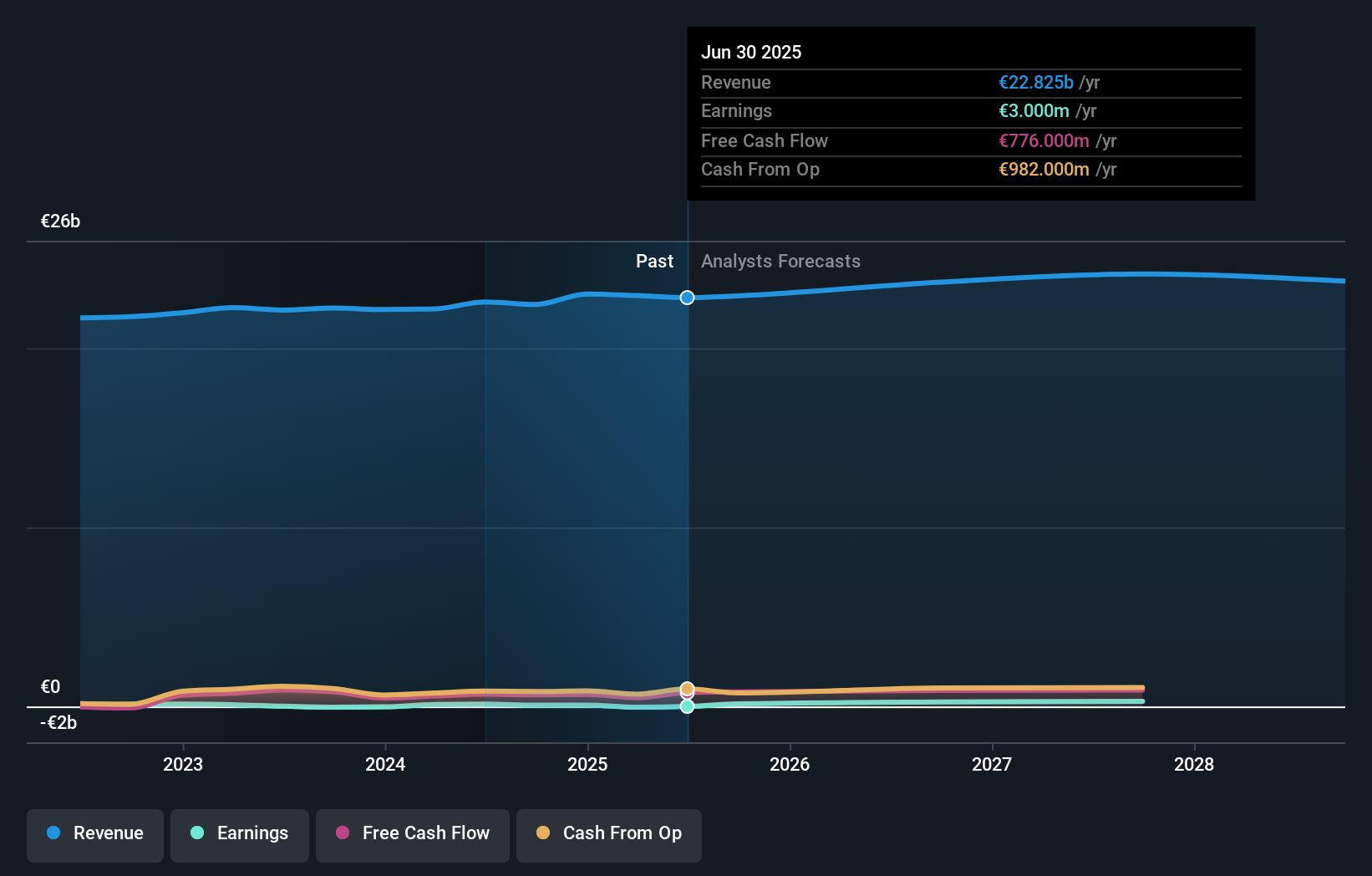

Ceconomy's narrative projects €24.8 billion revenue and €457.8 million earnings by 2028. This requires 2.8% yearly revenue growth and a €454.8 million increase in earnings from €3.0 million today.

Uncover how Ceconomy's forecasts yield a €4.53 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Ceconomy, ranging from €4.53 to €10.52 per share. While opinions vary widely, heightened focus remains on the proposed JD.com acquisition and how it could shape the company’s future amid ongoing sector shifts.

Explore 2 other fair value estimates on Ceconomy - why the stock might be worth over 2x more than the current price!

Build Your Own Ceconomy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ceconomy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ceconomy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ceconomy's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CEC

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)