- Germany

- /

- Specialty Stores

- /

- XTRA:AG1

The Bull Case For AUTO1 Group (XTRA:AG1) Could Change Following Major Expansion of Autohero Production Centers

Reviewed by Sasha Jovanovic

- Earlier this month, AUTO1 Group SE announced the opening of three new production centers in Italy, Austria, and the Netherlands for its Autohero retail brand, increasing annual refurbishment capacity to 248,400 cars and creating about 550 local jobs.

- This significant operational development enhances AUTO1 Group's control over quality, supports growing demand, and marks a major step in scaling its direct-to-consumer business.

- Let's explore how this expansion of production capacity and internalization of refurbishment impacts AUTO1 Group's broader investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AUTO1 Group Investment Narrative Recap

Investing in AUTO1 Group means believing in the company’s ability to leverage technology and operational scale to become a leading force in the European used car retail market. While the new production centers should support the key short-term catalyst of growing Autohero’s volume and quality control, the biggest near-term risk remains the impact of higher operational costs, particularly as AUTO1 increases investment in marketing and staffing, this news does not materially alter that risk profile.

The announcement of AUTO1 Group’s upcoming CFO transition is especially relevant right now, with Christian Wallentin’s deep banking and finance background coming at a time when operational scale is accelerating and financial discipline will be under the spotlight as new investments ramp up. The smooth handover period through the end of 2025 signals continuity but the focus for investors remains on balancing rapid expansion against cost management...

Read the full narrative on AUTO1 Group (it's free!)

AUTO1 Group's outlook anticipates €10.0 billion in revenue and €213.2 million in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 13.9%, with earnings expected to rise by €159.0 million from the current €54.2 million.

Uncover how AUTO1 Group's forecasts yield a €29.24 fair value, in line with its current price.

Exploring Other Perspectives

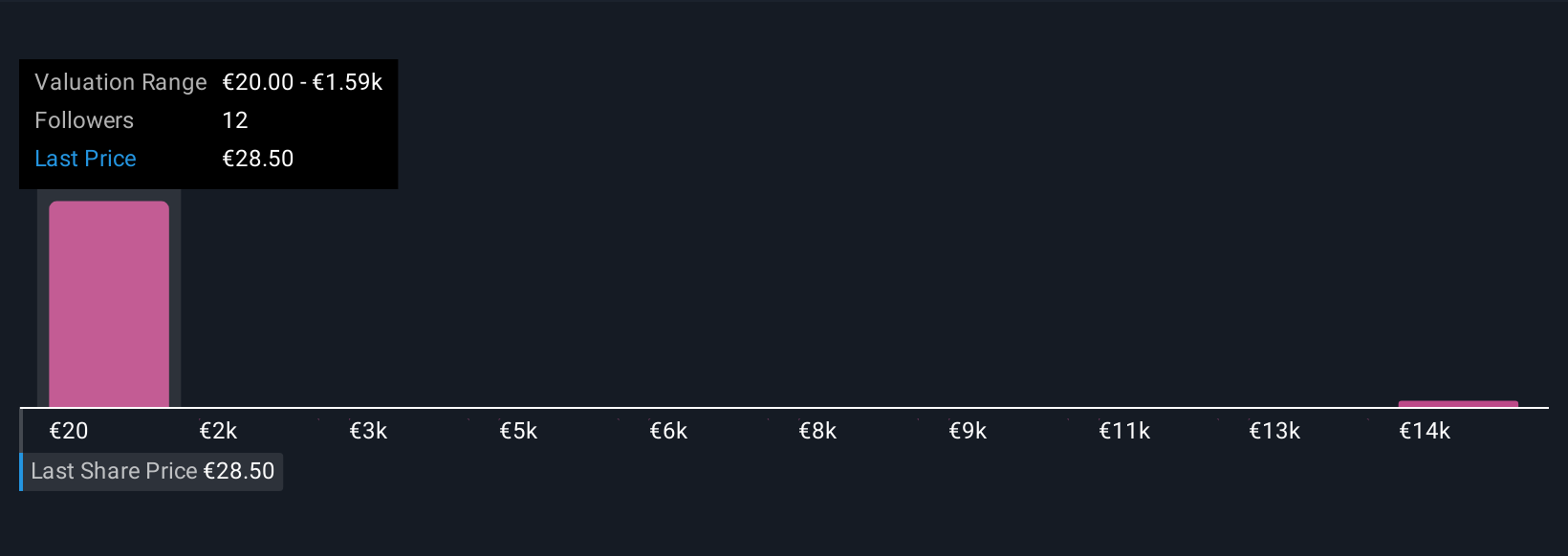

Five fair value estimates from the Simply Wall St Community show a wide range, from €20 to €15,721.92. With expansion driving up operational spending and margins in focus, investor opinions clearly differ, see how your view compares.

Explore 5 other fair value estimates on AUTO1 Group - why the stock might be worth 33% less than the current price!

Build Your Own AUTO1 Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AUTO1 Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AUTO1 Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AUTO1 Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AG1

AUTO1 Group

A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in