- Germany

- /

- Real Estate

- /

- XTRA:WCMK

WCM Beteiligungs- und Grundbesitz-AG (ETR:WCMK) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies WCM Beteiligungs- und Grundbesitz-AG (ETR:WCMK) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for WCM Beteiligungs- und Grundbesitz-AG

What Is WCM Beteiligungs- und Grundbesitz-AG's Debt?

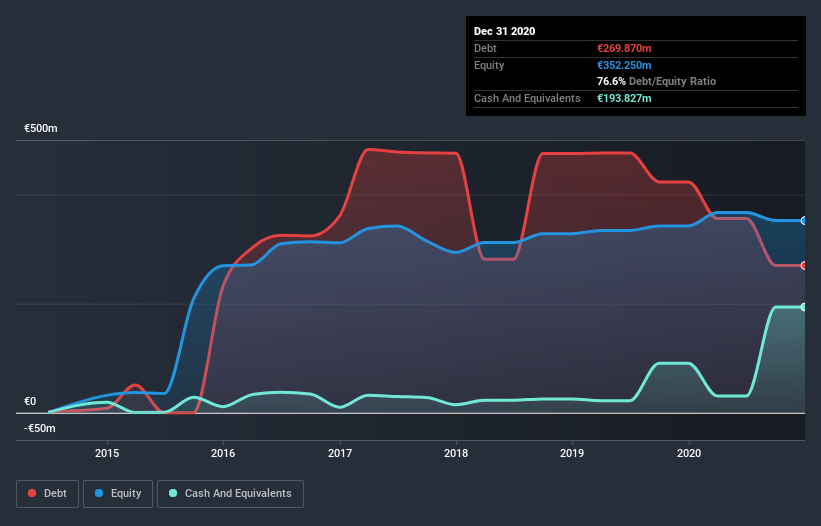

You can click the graphic below for the historical numbers, but it shows that WCM Beteiligungs- und Grundbesitz-AG had €269.9m of debt in December 2020, down from €423.2m, one year before. However, it does have €193.8m in cash offsetting this, leading to net debt of about €76.0m.

A Look At WCM Beteiligungs- und Grundbesitz-AG's Liabilities

Zooming in on the latest balance sheet data, we can see that WCM Beteiligungs- und Grundbesitz-AG had liabilities of €66.7m due within 12 months and liabilities of €274.0m due beyond that. Offsetting these obligations, it had cash of €193.8m as well as receivables valued at €3.96m due within 12 months. So its liabilities total €143.0m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because WCM Beteiligungs- und Grundbesitz-AG is worth €617.0m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

WCM Beteiligungs- und Grundbesitz-AG has net debt worth 1.5 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 6.9 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Also positive, WCM Beteiligungs- und Grundbesitz-AG grew its EBIT by 28% in the last year, and that should make it easier to pay down debt, going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since WCM Beteiligungs- und Grundbesitz-AG will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, WCM Beteiligungs- und Grundbesitz-AG recorded free cash flow of 44% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

The good news is that WCM Beteiligungs- und Grundbesitz-AG's demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. And its interest cover is good too. All these things considered, it appears that WCM Beteiligungs- und Grundbesitz-AG can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for WCM Beteiligungs- und Grundbesitz-AG you should be aware of, and 2 of them make us uncomfortable.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading WCM Beteiligungs- und Grundbesitz-AG or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade WCM Beteiligungs- und Grundbesitz-AG, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WCM Beteiligungs- und Grundbesitz-AG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:WCMK

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives