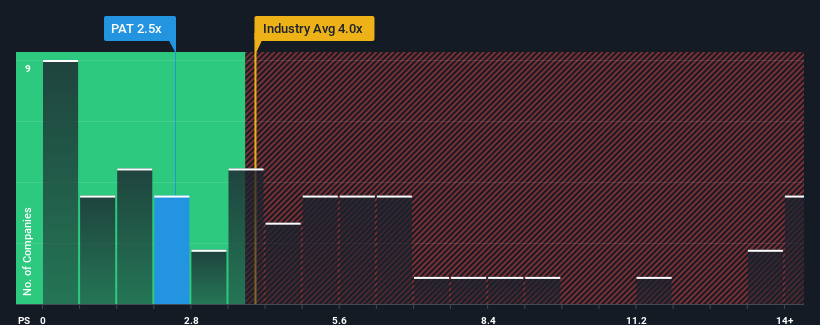

PATRIZIA SE's (ETR:PAT) price-to-sales (or "P/S") ratio of 2.5x might make it look like a buy right now compared to the Real Estate industry in Germany, where around half of the companies have P/S ratios above 4x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for PATRIZIA

How Has PATRIZIA Performed Recently?

Recent times have been more advantageous for PATRIZIA as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on PATRIZIA will help you uncover what's on the horizon.How Is PATRIZIA's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like PATRIZIA's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. As a result, revenue from three years ago have also fallen 3.1% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 4.7%. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 32%, that would be a solid result.

With this in consideration, we find it intriguing that PATRIZIA's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From PATRIZIA's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into PATRIZIA's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for PATRIZIA that we have uncovered.

If you're unsure about the strength of PATRIZIA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:PAT

PATRIZIA

PATRIZIA has been providing investment opportunities in smart real assets for institutional, semi-professional, and private investors for more than 40 years, focusing on real estate and infrastructure.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)