- Germany

- /

- Real Estate

- /

- XTRA:NUVA

Positive Sentiment Still Eludes Noratis AG (ETR:NUVA) Following 26% Share Price Slump

Noratis AG (ETR:NUVA) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

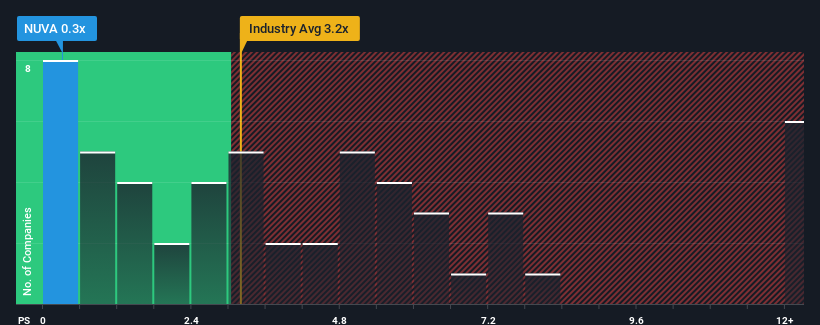

Since its price has dipped substantially, Noratis may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Real Estate industry in Germany have P/S ratios greater than 3.2x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Noratis

What Does Noratis' P/S Mean For Shareholders?

Recent times have been more advantageous for Noratis as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

Want the full picture on analyst estimates for the company? Then our free report on Noratis will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Noratis' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.9%. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 35% each year during the coming three years according to the only analyst following the company. Meanwhile, the broader industry is forecast to contract by 12% per year, which would indicate the company is doing very well.

With this information, we find it very odd that Noratis is trading at a P/S lower than the industry. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Shares in Noratis have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Noratis currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Noratis (2 make us uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Noratis, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Noratis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NUVA

Noratis

A real estate company, invests in, develops, manages, and sells residential property portfolios in Germany.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives