- Germany

- /

- Life Sciences

- /

- XTRA:GXI

Should FDA Approval of Lasix ONYU Prompt a Closer Look at Gerresheimer’s (XTRA:GXI) Growth Path?

Reviewed by Sasha Jovanovic

- On October 13, 2025, SQ Innovation received FDA approval for Lasix ONYU, a combination product featuring Gerresheimer’s proprietary on-body infusor for at-home subcutaneous drug delivery in select congestive heart failure patients.

- This milestone showcases Gerresheimer’s technological capabilities in advanced drug delivery devices and highlights its growing position as a full-service partner to pharmaceutical companies embracing home-based care.

- Next, we’ll explore how the FDA-backed rollout of Gerresheimer’s infusor technology could influence its longer-term outlook and growth assumptions.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Gerresheimer Investment Narrative Recap

To own Gerresheimer stock, you need to believe in its transformation into a full-service partner for pharma companies, capitalizing on demand for advanced drug delivery devices and high-value packaging. While the FDA approval of Lasix ONYU confirms Gerresheimer’s technical capabilities, in the short term the most important catalyst, successful integration and ramp-up of new product lines, remains unchanged, and the main risk continues to be execution challenges in integrating Bormioli Pharma and managing associated costs. The approval serves as encouraging validation, but does not fundamentally alter the immediate operational or financial risk profile.

One of the most relevant recent announcements was the October 8, 2025 adjustment to Gerresheimer’s full-year 2025 guidance, now expecting an organic revenue decline of 2–4%. This revision coincided with ongoing integration activities and headwinds in traditional packaging segments, adding context to the significance of new product wins like Lasix ONYU as potential offsets to near-term softness.

By contrast, investors should be aware of the ongoing integration risks tied to the Bormioli Pharma acquisition, particularly as Gerresheimer balances production ramp-ups and cost control ...

Read the full narrative on Gerresheimer (it's free!)

Gerresheimer's outlook anticipates €2.9 billion in revenue and €197.3 million in earnings by 2028. This is based on a projected 9.5% annual revenue growth rate and an increase in earnings of €134 million from the current €63.3 million.

Uncover how Gerresheimer's forecasts yield a €56.36 fair value, a 101% upside to its current price.

Exploring Other Perspectives

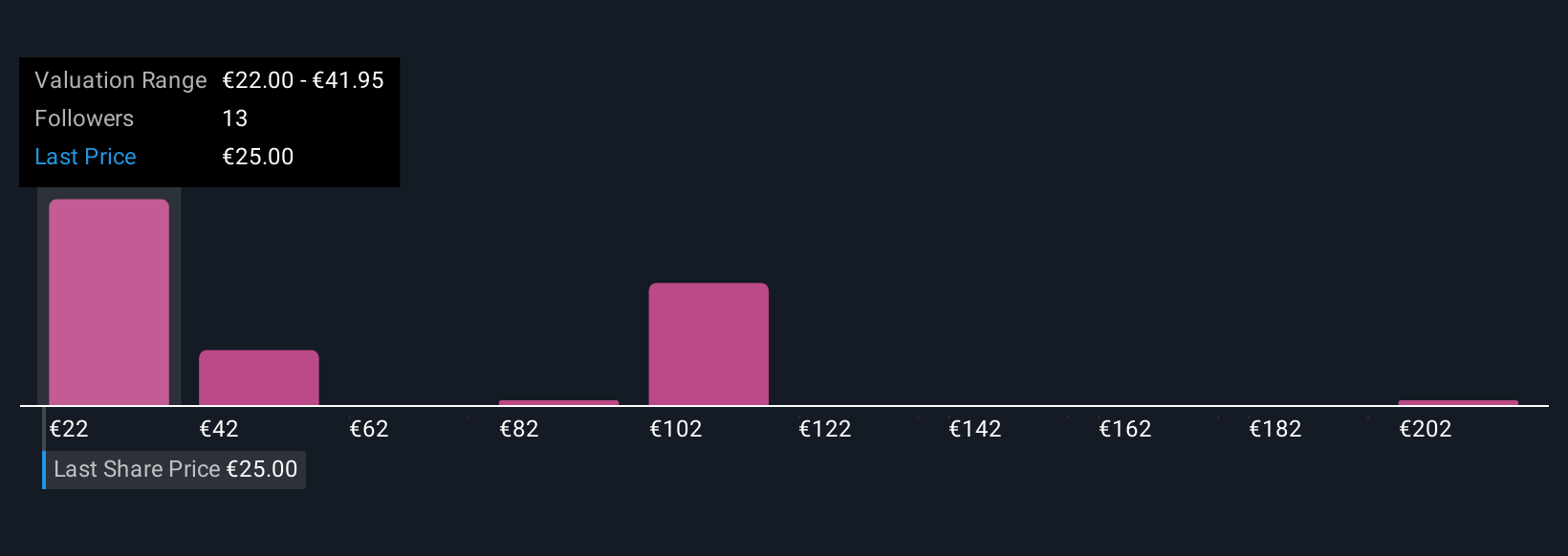

Fair value estimates from 10 Simply Wall St Community members range from €37.84 to €221.45 per share. As you review these opinions, keep in mind that integration risks could have broad implications for Gerresheimer’s earnings and profitability, suggesting reasons for differing outlooks.

Explore 10 other fair value estimates on Gerresheimer - why the stock might be worth over 7x more than the current price!

Build Your Own Gerresheimer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gerresheimer research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Gerresheimer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gerresheimer's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:GXI

Gerresheimer

Provides medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion