Does Bayer’s 40% Rally Signal a Turning Point After Legal Settlement News?

Reviewed by Bailey Pemberton

Thinking about what to do with Bayer stock? You are definitely not alone. With a year-to-date gain of 40.6%, Bayer has surprised many investors and grabbed the attention of market watchers who remember its far rockier past. Over the last three years, shares are still down a dramatic 42.4%, but this recent resurgence has some asking whether the tide has finally turned.

Bayer’s longer-term story has been marked by volatility, with notable dips over the last five years and a relatively modest 3.6% gain in the past year. Despite the bumps, the stock has recently attracted renewed interest as broader sector trends and shifts in investor sentiment put large healthcare and life sciences companies back in the spotlight. Many see Bayer’s price swings as a reflection of changing risk perceptions, especially as investors weigh the company’s complex legal landscape and growth potential against its global scale and diversified product lines.

If you are focused on value, there is even more reason to look closely. Bayer earns a valuation score of 5 out of 6, suggesting it is undervalued on virtually all commonly used metrics. But what does this score really mean for you, and how reliable are these checks on their own? Let’s break down how Bayer stacks up across different valuation approaches, and explore an even more effective way to judge if the stock might be a buy at current levels.

Approach 1: Bayer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and then discounting them back to today’s value. This approach allows investors to assess what the business might truly be worth based on its potential to generate cash in the years ahead.

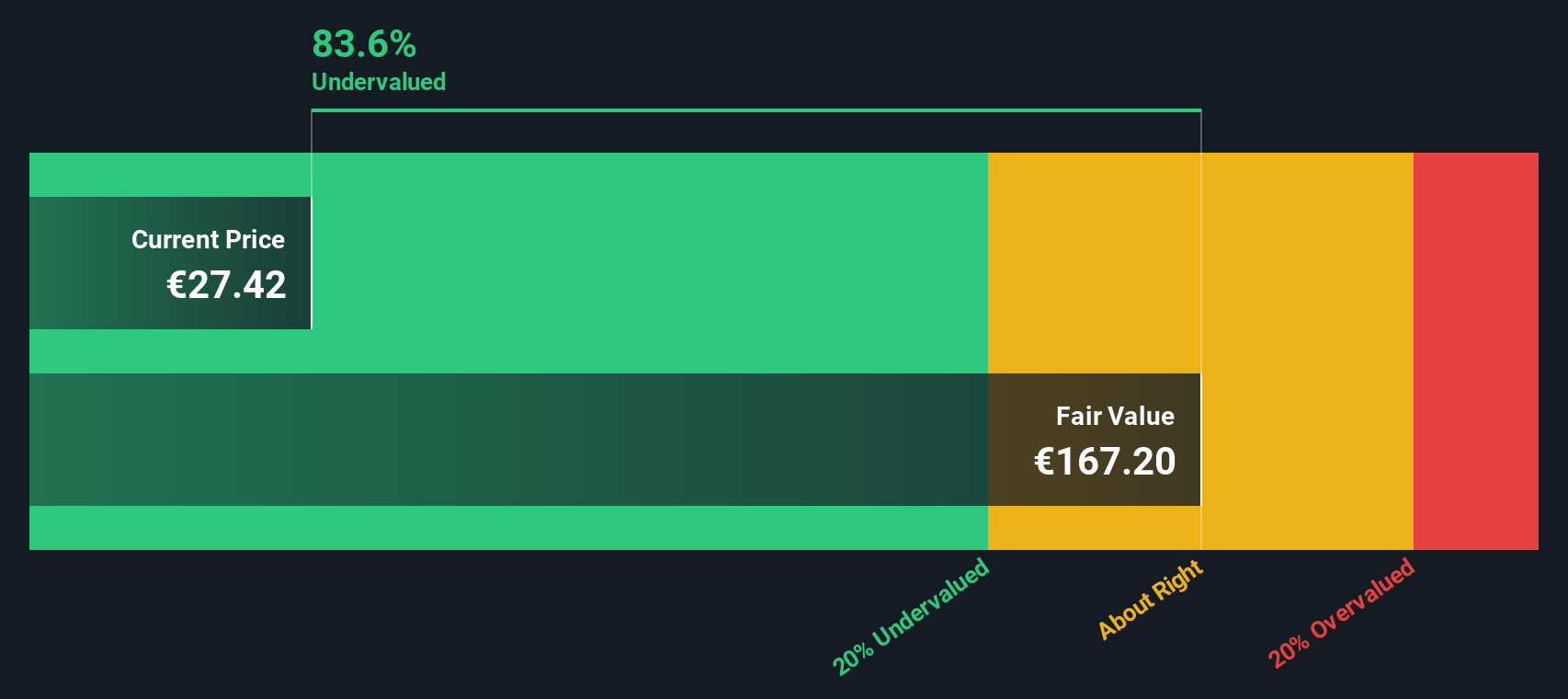

Bayer’s latest reported Free Cash Flow (FCF) stands at approximately €4.41 billion. According to analyst estimates and Simply Wall St's extrapolations, Bayer’s annual FCF is projected to grow steadily, potentially reaching about €7.49 billion by 2035. Analysts have provided detailed projections out to 2029, with FCF estimated at €6.15 billion that year. Beyond that, growth rates taper modestly in line with industry expectations.

Using this cash flow trajectory, the DCF model arrives at an intrinsic share value of €167.46. When compared to the current market price, the model suggests Bayer stock is trading at a substantial 83.7% discount to its estimated value. This points to a significant undervaluation, meaning the share price does not currently reflect the company’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bayer is undervalued by 83.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

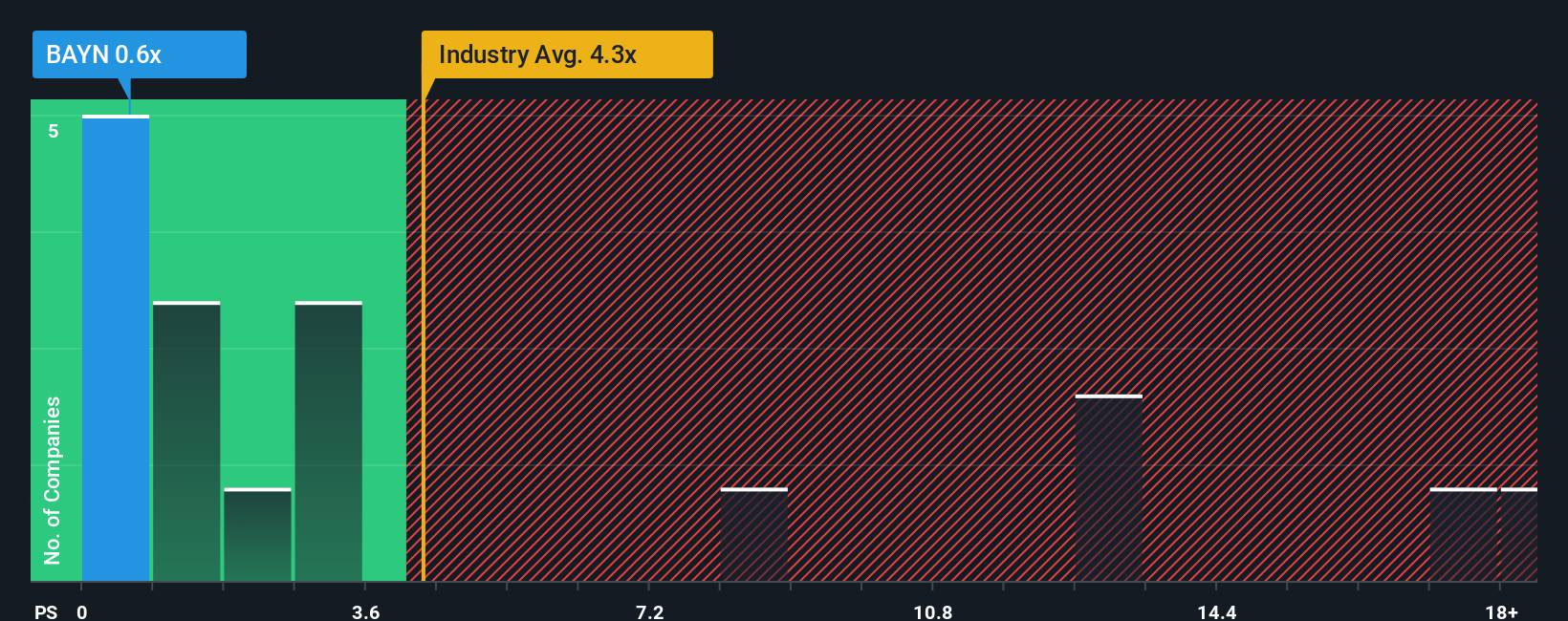

Approach 2: Bayer Price vs Sales

For companies like Bayer, which generate significant revenues across multiple business segments, the Price-to-Sales (P/S) ratio is a favored valuation metric. This is because it allows investors to quickly compare how much they are paying for each euro of Bayer’s generated sales, regardless of fluctuations in net earnings that could be distorted by non-cash items or one-off charges. The P/S ratio is particularly useful for businesses where profitability can be temporarily impacted by investments, legal costs, or cyclical trends, while underlying revenues remain robust.

Bayer is currently valued at a P/S ratio of 0.58x. This stands out compared to the Pharmaceuticals industry average of 2.76x and a peer group average of 1.96x, signaling a steep discount. However, there is more to the story than just a simple comparison. Multiples can be influenced by growth prospects and perceived risks, with faster-growing or more reliable companies typically commanding higher ratios. That is why it is crucial to factor in the quality of Bayer’s sales, its profit margins, and the risks specific to its markets and recent history.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated here as 1.44x, is designed to reflect the appropriate P/S multiple for Bayer specifically. It incorporates factors like its earnings growth, industry conditions, operating margins, scale, and risk environment. Unlike a plain industry average or peer comparison, the Fair Ratio aims to give an investor a more tailored benchmark for what the shares should be worth on a sales multiple basis today.

Comparing Bayer’s current P/S of 0.58x to the Fair Ratio of 1.44x, the company’s stock appears to be trading at a notable discount to where it should be. This suggests potential undervaluation based on underlying sales strength and adjusted for its unique risks and growth profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bayer Narrative

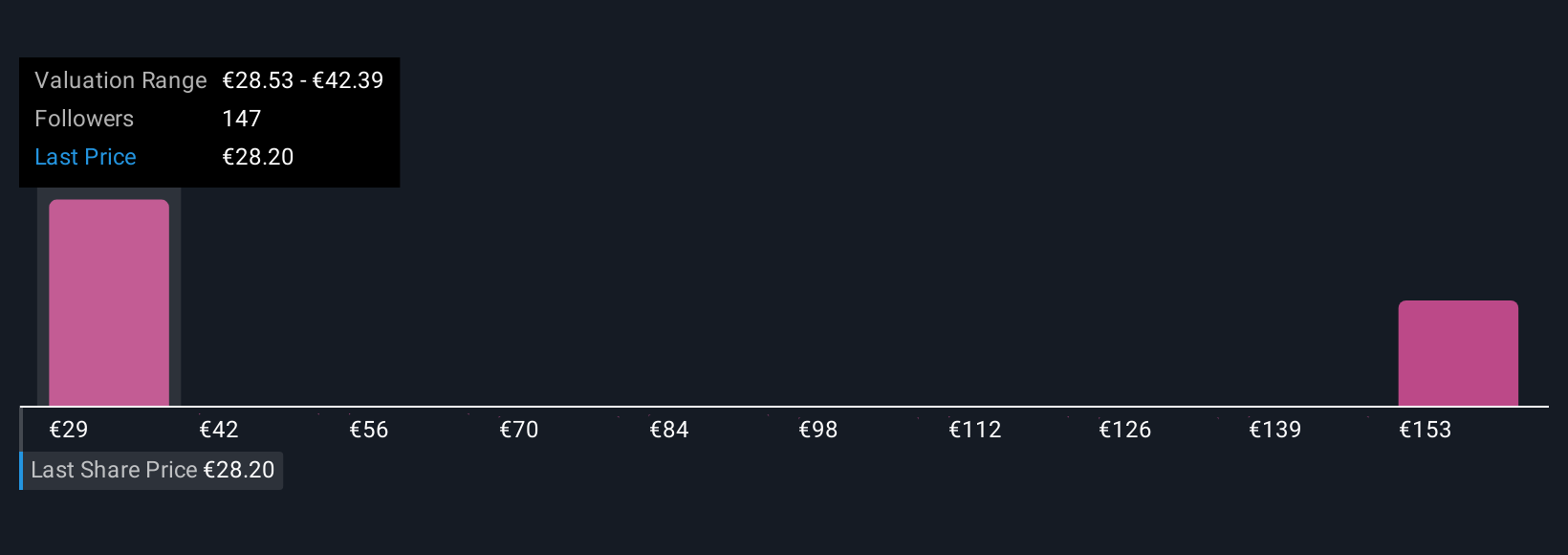

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, backed by the numbers you believe in, such as expected revenue, margins, or fair value. Narratives bring together both the "why" and the "how much" of investing. By linking Bayer’s business outlook to those key financial forecasts, a Narrative helps you see how the story actually impacts fair value and your buy or sell decision.

The beauty of Narratives is they are straightforward and accessible. On Simply Wall St’s platform (within the Community page), you can view, create, or compare Narratives used by millions of other investors. This means you do not need to build a model from scratch to visualize your thesis. Narratives let you measure your view against the current price, showing clearly if you (or the community) believe Bayer is undervalued or overvalued. They also update automatically as new earnings or news comes in, so your investment picture is always up to date.

For Bayer, this might mean one investor expects robust innovation and cost-saving strategies will drive a fair value as high as €39.0 per share. Another, more cautious investor, might factor in legal risks and expect a fair value closer to €23.0. With Narratives, you see the full spectrum and can decide which story and value makes sense to you.

Do you think there's more to the story for Bayer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives