Biofrontera AG (ETR:B8F) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

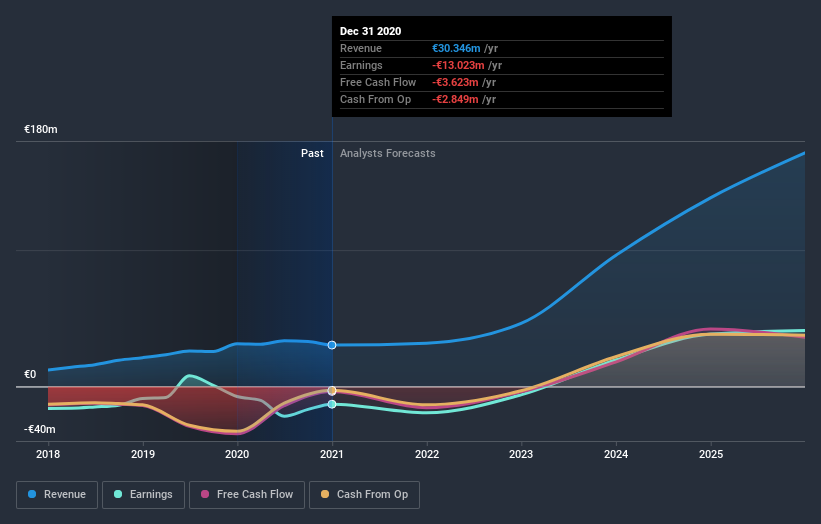

Last week, you might have seen that Biofrontera AG (ETR:B8F) released its yearly result to the market. The early response was not positive, with shares down 6.3% to €2.38 in the past week. It was an okay result overall, with revenues coming in at €30m, roughly what the analysts had been expecting. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Biofrontera after the latest results.

Check out our latest analysis for Biofrontera

After the latest results, the three analysts covering Biofrontera are now predicting revenues of €31.7m in 2021. If met, this would reflect a credible 4.5% improvement in sales compared to the last 12 months. Losses are forecast to balloon 21% to €0.29 per share. Before this earnings announcement, the analysts had been modelling revenues of €34.6m and losses of €0.28 per share in 2021. Overall it looks as though the analysts are negative in this update. Although sales forecasts held steady, the consensus also made a moderate increase in to its losses per share forecasts.

The analysts lifted their price target 61% to €10.33, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Biofrontera, with the most bullish analyst valuing it at €13.00 and the most bearish at €7.65 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Biofrontera's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Biofrontera's revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 4.5% growth on an annualised basis. This is compared to a historical growth rate of 39% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 26% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Biofrontera.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Biofrontera going out to 2025, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 2 warning signs for Biofrontera that you should be aware of.

If you’re looking to trade Biofrontera, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Biofrontera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:B8FK

Biofrontera

A biopharmaceutical company, engages in the research, development, and distribution of dermatological products in Germany, Spain, the United Kingdom, rest of Europe, the United States, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)