Do Media and Games Invest's (ETR:M8G) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Media and Games Invest (ETR:M8G). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Our analysis indicates that M8G is potentially undervalued!

Media and Games Invest's Improving Profits

In the last three years Media and Games Invest's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Media and Games Invest's EPS shot up from €0.067 to €0.10; a result that's bound to keep shareholders happy. That's a impressive gain of 50%.

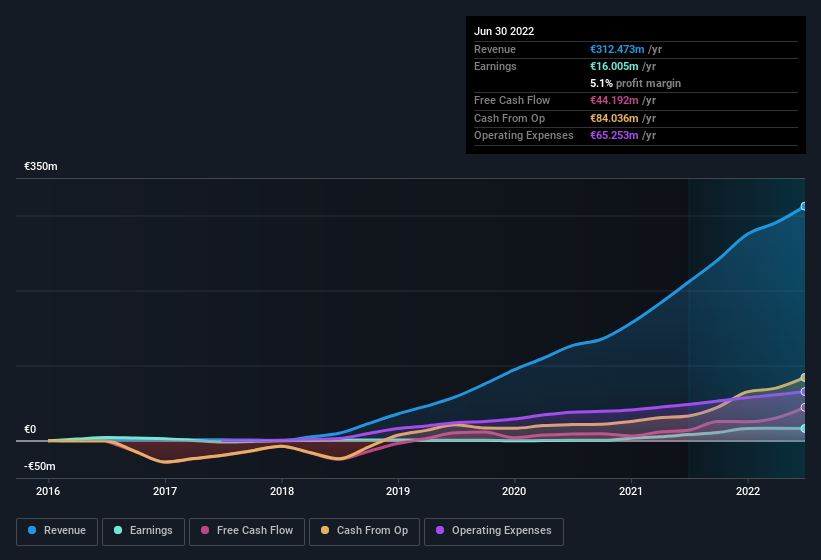

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Media and Games Invest maintained stable EBIT margins over the last year, all while growing revenue 48% to €312m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Media and Games Invest?

Are Media and Games Invest Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite €97k worth of sales, Media and Games Invest insiders have overwhelmingly been buying the stock, spending €581k on purchases in the last twelve months. This overall confidence in the company at current the valuation signals their optimism. It is also worth noting that it was Independent Director Elizabeth Para who made the biggest single purchase, worth €107k, paying €4.10 per share.

Along with the insider buying, another encouraging sign for Media and Games Invest is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at €74m, they have plenty of motivation to push the business to succeed. At 28% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

Should You Add Media and Games Invest To Your Watchlist?

You can't deny that Media and Games Invest has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Even so, be aware that Media and Games Invest is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

The good news is that Media and Games Invest is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M8G

Verve Group

A digital media company, engages in the provision of ad-software solutions in North America and Europe.

Moderate and good value.

Similar Companies

Market Insights

Community Narratives