As European markets show signs of recovery, with the STOXX Europe 600 Index climbing 3.93% over a recent seven-day period, investor sentiment is buoyed by the European Central Bank's decision to cut rates amid ongoing trade uncertainties. Amidst these developments, penny stocks—though an old term—remain a relevant investment area for those interested in smaller or newer companies. By focusing on solid financial foundations and potential growth trajectories, investors can uncover significant value in these stocks; we've selected three such examples that may offer both stability and upside potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.63 | SEK239.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.80 | SEK231.19M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.60 | PLN122.02M | ✅ 3 ⚠️ 2 View Analysis > |

| FAE Technology (BIT:FAE) | €2.27 | €45.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Cellularline (BIT:CELL) | €2.51 | €52.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.03 | €23.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.15 | €296.84M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 428 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Greenland Resources (DB:M0LY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greenland Resources Inc. is a mining company focused on acquiring, exploring, and developing mineral projects in Greenland with a market cap of €49.05 million.

Operations: Greenland Resources Inc. currently does not report any revenue segments.

Market Cap: €49.05M

Greenland Resources, with a market cap of €49.05 million, remains pre-revenue and unprofitable, facing increased losses over the past five years. The company is debt-free but has less than a year of cash runway, indicating potential funding challenges ahead. Despite high volatility in its share price, Greenland Resources has not significantly diluted shareholders recently. Recent developments include progress on the Malmbjerg Molybdenum Project and an off-take agreement with Outokumpu for molybdenum oxide supply. The new Greenland government supports business development initiatives which may benefit the company’s strategic goals in resource exploitation and investor engagement efforts.

- Get an in-depth perspective on Greenland Resources' performance by reading our balance sheet health report here.

- Learn about Greenland Resources' historical performance here.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector both within Finland and internationally, with a market capitalization of €467.90 million.

Operations: The company generates revenue from its Lindex segment at €628.8 million and Stockmann segment at €311.6 million.

Market Cap: €467.9M

Lindex Group Oyj, with a market cap of €467.90 million, operates in the retail sector and has shown resilience despite recent challenges. The company reported fourth-quarter sales of €273.7 million with net income rising to €19.8 million from €9.7 million year-over-year, highlighting improved profitability despite declining profit margins from 5.4% to 1.4%. Lindex's debt is well-covered by operating cash flow and its short-term assets exceed liabilities, though long-term liabilities remain uncovered by current assets. Recent board changes include the election of Andrea Collesei, indicating potential strategic shifts under new leadership amidst ongoing earnings growth efforts for 2025.

- Dive into the specifics of Lindex Group Oyj here with our thorough balance sheet health report.

- Understand Lindex Group Oyj's earnings outlook by examining our growth report.

Exasol (XTRA:EXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Exasol AG develops databases for analytics and data warehousing across Germany, Austria, Switzerland, Great Britain, North America, and other international markets with a market cap of €82.15 million.

Operations: The company's revenue segments are distributed as follows: €2.31 million from Great Britain, €7.62 million from North America, €25.97 million from Germany, Austria, and Switzerland (DACH), and €3.73 million from the rest of Europe and the rest of the world.

Market Cap: €82.15M

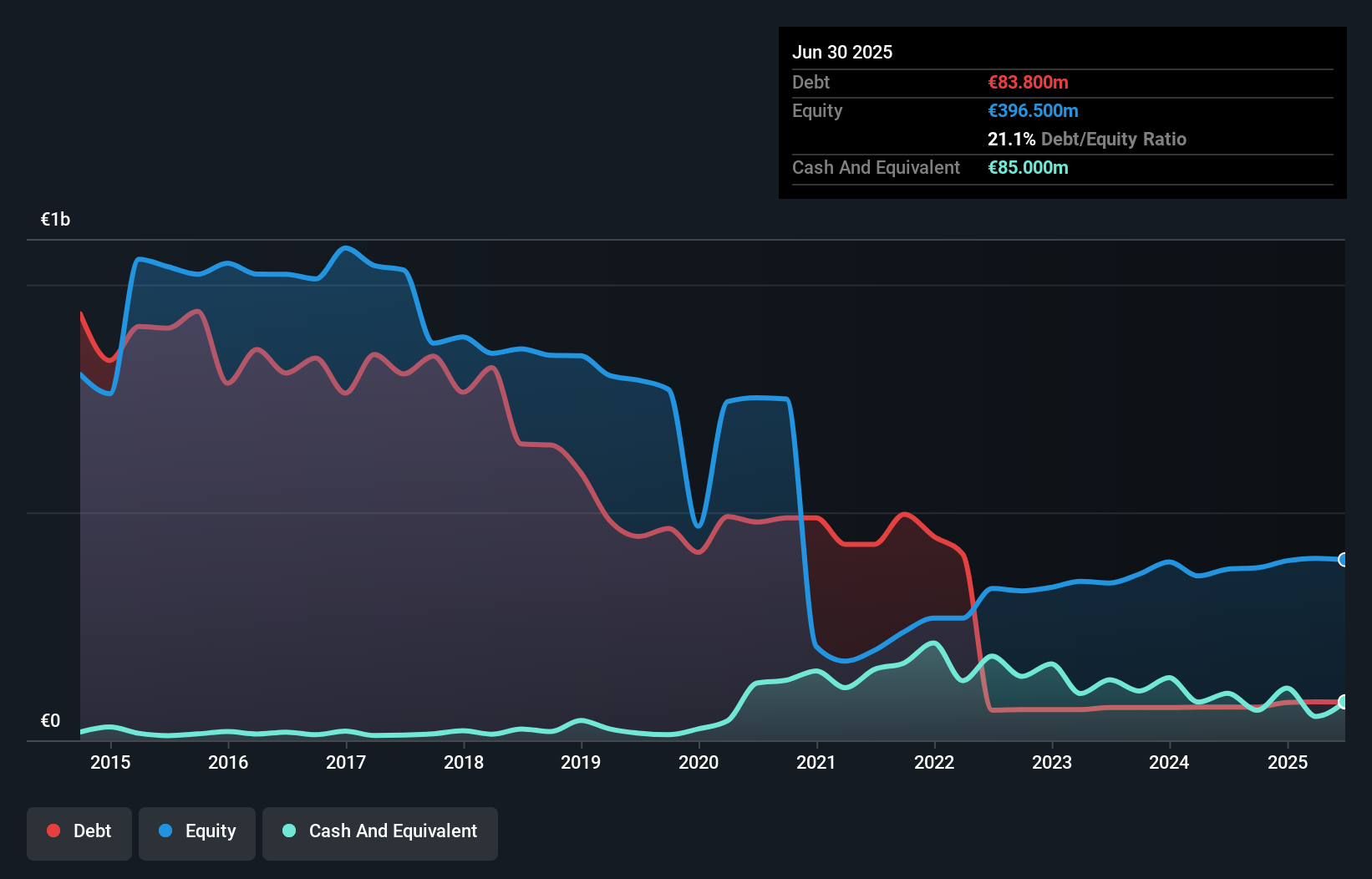

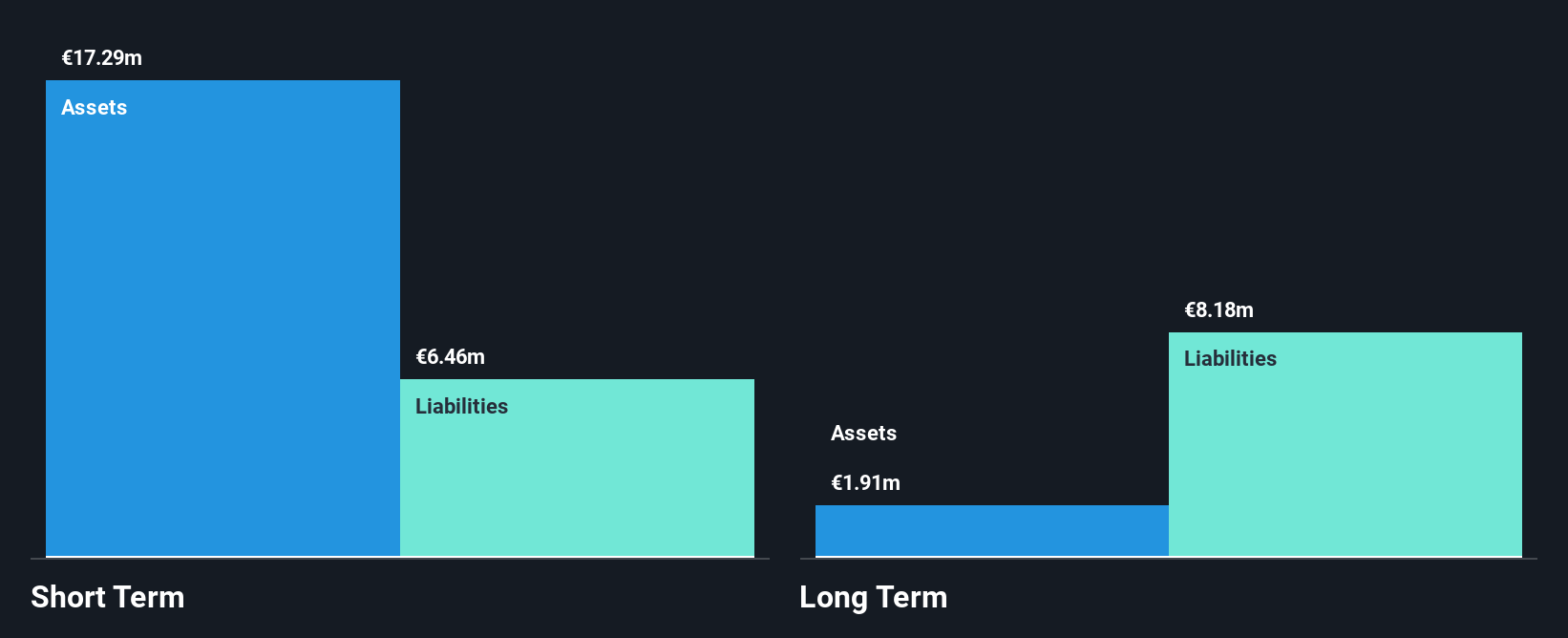

Exasol AG, with a market cap of €82.15 million, has transitioned to profitability, reporting sales of €39.63 million and a net income of €0.23 million for 2024 compared to a loss the previous year. The company operates debt-free, with short-term assets exceeding both short and long-term liabilities. Despite its volatile share price and low return on equity at 5%, Exasol's earnings are forecasted to grow significantly at 35% annually. Recent strategic management enhancements aim to bolster revenue growth in data analytics markets amid anticipated mid-single-digit revenue increases for 2025 despite ongoing contract terminations outside core areas.

- Click here and access our complete financial health analysis report to understand the dynamics of Exasol.

- Examine Exasol's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock more gems! Our European Penny Stocks screener has unearthed 425 more companies for you to explore.Click here to unveil our expertly curated list of 428 European Penny Stocks.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exasol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EXL

Exasol

Develops database for analytics and data warehousing in Germany, Austria, Switzerland, Great Britain, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives