- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

Avoid Thyssenkrupp And Explore This One Attractive Dividend Stock

Reviewed by Sasha Jovanovic

In the search for reliable dividend stocks in Germany, investors often find themselves navigating through a mix of attractive opportunities and potential pitfalls. A key factor to consider is the sustainability of a company's dividend payouts. High payout ratios, such as those seen with Thyssenkrupp, can be a red flag indicating that dividends might not be supported by the firm’s financial health over the long term.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.26% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.80% | ★★★★★★ |

| Brenntag (XTRA:BNR) | 3.33% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 6.53% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.62% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.13% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.00% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.25% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.18% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in designing vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle sectors globally, with a market capitalization of €270 million.

Operations: The company generates revenue through three primary segments: Vehicle Engineering (€488.93 million), Production Solutions (€268.86 million), and Electrics/Electronics (€111.45 million).

Dividend Yield: 5.1%

EDAG Engineering Group AG, with a dividend yield of 5.09%, stands out in the German market. Despite a recent dip in net income from €8.34 million to €7.04 million and EPS from €0.33 to €0.28, its dividends are supported by a sustainable payout ratio of 49.7% and cash payout ratio of 46.4%. However, the dividend track record has been unstable with volatile payments over the past eight years, reflecting some risk for dividend-focused investors.

- Navigate through the intricacies of EDAG Engineering Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that EDAG Engineering Group is priced higher than what may be justified by its financials.

One To Reconsider

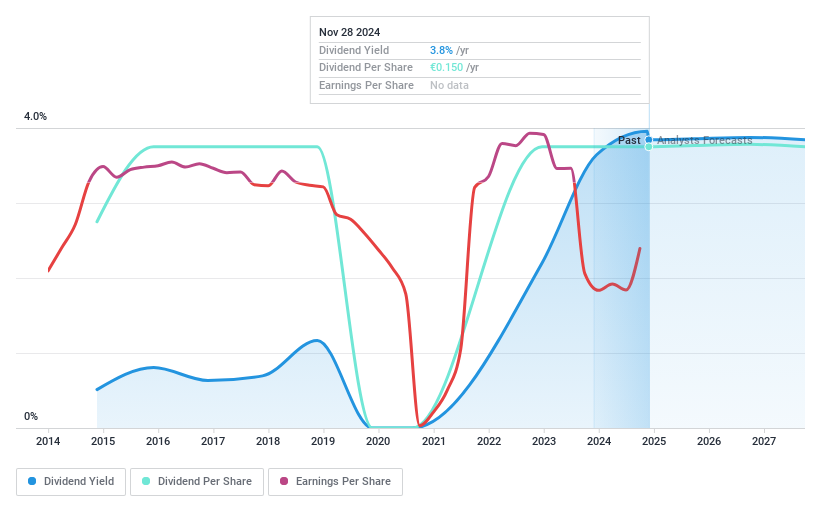

thyssenkrupp (XTRA:TKA)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: thyssenkrupp AG is a diversified industrial and technology company based in Germany, operating globally with a market capitalization of approximately €2.55 billion.

Operations: The company's revenue is derived from various segments, including Steel Europe (€11.43 billion), Marine Systems (€1.80 billion), Materials Services (€12.49 billion), and Automotive Technology (€5.37 billion).

Dividend Yield: 3.7%

thyssenkrupp AG's dividend yield of 3.66% is below the top quartile of German dividend stocks at 4.69%. Despite a high forecasted earnings growth, its dividends are not supported by reliable earnings or cash flows, evidenced by recent financials showing a net loss of €78 million and no free cash flow. The company's history of volatile and uncovered dividend payments further underscores the risks for dividend-seeking investors, making it less attractive compared to more stable options in the market.

Key Takeaways

- Access the full spectrum of 32 Top Dividend Stocks by clicking on this link.

- Already own some of these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives