How Analyst Perspectives Are Shifting the K+S Story for Investors

Reviewed by Simply Wall St

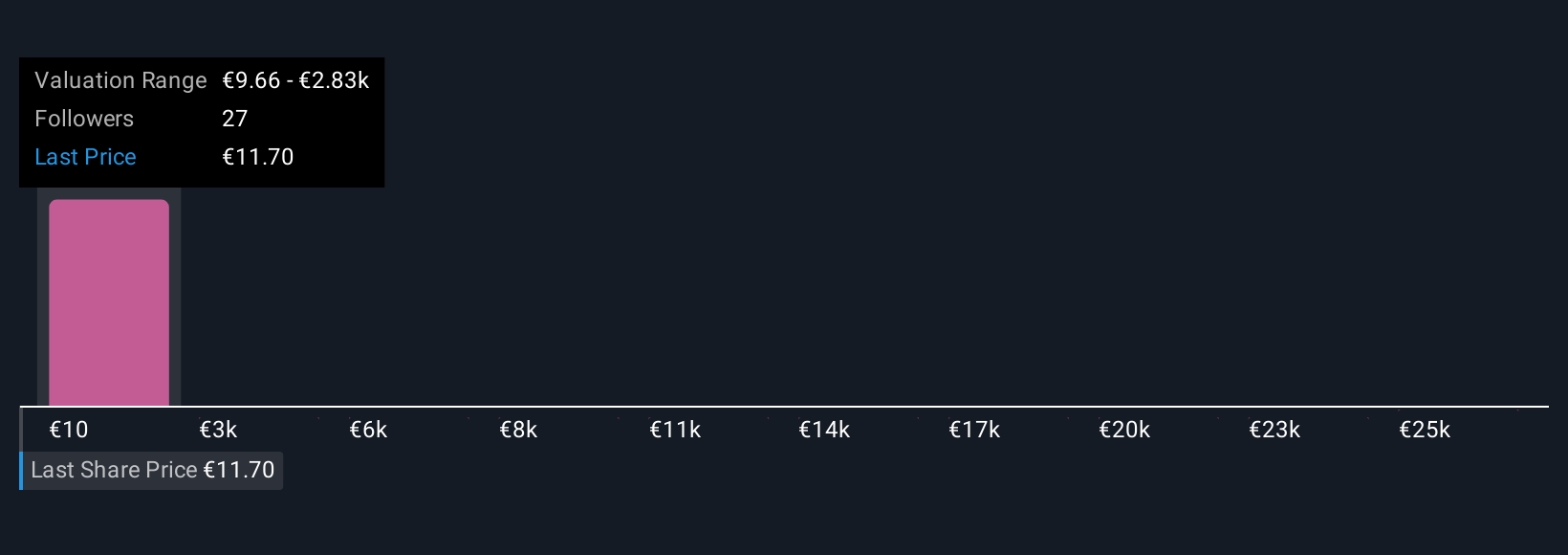

Analysts have made a slight downward revision to the consensus price target for K+S, lowering it from €13.99 to €13.66. This adjustment reflects an ongoing reassessment of the company's prospects, with some experts citing concerns about a softening market outlook and slower demand growth. Stay tuned to discover how investors can stay informed as the narrative around K+S continues to evolve.

What Wall Street Has Been Saying

Recent analyst commentary on K+S reflects a mix of cautious optimism and growing concern. While some remain confident in the company’s ability to manage operational challenges and capitalize on incremental improvements, others emphasize lingering industry headwinds. The following outlines the primary bullish and bearish perspectives currently shaping sentiment around the stock.

🐂 Bullish Takeaways- Several analysts credit K+S for ongoing improvements in operational efficiency and cost discipline, which have helped support modest upward revisions to price targets.

- Berenberg Bank highlighted better transparency and steady execution in recent quarters, awarding the company a Neutral rating but noting the potential for positive earnings surprises should market trends stabilize.

- Bullish voices such as Deutsche Bank have echoed confidence in management's ability to navigate challenging fertilizer markets. They have cited slight long-term growth momentum as a driver for raising their price target to €15.20.

- However, even among more constructive analysts, caution remains regarding valuation. Some believe much of the near-term upside is already reflected in the stock price.

- Cautious analysts, including those at UBS, point to fading positive momentum and recommend profit-taking after recent share price gains. They underscore a more subdued outlook.

- Several firms, such as Morgan Stanley, have reduced their price targets. Morgan Stanley most recently revised its target to €12.50, citing concerns about weaker pricing trends and softer demand in core fertilizer markets.

- Reduced earnings estimates across the Street have been attributed to a less favorable industry outlook and limited near-term catalysts for upside performance.

- The majority of updated research notes highlight key risks surrounding valuation and sector headwinds, with a consensus that investors should remain cautious until signs of recovery in demand emerge.

How This Changes the Fair Value For K+S

- The Consensus Analyst Price Target has fallen slightly from €13.99 to €13.66.

- The Consensus Revenue Growth forecasts for K+S have fallen from 2.3% per annum to 2.1% per annum.

- The Future P/E for K+S remained effectively unchanged, moving only marginally from 30.25x to 29.81x.

🔔 Never Miss an Update: Follow The Narrative

Narratives are a powerful way to understand investments, connecting the story and outlook of a company to real forecasts and up-to-date fair value estimates. On Simply Wall St's Community page, millions of investors use Narratives to make informed buy or sell decisions by comparing Fair Value with the current Price. Narratives are kept current and adapt to new news or earnings, providing a living guide to each company.

Interested in how global trends, company strategy, and industry shifts are shaping K+S? Read the original K+S Narrative to keep up with crucial factors, including:

- Why rising global food demand and tight supply support stable growth and better margins for K+S’s core fertilizer products.

- How strategic investments and effective cost controls can drive earnings stability and resilience.

- Which risks such as global competition, regulation, and exchange rates could challenge K+S’s profitability and market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if K+S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SDF

K+S

Operates as a supplier of mineral products for the agricultural, industrial, consumer, and community sectors in Europe, the United States, Asia, Africa, and Oceania.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion