How Investors Are Reacting To Evonik Industries (XTRA:EVK) Lowering Its Q3 2025 Revenue Outlook

Reviewed by Sasha Jovanovic

- Evonik Industries AG recently issued earnings guidance indicating it expects third-quarter 2025 revenue to be approximately €3.4 billion, down from €3.8 billion in the prior year period.

- This preview of lower revenue signals a shift in near-term business conditions, which often leads stakeholders to reassess the company's commercial momentum and outlook.

- We'll explore how Evonik's lowered third-quarter revenue forecast could influence its trajectory toward more sustainable, higher-margin chemical segments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Evonik Industries Investment Narrative Recap

To be a shareholder in Evonik Industries right now, you have to believe in the company’s ability to press ahead with its margin improvement plans and pivot its business mix toward higher-value specialty chemicals, even as demand remains lackluster in core cyclical sectors. The recent Q3 2025 revenue guidance, which points to a drop from €3.8 billion to €3.4 billion, draws attention to weak end-market conditions, which remain the most important catalyst and material risk in the short term, especially for the pace of recovery and future earnings progression.

One recent alliance that stands out is Evonik’s partnership with Ethris to advance its lipid nanoparticle (LNP) platform for nucleic acid delivery. While unrelated to immediate sales figures, this collaboration is aligned with the company’s drive to build out its healthcare and biopharmaceutical segments, areas seen as less exposed to the cyclical swings impacting current results.

By contrast, investors should be alert to ongoing exposure to weak demand in cyclical end-markets, particularly since...

Read the full narrative on Evonik Industries (it's free!)

Evonik Industries' narrative projects €15.2 billion revenue and €779.3 million earnings by 2028. This requires 1.1% yearly revenue growth and a €356.3 million earnings increase from €423.0 million today.

Uncover how Evonik Industries' forecasts yield a €19.88 fair value, a 33% upside to its current price.

Exploring Other Perspectives

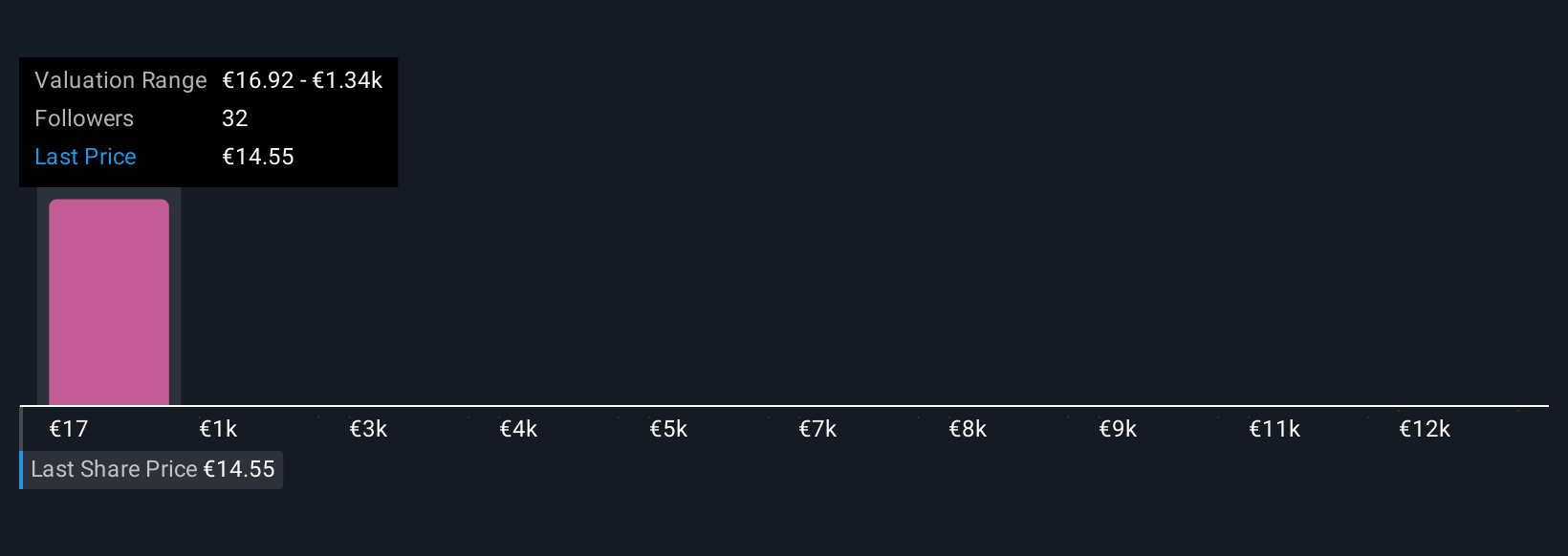

Seven members of the Simply Wall St Community have shared fair value estimates for Evonik Industries, ranging from €16.92 to an outlier of €13,205.30. As you review these diverse investor viewpoints, keep in mind that exposure to volatile end-markets may continue to affect Evonik’s revenue and profit recovery.

Explore 7 other fair value estimates on Evonik Industries - why the stock might be worth just €16.92!

Build Your Own Evonik Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evonik Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Evonik Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evonik Industries' overall financial health at a glance.

No Opportunity In Evonik Industries?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evonik Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives