Last Update25 Sep 25Fair value Decreased 3.00%

Evonik Industries' consensus price target has been reduced from €20.49 to €19.88 as analysts factor in increased downside risks to earnings, moderating growth expectations, persistent margin concerns, and industry headwinds, prompting greater near-term caution.

Analyst Commentary

- Bearish analysts highlight increased downside risks to earnings estimates due to both cyclical and structural pressures facing the company.

- Bullish analysts remain constructive but have trimmed price targets, implying reduced near-term upside amid market headwinds.

- Reduced price targets reflect moderating growth expectations and slower recovery assumptions in key end markets.

- Concerns persist around the sustainability of margin improvement initiatives amidst a challenging macroeconomic environment.

- While long-term fundamentals remain intact for some, consensus shifts suggest near-term caution due to industry and company-specific uncertainties.

What's in the News

- Evonik and Ethris have formed a strategic collaboration to develop and commercialize a novel lipid nanoparticle (LNP) platform for nucleic acid delivery, focusing on mRNA lung therapies.

- The partnership combines Evonik's formulation and clinical manufacturing expertise with Ethris' proprietary SNaP LNP technology, offering improved stability and targeted delivery, including for respiratory diseases via nebulized administration.

- The Ethris platform has demonstrated no systemic bioavailability of mRNA or protein in clinical trials, reducing off-target risks, and their lead asthma product is in Phase 2a trials.

Valuation Changes

Summary of Valuation Changes for Evonik Industries

- The Consensus Analyst Price Target has fallen slightly from €20.49 to €19.88.

- The Consensus Revenue Growth forecasts for Evonik Industries has significantly fallen from 1.1% per annum to 0.9% per annum.

- The Net Profit Margin for Evonik Industries has fallen from 5.13% to 4.82%.

Key Takeaways

- Aggressive cost optimization and a shift to specialty chemicals are set to strengthen margins and align with rising demand for sustainable solutions.

- Expanded production in key plants and focus on healthcare, nutrition, and biopharma position the company for stable growth aided by regulatory and demographic trends.

- Heavy dependence on cyclical sectors, ongoing exposure to low-margin commodities, and external macroeconomic and regulatory risks threaten Evonik's revenue stability and margin expansion prospects.

Catalysts

About Evonik Industries- Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

- Strategic cost optimization programs-including significant headcount reductions and site closures (notably in Silica)-are expected to lower operating costs and support net margin expansion throughout 2025 as savings become fully visible by year-end.

- Ramp-up of new production capacities, especially the alkoxides plant in Singapore and the RNA/lipids plant in Slovakia, positions the company to capture incremental volume opportunities tied to sustainable materials and biopharmaceutical applications, supporting medium-term revenue growth.

- Strong resilience and operational improvements in Healthcare and Nutrition segments, coupled with contracted year-end sales, are set to benefit from demographic shifts and rising healthcare/nutrition demands, resulting in more stable and recurring earnings streams.

- Ongoing portfolio shift towards high-margin specialty chemicals and away from commoditized businesses aligns with strict regulatory trends and customer demands for eco-friendly, high-value additives, supporting both top-line growth and structural margin uplift over the long term.

- Increasing support from EU decarbonization and circular economy initiatives is likely to benefit Evonik's innovation funding and operational cost base (through incentives and energy transition support), providing structural tailwinds for sustainable earnings growth.

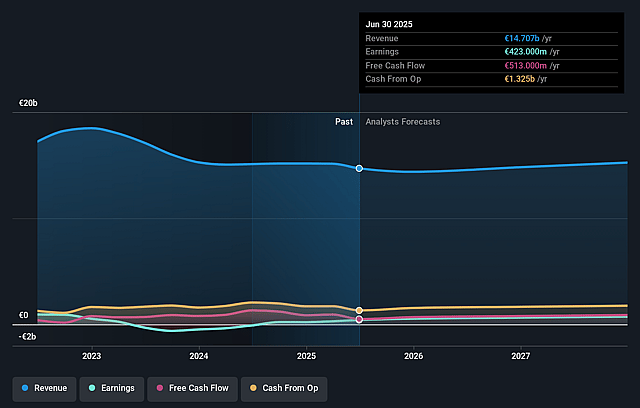

Evonik Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Evonik Industries's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 5.1% in 3 years time.

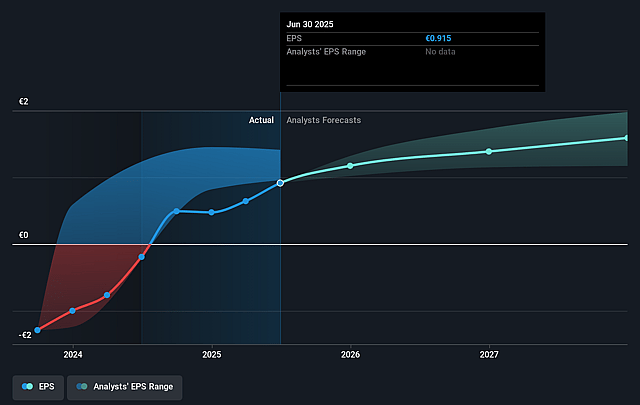

- Analysts expect earnings to reach €779.3 million (and earnings per share of €1.51) by about September 2028, up from €423.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €924 million in earnings, and the most bearish expecting €545.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 17.8x today. This future PE is lower than the current PE for the GB Chemicals industry at 22.0x.

- Analysts expect the number of shares outstanding to decline by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

Evonik Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weak demand and low consumer confidence across key end-markets, combined with limited visibility on macroeconomic improvement, exposes Evonik to revenue volatility and constrains earnings growth in the medium to long term.

- Heavy reliance on cyclical sectors such as construction and automotive makes Evonik vulnerable to economic downturns and delays in sectoral recovery, hampering revenue stability and profit margins.

- Continued exposure to the underperforming C4 and commodity chemicals business, with no clear timeline for strategic exit, could limit Evonik's ability to accelerate its shift toward higher-margin specialty products, restraining future margin expansion and top-line growth.

- Ongoing geopolitical tensions and evolving trade policies (e.g., tariffs, deglobalization pressures) create supply chain risks and input cost uncertainty, which may increase costs or disrupt operations, thereby impacting net margins and overall global competitiveness.

- Over-optimism regarding decarbonization incentives and EU action plans may be misplaced if regulatory burdens, higher compliance costs, and market shifts toward bio-based products accelerate, potentially outpacing Evonik's internal transformation efforts and weighing on long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €20.492 for Evonik Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €25.0, and the most bearish reporting a price target of just €17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €15.2 billion, earnings will come to €779.3 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of €16.15, the analyst price target of €20.49 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.