Key Takeaways

- Aggressive cost-saving initiatives and digital transformation are set to drive lasting margin expansion, with management guiding for significantly higher-than-expected operational efficiency gains.

- Strategic focus on sustainable technologies and resilient production supports robust earnings growth, with premium revenue opportunities unlocking across healthcare, nutrition, and green specialty chemicals.

- Exposure to weak end markets, regulatory pressures, operational inefficiencies, and global disruptions threatens Evonik's profitability and long-term growth prospects.

Catalysts

About Evonik Industries- Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

- While analysts broadly expect cost savings and self-help measures to support margins, management actions and already-locked-in workforce reductions suggest savings could significantly exceed the high double-digit millions, translating into a more dramatic and sustained net margin expansion, particularly as site closures and digitalization ramp up into 2026.

- Analyst consensus sees stable to improving methionine pricing, but Evonik's conservative supply-demand assumptions and management's explicit confidence in continued market tightness through 2026 indicate the potential for an upside surprise in earnings from Animal Nutrition, especially if global protein consumption grows faster than modeled.

- Major long-term investments in circular economy, decarbonization, and advanced biosolutions-many supported by powerful EU and national legislative incentives-are set to unlock new, premium revenue streams from green packaging, sustainable energy, and next-generation specialty chemicals, rapidly expanding addressable markets and driving growth ahead of current expectations.

- Evonik's diversified, regionally anchored production and procurement structure makes it uniquely resilient to geopolitical and raw material risks relative to peers, stabilizing gross margins and reducing operational volatility as global supply chains and energy markets remain uncertain.

- Strong structural growth in healthcare, food, and urban infrastructure-driven by changing global demographics and advancing life sciences-positions Evonik's specialty additives and delivery technologies for sustained volume and pricing power, underpinning robust multi-year revenue and earnings growth far above cyclical peers.

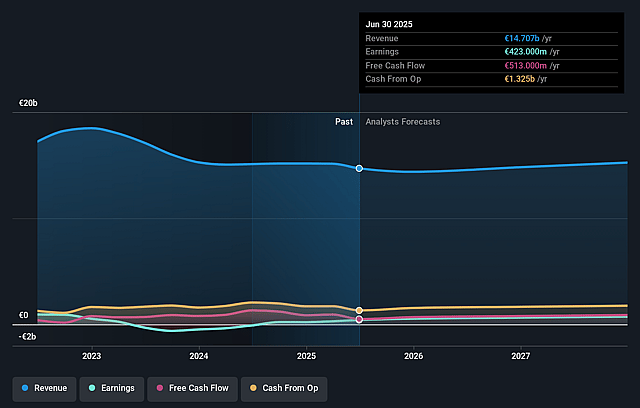

Evonik Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Evonik Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Evonik Industries's revenue will grow by 2.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.9% today to 6.5% in 3 years time.

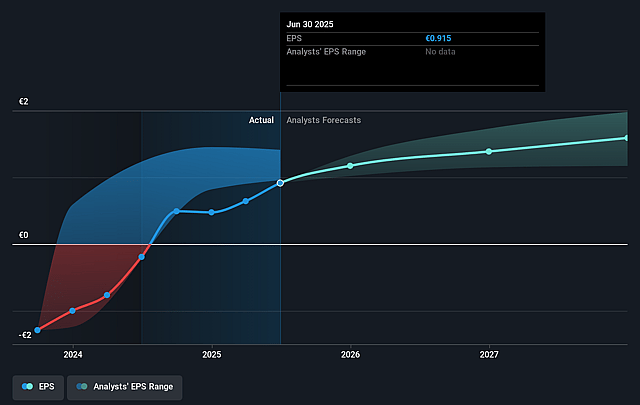

- The bullish analysts expect earnings to reach €1.0 billion (and earnings per share of €2.2) by about September 2028, up from €423.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, down from 17.7x today. This future PE is lower than the current PE for the GB Chemicals industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.2%, as per the Simply Wall St company report.

Evonik Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness in key end markets such as automotive and construction, combined with low consumer confidence and uncertain macroeconomic recovery, could result in stagnant or declining demand for Evonik's products, posing ongoing risks to revenue growth.

- Increased environmental regulations, European Union chemical action plans, and accelerating decarbonization requirements threaten to raise compliance costs and restrict Evonik's traditional fossil-based specialty chemicals business, leading to higher operational expenses and lower net margins.

- Heavy dependence on European operations exposes Evonik to structurally higher energy costs and regulatory burdens compared to global competitors, which could erode EBITDA margins and reduce overall profitability in the long term.

- Deglobalization, geopolitical volatility, and protectionist trade policies-exemplified by new US tariffs and supply chain disruptions-present ongoing risks to global supply chain stability, potentially increasing input costs and undermining earnings stability and free cash flow generation.

- Slow pace of digital transformation and continued reliance on cyclical or commoditized products, such as the C4 business and legacy chemical segments, raises the risk of ongoing price competition, lower operational efficiency, and shrinking industry-wide margins, which could undermine both revenue and net profit over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Evonik Industries is €25.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Evonik Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €25.0, and the most bearish reporting a price target of just €17.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €15.9 billion, earnings will come to €1.0 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of €16.07, the bullish analyst price target of €25.0 is 35.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.