Key Takeaways

- Rising regulatory costs, required environmental upgrades, and green competition threaten Evonik's margins and long-term profitability.

- Dependence on shrinking European markets and intensified low-cost competition limit growth prospects and erode pricing power.

- Strategic cost cuts, EU policy support, supply chain resilience, and innovation in specialty products position Evonik for stable margins and differentiated growth amid global industry trends.

Catalysts

About Evonik Industries- Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

- Intensifying regulatory pressure and the ongoing tightening of environmental standards in Europe and globally are set to force Evonik into higher compliance costs and potentially expensive upgrades or even phase-outs of legacy production lines, which will likely result in persistent margin compression and depress net earnings for years to come.

- The accelerating shift toward circular economies and sustainable consumer products is expected to erode demand for Evonik's conventional specialty chemicals portfolio, as newer, greener substitutes capture market share, leading to long-term revenue stagnation or decline.

- Heavy dependence on mature European markets, coupled with the risk of further manufacturing site closures and restructuring, will constrain organic growth, making Evonik increasingly vulnerable to weak regional demand and limiting its ability to drive top-line expansion versus better-positioned global competitors.

- Ongoing commoditization within key specialty chemical segments, especially as Asian manufacturers ramp up capacity at lower cost, is set to further undermine Evonik's pricing power, exacerbating the risk of margin erosion and lower profitability through heightened competition.

- Global decarbonization efforts and the energy transition will necessitate large-scale investments in green technologies, hitting Evonik with elevated capital expenditures that squeeze free cash flow and restrict funds available for innovation or shareholder returns, ultimately weighing on long-term value creation.

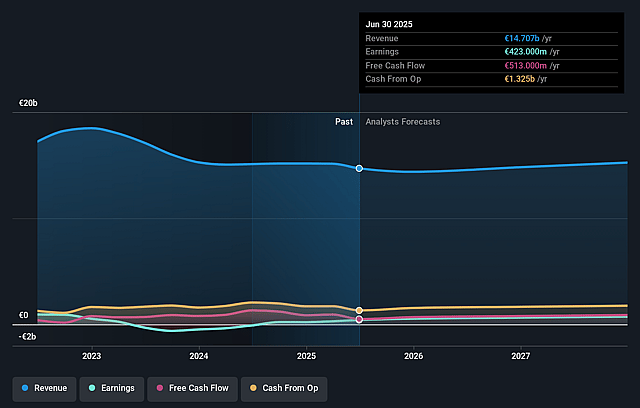

Evonik Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Evonik Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Evonik Industries's revenue will decrease by 0.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.9% today to 4.0% in 3 years time.

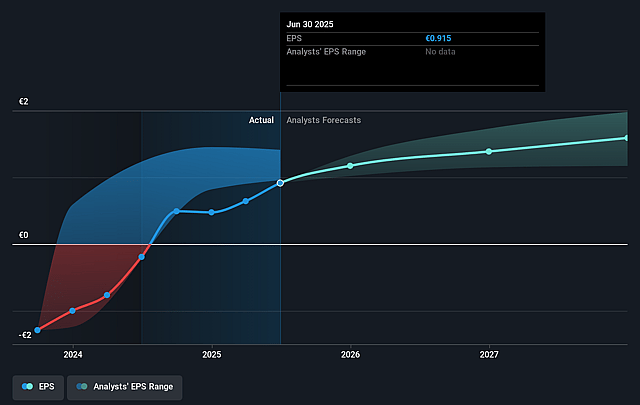

- The bearish analysts expect earnings to reach €600.9 million (and earnings per share of €1.29) by about August 2028, up from €423.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 18.8x today. This future PE is lower than the current PE for the GB Chemicals industry at 21.4x.

- Analysts expect the number of shares outstanding to decline by 2.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.09%, as per the Simply Wall St company report.

Evonik Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Evonik expects to benefit from major long-term European Union policy support, including incentives for decarbonization projects and funding for circular economy and bio-based solutions, which could enhance revenue growth and reduce operating costs over the medium to long term.

- The company is in the process of rolling out substantial cost optimization measures, with a high double-digit million euro cost savings plan in 2025 and significant workforce reductions already underway, which are expected to support EBITDA and strengthen net margins going forward.

- Evonik's strategy of securing regional supply chains-especially its closed-loop supply and sales model in the United States-enables resilience against global supply disruptions or geopolitical turbulence, helping to stabilize earnings and reduce input cost volatility over time.

- Market intelligence for key specialty product lines such as methionine and high-performance polymers indicates continued high industry utilization rates and stable or firm pricing, supporting ongoing strong earnings contributions from these segments in coming years.

- The company's growing focus on innovation, with investments in new capacity for high-value products like PA12 and catalysts as well as continued ramp-up in healthcare specialty ingredients and animal nutrition, positions Evonik to benefit from secular trends in sustainability, health, and advanced manufacturing, driving differentiated revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Evonik Industries is €17.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Evonik Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €25.0, and the most bearish reporting a price target of just €17.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €15.0 billion, earnings will come to €600.9 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of €17.09, the bearish analyst price target of €17.5 is 2.3% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.