Last Update 09 Dec 25

Fair value Decreased 2.86%EVK: Margin Resilience And Efficiency Measures Will Drive Future Upside Potential

The analyst price target for Evonik Industries has been revised modestly lower, from approximately EUR 16.14 to EUR 15.68. Analysts are factoring in softer revenue growth, slightly lower profit margins, and a more cautious sector stance, despite some institutions maintaining positive ratings.

Analyst Commentary

Recent Street research on Evonik Industries reflects a more balanced, selectively constructive stance, with price targets drifting lower but opinions divided on the company’s medium term upside potential.

Bullish Takeaways

- Bullish analysts continue to see upside from current levels, as several price targets still sit comfortably above the revised consensus. This supports a view that the market is already discounting much of the cyclical weakness.

- Some expect execution on efficiency and portfolio measures to support margin resilience. They argue that cost discipline and asset optimization can offset part of the softer demand environment.

- JPMorgan’s Overweight rating, even after trimming its target, signals confidence that Evonik can outperform peers if industrial demand normalizes and the company delivers on self help initiatives.

- The presence of Buy ratings, despite downward target revisions, suggests that long term growth in specialty segments and potential for improved capital allocation remain underappreciated in the share price.

Bearish Takeaways

- Bearish analysts are cutting price targets to reflect cyclical and structural headwinds in European chemicals, which they see limiting top line growth and putting further pressure on profitability.

- Downgrades to more neutral stances highlight concerns that earnings estimates are still at risk, with slower volume recovery and weaker pricing power challenging near term valuation support.

- A shift in preference toward industrial gases, ingredients, and distributors underscores skepticism that diversified chemicals like Evonik can command premium multiples versus more focused peers.

- Lower targets around the mid teens indicate a view that operational improvements may only partially offset macro and sector pressures. As a result, the risk reward profile appears more balanced than compelling in the short run.

What's in the News

- Issued new earnings guidance for the third quarter of 2025, projecting revenue of about €3.4 billion versus €3.8 billion in the third quarter of 2024, which signals expectations for a softer top line in the near term (company guidance)

Valuation Changes

- Fair Value: reduced slightly from approximately €16.14 to €15.68 per share, implying a modestly lower intrinsic valuation.

- Discount Rate: increased marginally from around 6.38 percent to 6.39 percent, reflecting a slightly higher required return.

- Revenue Growth: eased from about 1.47 percent to 1.45 percent, indicating a slightly more cautious outlook on top line expansion.

- Net Profit Margin: lowered modestly from roughly 4.28 percent to 4.23 percent, pointing to a small downward adjustment in expected profitability.

- Future P/E: edged down from about 13.55x to 13.34x, suggesting a slightly less optimistic multiple on forward earnings.

Key Takeaways

- Aggressive cost optimization and a shift to specialty chemicals are set to strengthen margins and align with rising demand for sustainable solutions.

- Expanded production in key plants and focus on healthcare, nutrition, and biopharma position the company for stable growth aided by regulatory and demographic trends.

- Heavy dependence on cyclical sectors, ongoing exposure to low-margin commodities, and external macroeconomic and regulatory risks threaten Evonik's revenue stability and margin expansion prospects.

Catalysts

About Evonik Industries- Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

- Strategic cost optimization programs-including significant headcount reductions and site closures (notably in Silica)-are expected to lower operating costs and support net margin expansion throughout 2025 as savings become fully visible by year-end.

- Ramp-up of new production capacities, especially the alkoxides plant in Singapore and the RNA/lipids plant in Slovakia, positions the company to capture incremental volume opportunities tied to sustainable materials and biopharmaceutical applications, supporting medium-term revenue growth.

- Strong resilience and operational improvements in Healthcare and Nutrition segments, coupled with contracted year-end sales, are set to benefit from demographic shifts and rising healthcare/nutrition demands, resulting in more stable and recurring earnings streams.

- Ongoing portfolio shift towards high-margin specialty chemicals and away from commoditized businesses aligns with strict regulatory trends and customer demands for eco-friendly, high-value additives, supporting both top-line growth and structural margin uplift over the long term.

- Increasing support from EU decarbonization and circular economy initiatives is likely to benefit Evonik's innovation funding and operational cost base (through incentives and energy transition support), providing structural tailwinds for sustainable earnings growth.

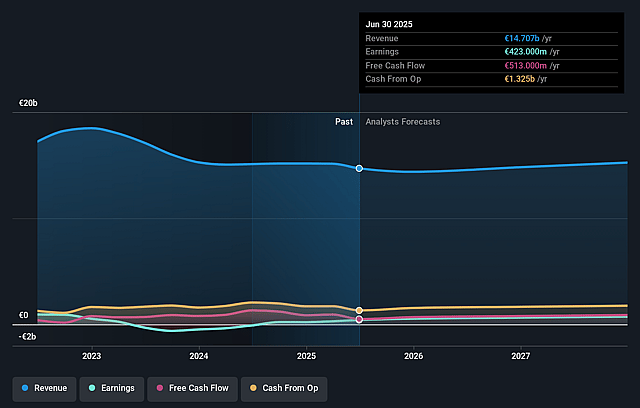

Evonik Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Evonik Industries's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 5.1% in 3 years time.

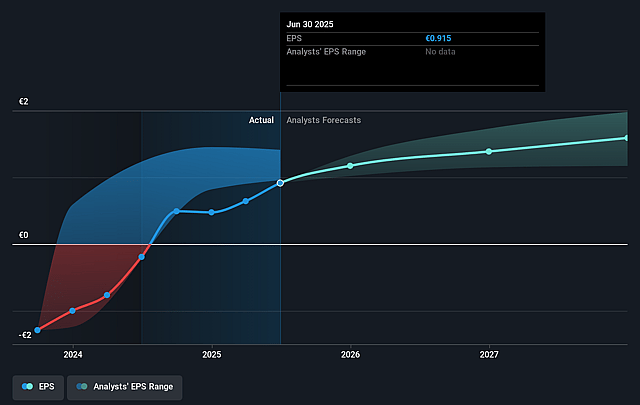

- Analysts expect earnings to reach €779.3 million (and earnings per share of €1.51) by about September 2028, up from €423.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €924 million in earnings, and the most bearish expecting €545.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 17.8x today. This future PE is lower than the current PE for the GB Chemicals industry at 22.0x.

- Analysts expect the number of shares outstanding to decline by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

Evonik Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weak demand and low consumer confidence across key end-markets, combined with limited visibility on macroeconomic improvement, exposes Evonik to revenue volatility and constrains earnings growth in the medium to long term.

- Heavy reliance on cyclical sectors such as construction and automotive makes Evonik vulnerable to economic downturns and delays in sectoral recovery, hampering revenue stability and profit margins.

- Continued exposure to the underperforming C4 and commodity chemicals business, with no clear timeline for strategic exit, could limit Evonik's ability to accelerate its shift toward higher-margin specialty products, restraining future margin expansion and top-line growth.

- Ongoing geopolitical tensions and evolving trade policies (e.g., tariffs, deglobalization pressures) create supply chain risks and input cost uncertainty, which may increase costs or disrupt operations, thereby impacting net margins and overall global competitiveness.

- Over-optimism regarding decarbonization incentives and EU action plans may be misplaced if regulatory burdens, higher compliance costs, and market shifts toward bio-based products accelerate, potentially outpacing Evonik's internal transformation efforts and weighing on long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €20.492 for Evonik Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €25.0, and the most bearish reporting a price target of just €17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €15.2 billion, earnings will come to €779.3 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of €16.15, the analyst price target of €20.49 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Evonik Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.