- Germany

- /

- Healthcare Services

- /

- XTRA:MED

Shareholders in MEDICLIN (ETR:MED) have lost 50%, as stock drops 10% this past week

While it may not be enough for some shareholders, we think it is good to see the MEDICLIN Aktiengesellschaft (ETR:MED) share price up 10% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 50% in that time, significantly under-performing the market.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for MEDICLIN

Given that MEDICLIN didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, MEDICLIN grew its revenue at 3.0% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 8% (annualized) in the same time frame. The key question is whether the company can make it to profitability, and beyond, without trouble. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

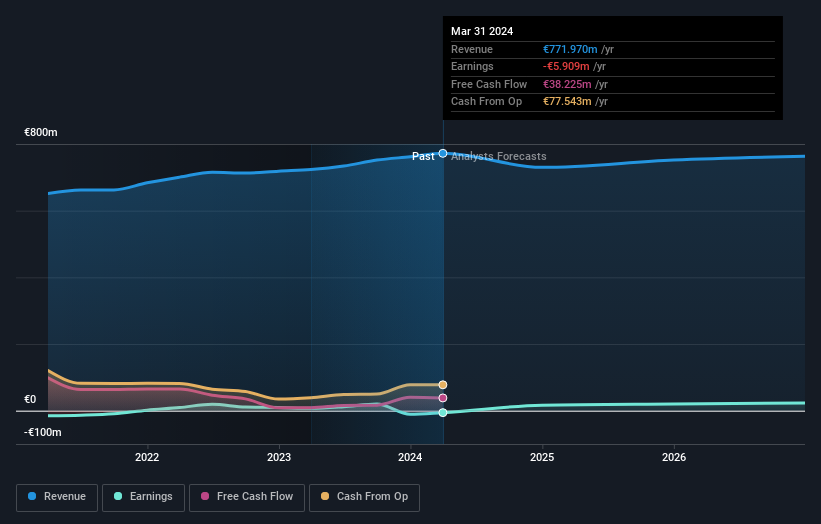

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling MEDICLIN stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 5.8% in the last year, MEDICLIN shareholders lost 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MED

Undervalued with excellent balance sheet.

Market Insights

Community Narratives