As the German market navigates through a period of cautious investor sentiment due to escalating Middle East tensions and a potential rate cut by the European Central Bank, dividend stocks continue to attract attention for their potential to provide steady income amidst volatility. In such an environment, selecting stocks with strong fundamentals and consistent dividend payouts can be an effective strategy for investors seeking stability in their portfolios.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.92% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.61% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.64% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.46% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.69% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.39% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.27% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.31% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.71% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, develops, produces, and markets frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market cap of €415.57 million.

Operations: FRoSTA Aktiengesellschaft generates revenue through the development, production, and marketing of frozen food products in multiple European countries including Germany, Poland, Austria, Italy, and Eastern Europe.

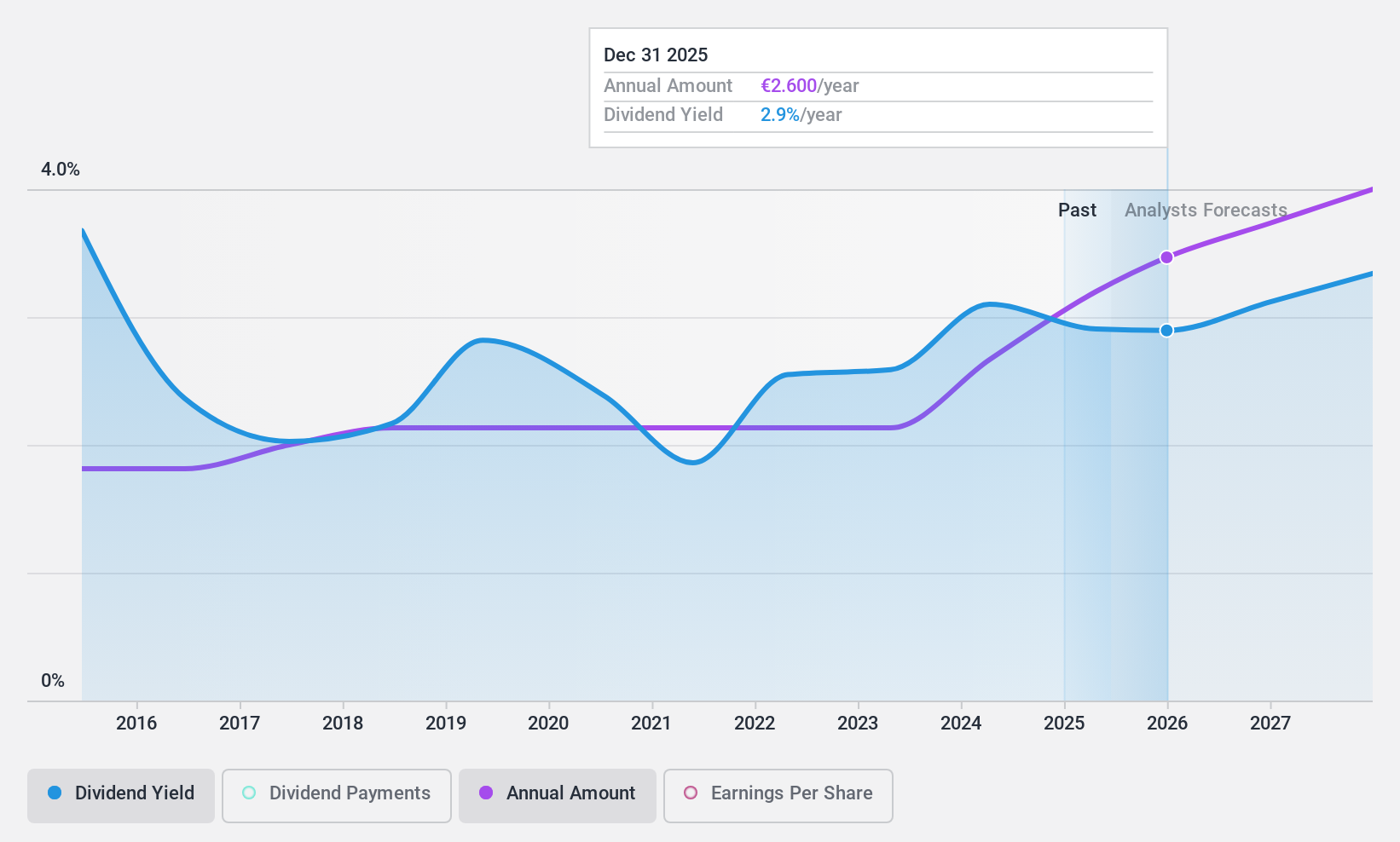

Dividend Yield: 3.3%

FRoSTA's dividends are well-supported by both earnings and cash flows, with a payout ratio of 40% and a cash payout ratio of 19.3%. The company has demonstrated consistent dividend growth over the past decade, maintaining stability without significant volatility. Though its dividend yield of 3.31% is lower than the top quartile in Germany, FRoSTA trades significantly below its estimated fair value, potentially offering value to investors seeking reliable income streams.

- Delve into the full analysis dividend report here for a deeper understanding of FRoSTA.

- The analysis detailed in our FRoSTA valuation report hints at an deflated share price compared to its estimated value.

Bertrandt (XTRA:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bertrandt Aktiengesellschaft offers engineering services and has a market cap of €202.11 million.

Operations: Bertrandt Aktiengesellschaft generates revenue from three primary segments: Digital Engineering (€640.06 million), Physical Engineering (€253.89 million), and Electrical Systems/Electronics (€409.76 million).

Dividend Yield: 6%

Bertrandt's dividend yield of 6% ranks in the top 25% of German payers, though its track record has been volatile over the past decade. The dividends are covered by earnings and cash flows, with payout ratios of 71.1% and 26.8%, respectively. Despite recent inclusion in the S&P Global BMI Index, Bertrandt reported a net loss for Q3 2024 amid declining profit margins, raising concerns about future dividend stability despite trading below estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Bertrandt.

- According our valuation report, there's an indication that Bertrandt's share price might be on the cheaper side.

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in the development of vehicles, derivatives, modules, and production facilities for the global automotive and commercial vehicle industries, with a market cap of €224.50 million.

Operations: EDAG Engineering Group AG generates its revenue through three primary segments: Vehicle Engineering (€485.66 million), Production Solutions (€276.56 million), and Electrics/Electronics (€110.02 million).

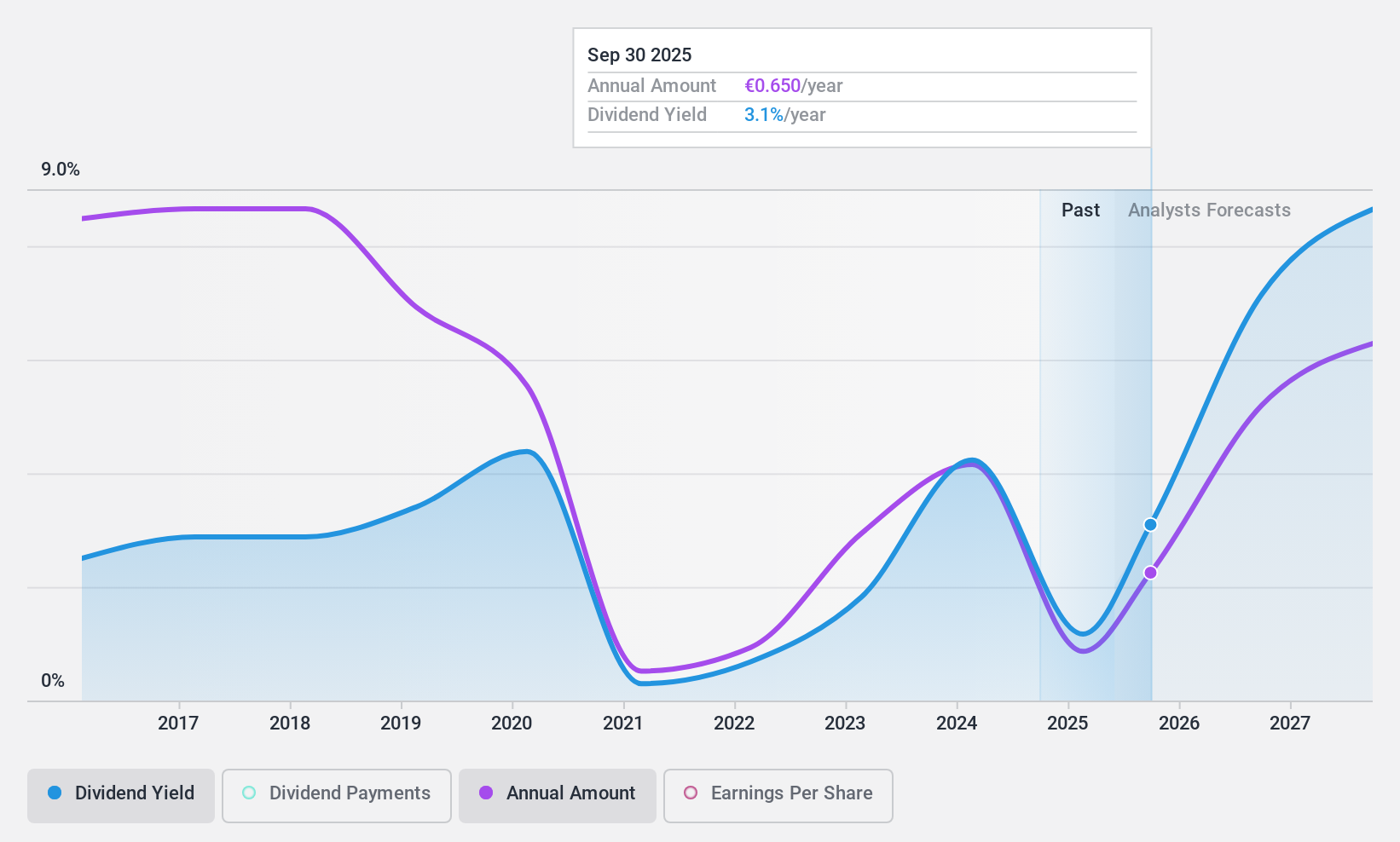

Dividend Yield: 6.1%

EDAG Engineering Group's dividend yield of 6.12% is among the top 25% in Germany, but its track record over eight years has been unstable with declining payments. While dividends are well-covered by earnings (54.1% payout ratio) and cash flows (28.5%), high debt levels pose risks to sustainability. Recent earnings showed a decline, with net income dropping to €3.46 million for Q2 2024 from €5.63 million a year earlier, potentially impacting future payouts despite trading below analyst targets.

- Get an in-depth perspective on EDAG Engineering Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that EDAG Engineering Group's current price could be inflated.

Taking Advantage

- Gain an insight into the universe of 33 Top German Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NLM

FRoSTA

Develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives