- Germany

- /

- Healthcare Services

- /

- XTRA:RHK

Undiscovered Gems in Germany To Watch This September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, European indices have shown mixed results, with Germany's DAX seeing a modest gain. Against this backdrop of cautious optimism and shifting monetary policies, investors are increasingly looking toward small-cap stocks for potential growth opportunities. In this environment, identifying promising stocks often involves seeking companies with strong fundamentals and the ability to adapt to changing economic conditions. Here are three undiscovered gems in Germany that stand out this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €905.11 million.

Operations: Eckert & Ziegler SE generates revenue primarily from its Medical (€132.80 million) and Isotopes Products (€150.97 million) segments. The company faces a negative impact of €10.32 million due to eliminations within these segments, resulting in a net adjustment of €0.07 million.

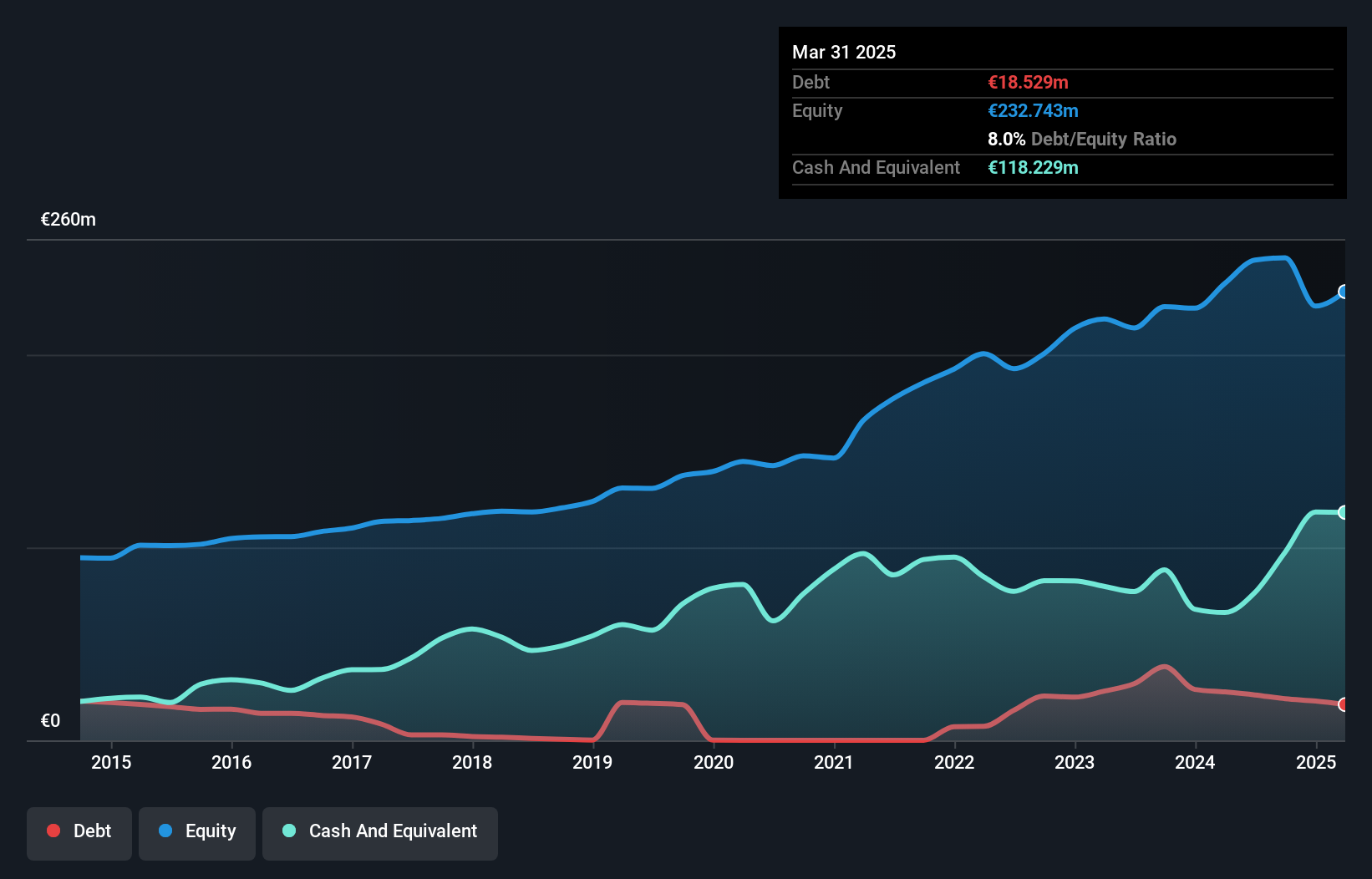

Eckert & Ziegler, a small cap in the medical equipment sector, has shown impressive performance with earnings growing by 31.6% over the past year, outpacing the industry average of 16.2%. The company reported second-quarter sales of €77.76M and net income of €9.54M, compared to €60.03M and €6.17M respectively from last year. Trading at 82.8% below its fair value estimate and having reduced its debt to equity ratio from 14.7% to 9.5% over five years, EUZ appears well-positioned for future growth.

- Unlock comprehensive insights into our analysis of Eckert & Ziegler stock in this health report.

Explore historical data to track Eckert & Ziegler's performance over time in our Past section.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★☆

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services in Germany and has a market cap of €836.73 million.

Operations: RHÖN-KLINIKUM generates revenue primarily from its acute hospitals (€1.45 billion), medical care centres (€23.90 million), and rehabilitation hospitals (€34.70 million).

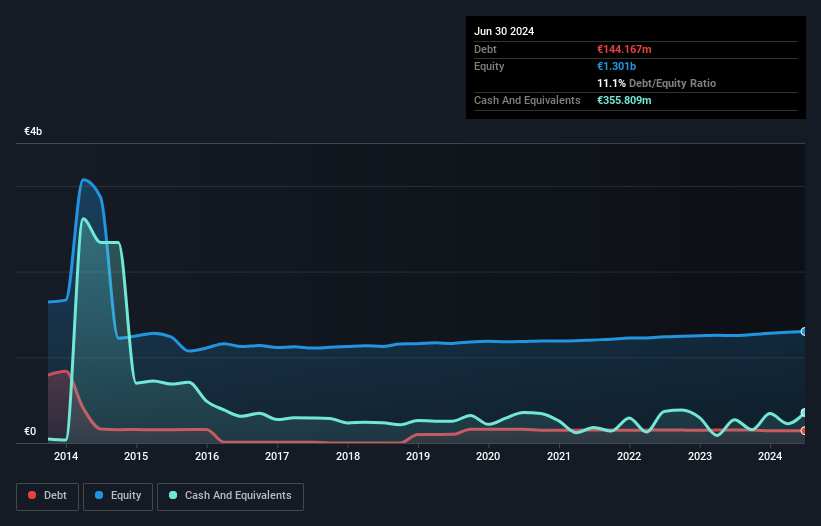

RHÖN-KLINIKUM, a notable player in Germany's healthcare sector, exhibited impressive earnings growth of 81.6% over the past year, outpacing the industry’s 30.9%. The company reported second-quarter sales of €392.69 million and net income of €9.01 million, up from €5.73 million a year prior. With a Price-To-Earnings ratio of 18x below the industry average and positive free cash flow, RHÖN-KLINIKUM appears well-positioned for continued growth despite global economic uncertainties.

- Delve into the full analysis health report here for a deeper understanding of RHÖN-KLINIKUM.

Evaluate RHÖN-KLINIKUM's historical performance by accessing our past performance report.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE offers a range of solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €468.00 million.

Operations: The company's revenue streams include €95.30 million from electricity, €160.89 million from natural gas, €28.38 million from clean hydrogen, and €117.28 million from adjacent opportunities.

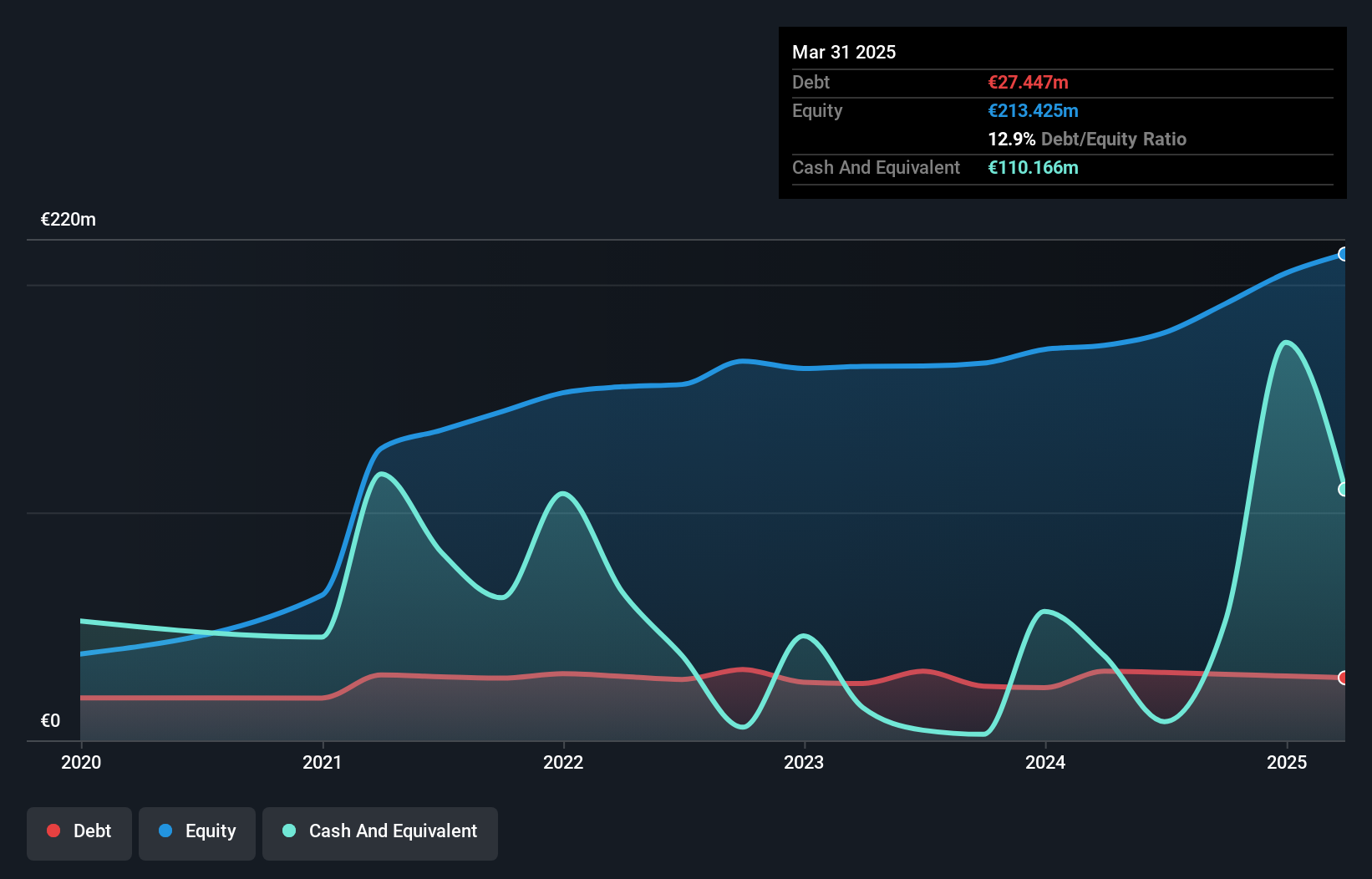

Friedrich Vorwerk Group, a promising player in Germany's energy sector, has shown robust financial performance recently. For the second quarter of 2024, sales reached €117.41 million, up from €92.55 million the previous year, with revenue at €121.04 million compared to €96.41 million a year ago. Net income also saw significant improvement to €7.96 million from last year's €2.38 million, reflecting strong operational efficiency and market demand for their services and products.

- Dive into the specifics of Friedrich Vorwerk Group here with our thorough health report.

Gain insights into Friedrich Vorwerk Group's past trends and performance with our Past report.

Taking Advantage

- Investigate our full lineup of 53 German Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade RHÖN-KLINIKUM, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHK

RHÖN-KLINIKUM

Offers in-patient, semi-patient, and outpatient healthcare services in Germany.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives