German Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East have led to cautious sentiment across European markets, Germany's DAX Index recently experienced a decline of 1.81%. Despite these challenges, growth companies with high insider ownership can offer unique insights and potential resilience in volatile market conditions. Investors often view substantial insider ownership as a positive indicator, suggesting that those closest to the company are confident in its future prospects.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| Stemmer Imaging (XTRA:S9I) | 25% | 23.2% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

| adidas (XTRA:ADS) | 16.6% | 41.8% |

| pferdewetten.de (XTRA:EMH) | 20.6% | 97.9% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Beyond Frames Entertainment (DB:8WP) | 10.8% | 112.2% |

| Redcare Pharmacy (XTRA:RDC) | 17.4% | 51.5% |

| elumeo (XTRA:ELB) | 25.8% | 120.2% |

| Your Family Entertainment (DB:RTV) | 17.3% | 124.4% |

Underneath we present a selection of stocks filtered out by our screen.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €284.18 million.

Operations: The company generates revenue from its Security Technologies segment, which accounts for €37.03 million, and its Financial Technologies segment, contributing €174.59 million.

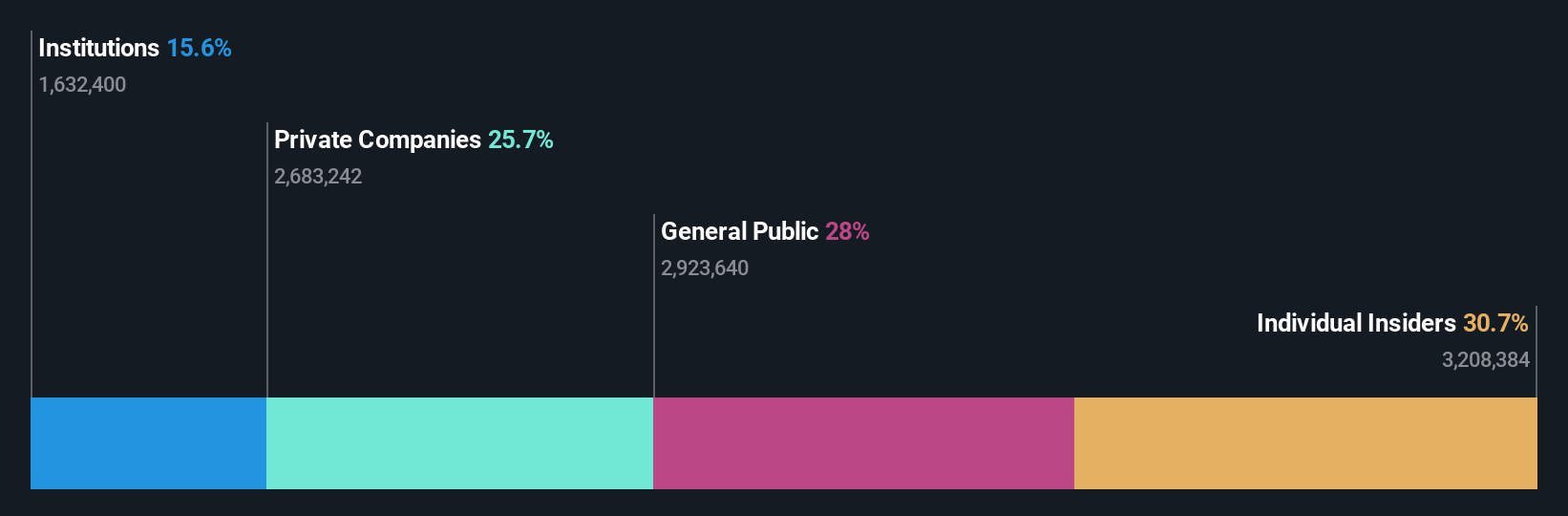

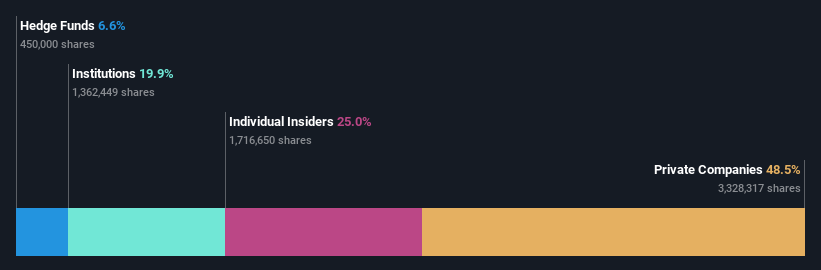

Insider Ownership: 26.6%

Brockhaus Technologies is experiencing significant growth, with earnings expected to rise 93% annually and profitability anticipated within three years. Despite a net loss of €6.65 million in H1 2024, revenue grew from €84.64 million to €109.49 million year-over-year. The company trades significantly below its estimated fair value and forecasts revenue between €220-240 million for 2024, increasing to €290-320 million in 2025, outpacing the German market's growth rate.

- Unlock comprehensive insights into our analysis of Brockhaus Technologies stock in this growth report.

- Our valuation report here indicates Brockhaus Technologies may be undervalued.

Stemmer Imaging (XTRA:S9I)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stemmer Imaging AG offers machine vision technology for various industry and non-industry applications globally, with a market cap of €315.90 million.

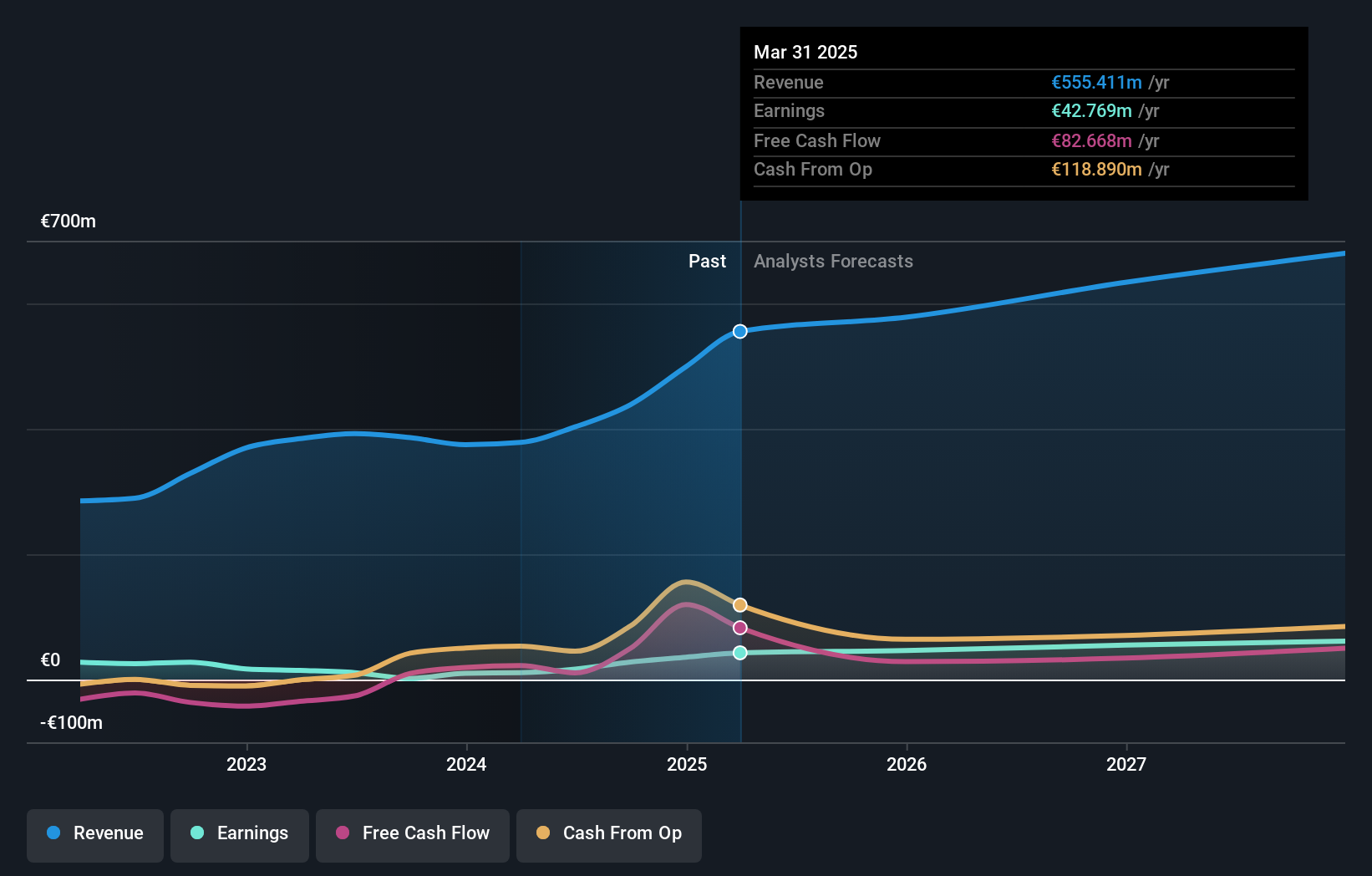

Operations: The company's revenue is primarily derived from its machine vision technology segment, which generated €126.23 million.

Insider Ownership: 25%

Stemmer Imaging is undergoing a transformative phase with MiddleGround Capital's takeover offer at €48 per share, representing substantial premiums to recent prices. Despite volatile share performance and declining recent earnings, the company's revenue is forecast to grow 13.3% annually, outpacing the broader German market. Earnings are expected to rise significantly by 23.2% per year over three years, and shares trade below their estimated fair value, reflecting potential growth prospects amid insider ownership stability.

- Click here to discover the nuances of Stemmer Imaging with our detailed analytical future growth report.

- Our expertly prepared valuation report Stemmer Imaging implies its share price may be too high.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE offers solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €488 million.

Operations: The company's revenue is primarily derived from its segments in Natural Gas (€160.89 million), Adjacent Opportunities (€117.28 million), Electricity (€95.30 million), and Clean Hydrogen (€28.38 million).

Insider Ownership: 18.8%

Friedrich Vorwerk Group shows promising growth prospects with its earnings projected to increase 24.6% annually, surpassing the German market's 20.2%. Recent earnings results reveal significant improvements, including a net income rise to €7.96 million for Q2 2024 from €2.38 million a year ago. The company forecasts revenue exceeding €410 million for fiscal year 2024, indicating at least a 10% growth compared to the previous year, highlighting its robust performance amidst stable insider ownership levels.

- Get an in-depth perspective on Friedrich Vorwerk Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Friedrich Vorwerk Group is priced higher than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 19 Fast Growing German Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Stemmer Imaging, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:S9I

Stemmer Imaging

Provides machine vision technology for industry and non-industry applications worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives