Discovering Eckert & Ziegler And 2 Other Hidden Small Cap Treasures

Reviewed by Simply Wall St

Amid a backdrop of cautious optimism in the European markets, Germany's DAX index has shown modest gains, reflecting a broader sentiment of stability following the U.S. Federal Reserve's recent rate cut. Investors are increasingly looking towards small-cap stocks for potential growth opportunities as these companies often offer unique value propositions and agility in dynamic market conditions. In this context, discovering hidden gems like Eckert & Ziegler can be particularly rewarding for those seeking to capitalize on innovative sectors within Germany’s economy.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €933.46 million.

Operations: Eckert & Ziegler SE generates revenue primarily from its Medical (€132.80 million) and Isotope Products (€150.97 million) segments, with total revenues impacted by segment adjustments and eliminations.

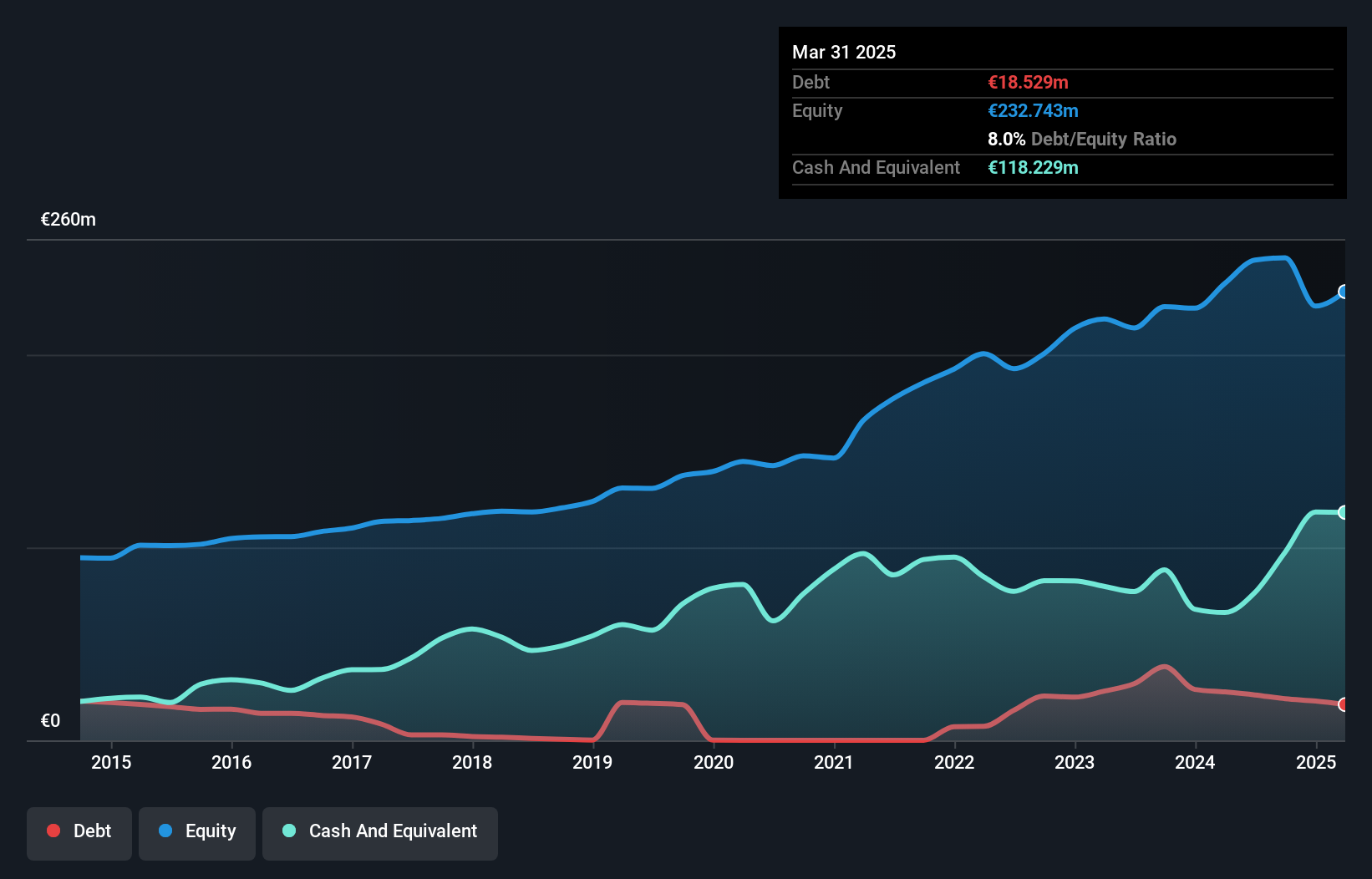

Eckert & Ziegler, a small cap gem in Germany, reported second-quarter sales of €77.76 million and net income of €9.54 million, up from €60.03 million and €6.17 million respectively last year. Basic earnings per share rose to €0.52 from €0.34 a year ago, reflecting strong growth in the medical equipment sector with earnings growing 31.6% over the past year compared to the industry’s 16.2%. The company’s debt-to-equity ratio improved from 14.7% to 9.5% over five years while maintaining high-quality earnings and positive free cash flow.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProCredit Holding AG, along with its subsidiaries, offers commercial banking services to small and medium enterprises as well as private customers across Europe, South America, and Germany, with a market cap of €501.82 million.

Operations: ProCredit Holding AG generates its revenue primarily from banking services, amounting to €422.15 million. The company's net profit margin stands at 14.25%.

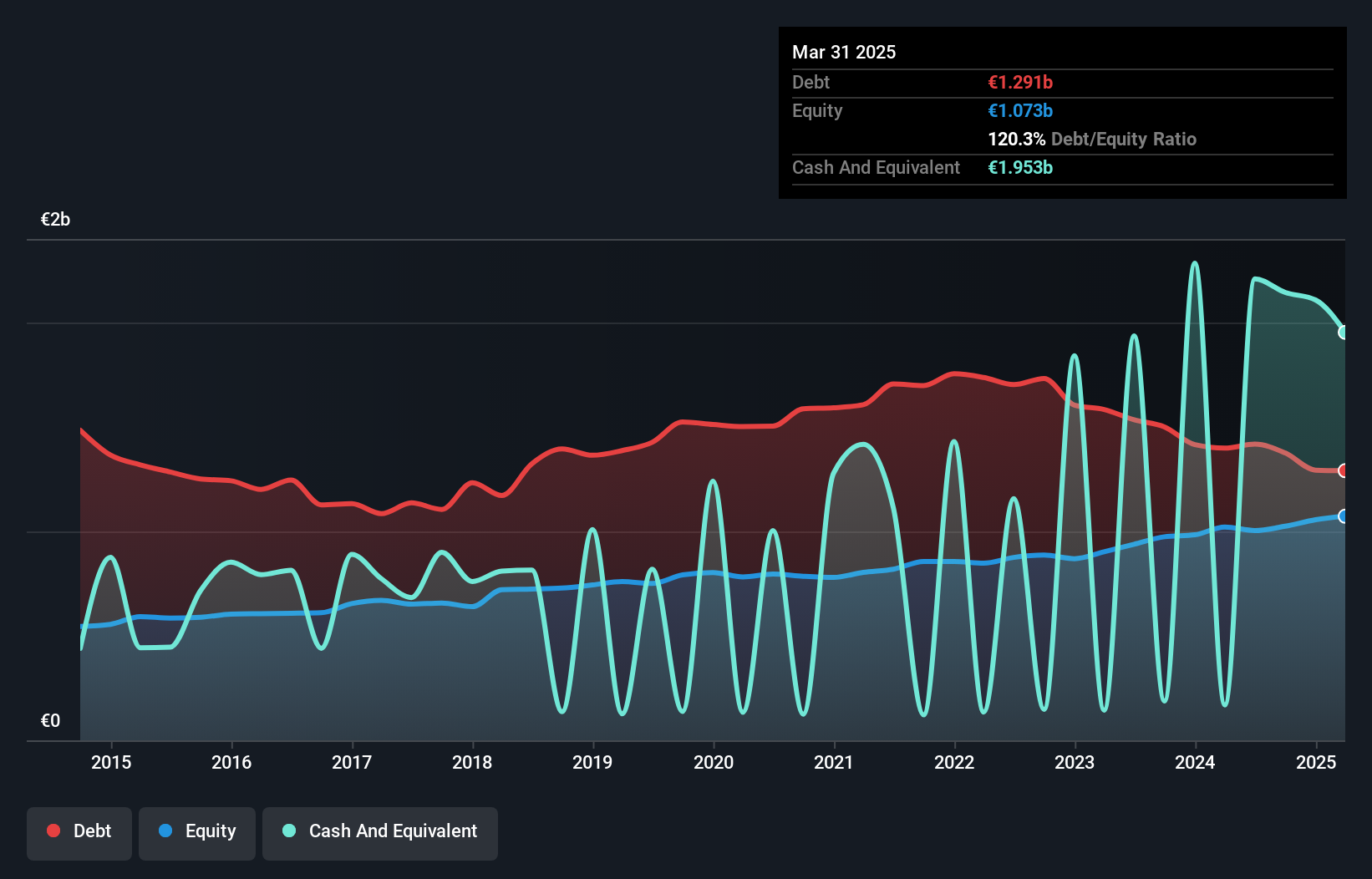

ProCredit Holding, with total assets of €10.1B and equity of €1.0B, has deposits amounting to €7.5B and loans at €6.5B. The bank's net interest margin stands at 3.6%, while its allowance for bad loans is sufficient at 2.4% of total loans. Earnings grew by 46.7% over the past year, surpassing the industry average growth rate of 18%. Trading at a significant discount, it is valued at 72% below its estimated fair value.

- Delve into the full analysis health report here for a deeper understanding of ProCredit Holding.

Examine ProCredit Holding's past performance report to understand how it has performed in the past.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE offers diverse solutions for energy transformation and transportation across Germany and Europe, with a market cap of €483.00 million.

Operations: Friedrich Vorwerk Group SE generates revenue primarily from Natural Gas (€160.89 million), Electricity (€95.30 million), Clean Hydrogen (€28.38 million), and Adjacent Opportunities (€117.28 million).

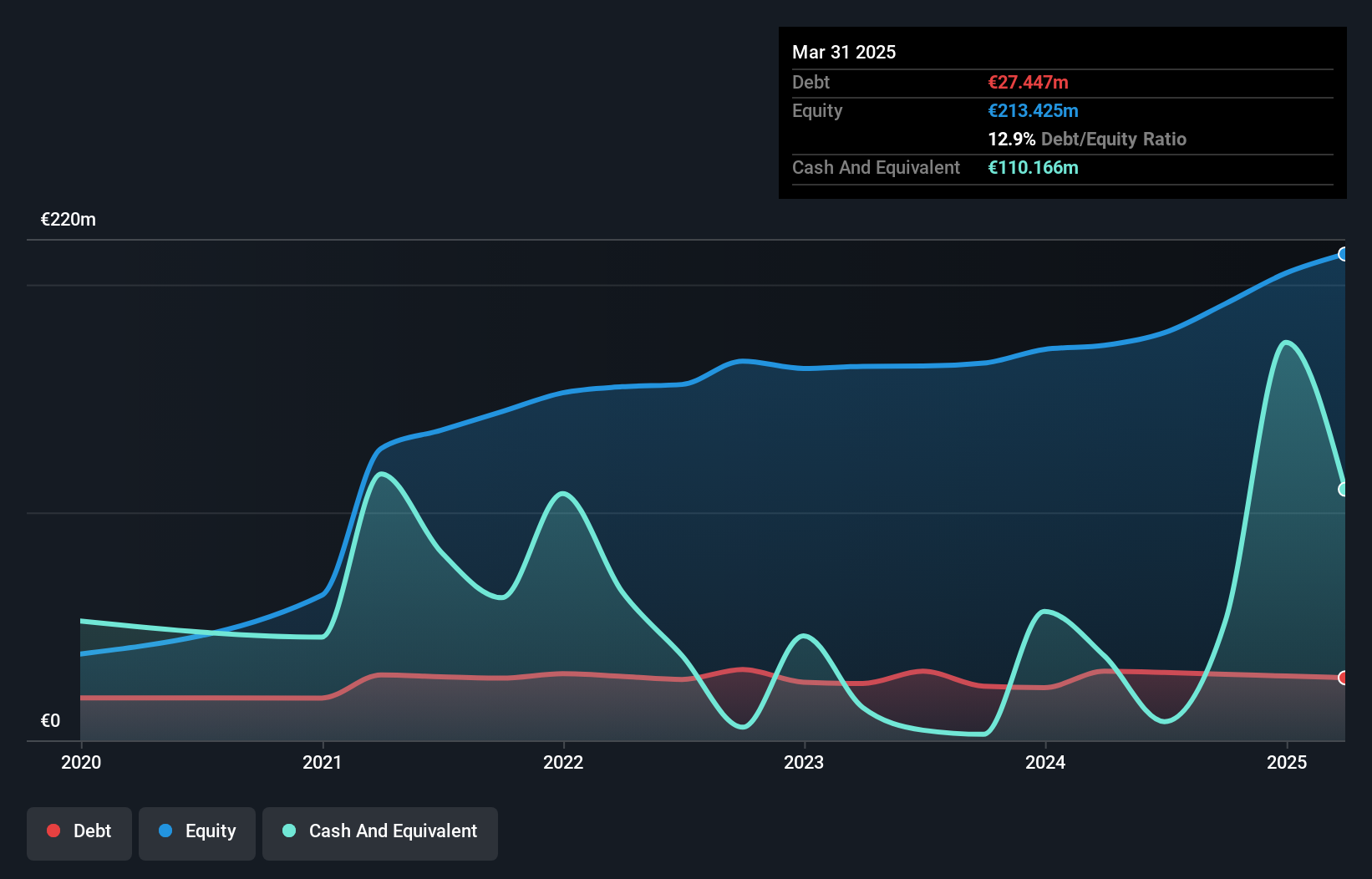

Friedrich Vorwerk Group's recent performance showcases promising growth, with Q2 2024 sales reaching €117.41 million, up from €92.55 million the previous year. Revenue for the same period hit €121.04 million compared to last year's €96.41 million, while net income surged to €7.96 million from €2.38 million a year ago. The company expects its 2024 revenue to exceed €410 million, reflecting at least a 10% growth over 2023 projections and demonstrating strong potential in its sector.

Summing It All Up

- Delve into our full catalog of 57 German Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PCZ

ProCredit Holding

Provides commercial banking products and services for small and medium enterprises and private customers in Europe, South America, and Germany.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives