3 German Growth Stocks With High Insider Ownership And Up To 25% Earnings Growth

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cuts have buoyed major stock indexes, Germany's DAX has seen a notable increase, reflecting optimism in the market. In this environment of monetary easing and moderated inflation expectations, growth companies with high insider ownership can present unique opportunities for investors seeking robust earnings potential.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| Stemmer Imaging (XTRA:S9I) | 27.8% | 23.2% |

| Multitude (XTRA:E4I) | 31% | 20.7% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.6% | 54.1% |

| adidas (XTRA:ADS) | 16.6% | 40.4% |

| pferdewetten.de (XTRA:EMH) | 20.6% | 97.9% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18.8% | 25.5% |

| Redcare Pharmacy (XTRA:RDC) | 17.2% | 54.3% |

| elumeo (XTRA:ELB) | 25.8% | 129.5% |

Here's a peek at a few of the choices from the screener.

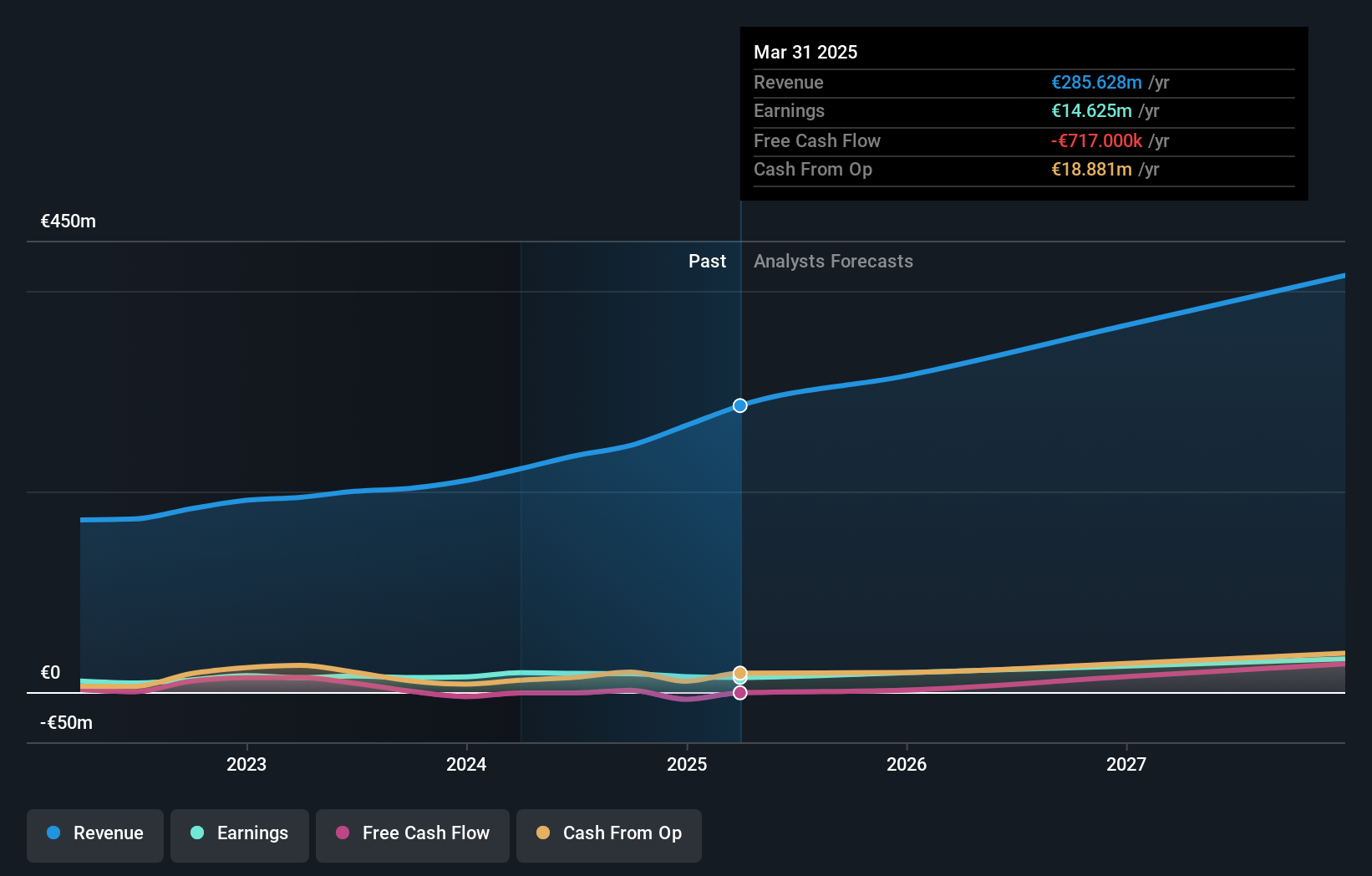

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €360.48 million.

Operations: The company's revenue segment is primarily from Wireless Communications Equipment, generating €235.67 million.

Insider Ownership: 39.6%

Earnings Growth Forecast: 21.6% p.a.

init innovation in traffic systems SE demonstrates growth potential with earnings anticipated to rise significantly at 21.62% annually, surpassing the German market's pace. Despite a recent dip in quarterly net income to €2.42 million, six-month results show robust improvement with net income reaching €4.82 million from €1.34 million year-over-year. The stock trades below its fair value and offers good relative value compared to peers, though its dividend sustainability is questionable due to coverage issues by free cash flows.

- Click to explore a detailed breakdown of our findings in init innovation in traffic systems' earnings growth report.

- The valuation report we've compiled suggests that init innovation in traffic systems' current price could be quite moderate.

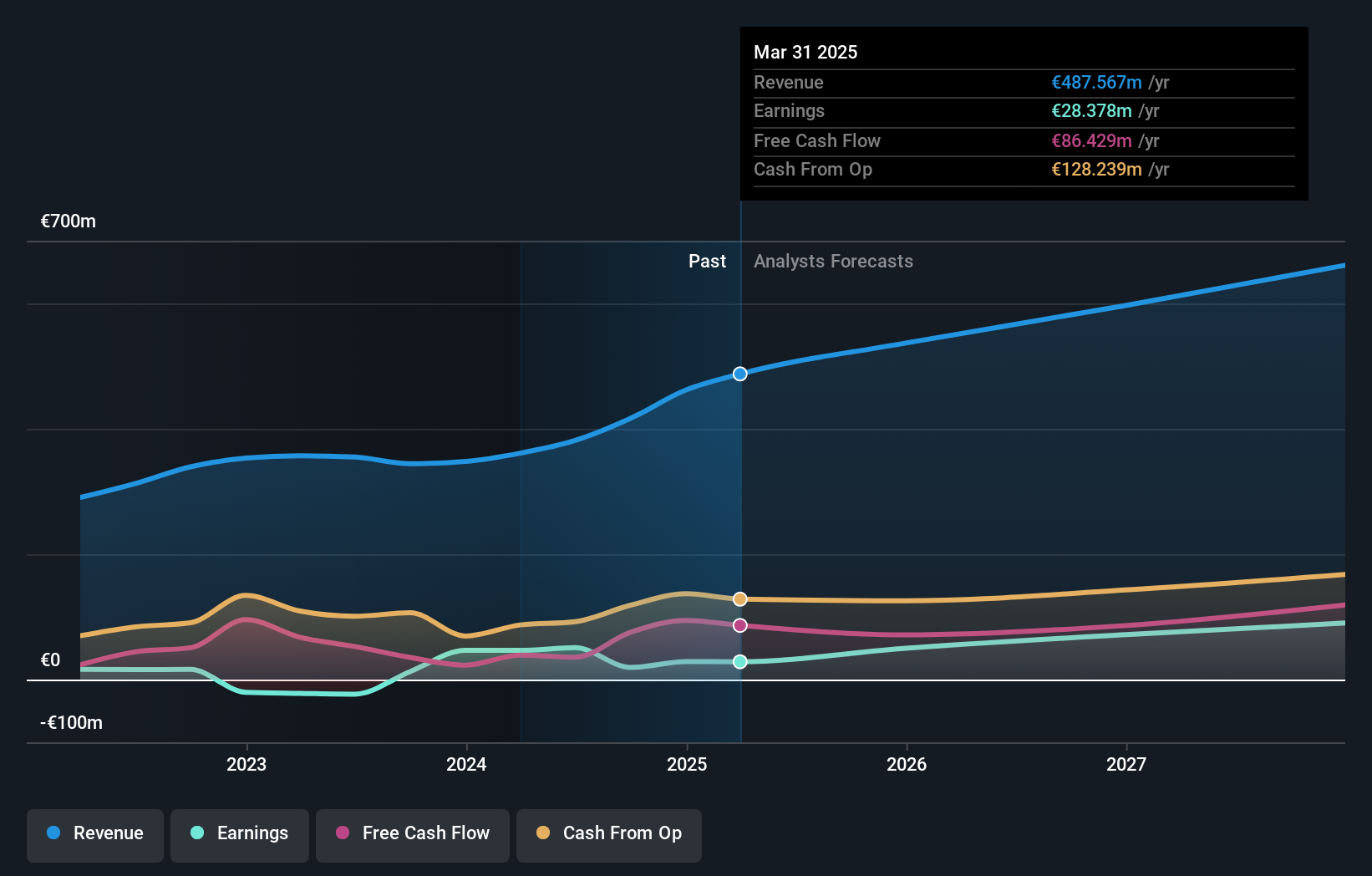

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €642.93 million.

Operations: The company's revenue is primarily derived from its Supply Side Platforms (SSP) segment, generating €341.35 million, and its Demand Side Platforms (DSP) segment, contributing €57.59 million.

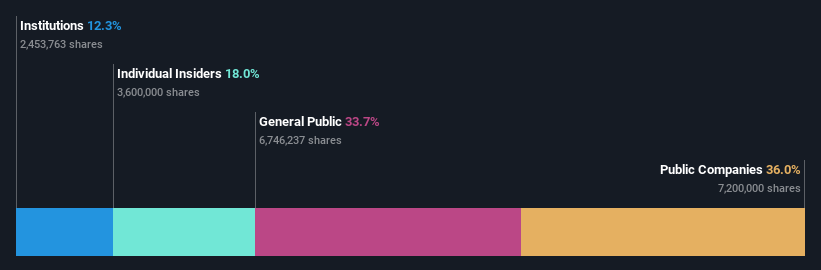

Insider Ownership: 25.1%

Earnings Growth Forecast: 20.1% p.a.

Verve Group SE has shown profitability this year, with earnings expected to grow significantly at 20.08% annually, outpacing the German market. Despite recent share dilution and volatility, the stock trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent financials reveal strong performance with second-quarter sales of €102.82 million and net income of €6.26 million, reflecting solid growth from the previous year.

- Take a closer look at Verve Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Verve Group's share price might be too pessimistic.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE offers solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €565 million.

Operations: The company's revenue segments include €95.30 million from electricity, €160.89 million from natural gas, €28.38 million from clean hydrogen, and €117.28 million from adjacent opportunities.

Insider Ownership: 18.8%

Earnings Growth Forecast: 25.5% p.a.

Friedrich Vorwerk Group SE has demonstrated robust growth, with second-quarter sales reaching €117.41 million, up from €92.55 million a year ago, and net income increasing to €7.96 million from €2.38 million. The company forecasts revenue growth of at least 10% for 2024, outpacing the German market's average rate. Despite low expected return on equity at 12.3%, earnings are projected to grow significantly at 25.5% annually over the next three years.

- Unlock comprehensive insights into our analysis of Friedrich Vorwerk Group stock in this growth report.

- Our valuation report unveils the possibility Friedrich Vorwerk Group's shares may be trading at a premium.

Key Takeaways

- Get an in-depth perspective on all 22 Fast Growing German Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M8G

Verve Group

Operates a software platform for the automated buying and selling of digital advertising space in North America and Europe.

Reasonable growth potential with proven track record.