- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

Undiscovered Gems with Strong Potential This January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are navigating a mixed landscape, with the S&P 500 Index closing out a strong year despite recent volatility, while economic indicators like the Chicago PMI highlight ongoing challenges in manufacturing. Amid these dynamics, small-cap stocks present intriguing opportunities for investors seeking growth potential in an environment marked by cautious optimism and selective risk-taking. Identifying undiscovered gems involves looking for companies that demonstrate resilience and adaptability in these fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

OEM International (OM:OEM B)

Simply Wall St Value Rating: ★★★★★★

Overview: OEM International AB (publ) is a technology trading company operating through its subsidiaries in various countries including Sweden, Finland, and China, with a market capitalization of approximately SEK15.58 billion.

Operations: The company generates revenue primarily from its operations in Sweden, contributing SEK3.31 billion, followed by Denmark, Norway, the British Isles, and East Central Europe with SEK1.21 billion. The segment covering Finland, the Baltic States, and China adds SEK1.03 billion to the total revenue.

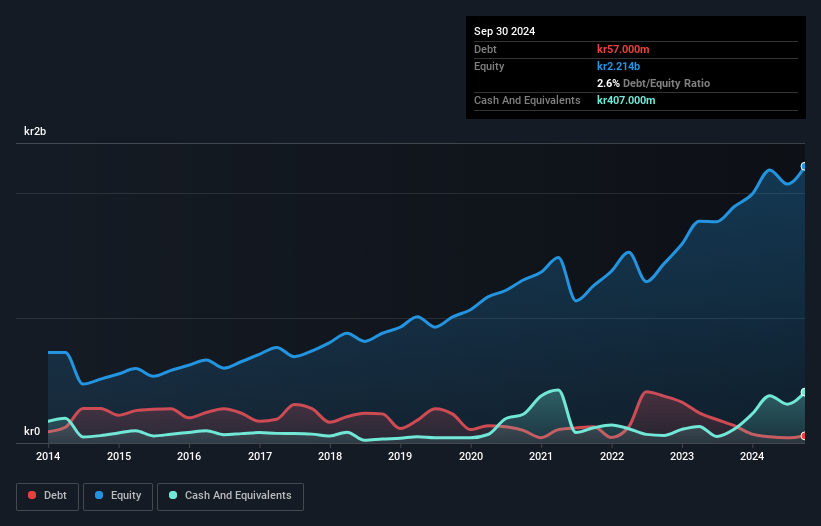

OEM International, a modestly-sized player in the trade distribution sector, recently faced a setback with negative earnings growth of -6.2%, underperforming against the industry average of -2.1%. Despite this, its financial health appears robust; the debt-to-equity ratio impressively shrank from 22.9% to 2.6% over five years, and it holds more cash than total debt. OEM's interest payments are comfortably managed with EBIT covering them 244 times over, indicating strong operational efficiency. Although trading at roughly half its estimated fair value suggests potential undervaluation, recent M&A activity was canceled, which could impact future strategic directions.

- Navigate through the intricacies of OEM International with our comprehensive health report here.

Explore historical data to track OEM International's performance over time in our Past section.

Yamaichi ElectronicsLtd (TSE:6941)

Simply Wall St Value Rating: ★★★★★★

Overview: Yamaichi Electronics Co., Ltd. is a company that manufactures and sells test, connector, and optical-related products both in Japan and internationally, with a market cap of ¥48.04 billion.

Operations: Yamaichi Electronics generates revenue primarily from its Test Solutions Business and Connector Solutions Business, which contribute ¥25.02 billion and ¥19.18 billion respectively, while the Optical Related Business adds ¥1.20 billion.

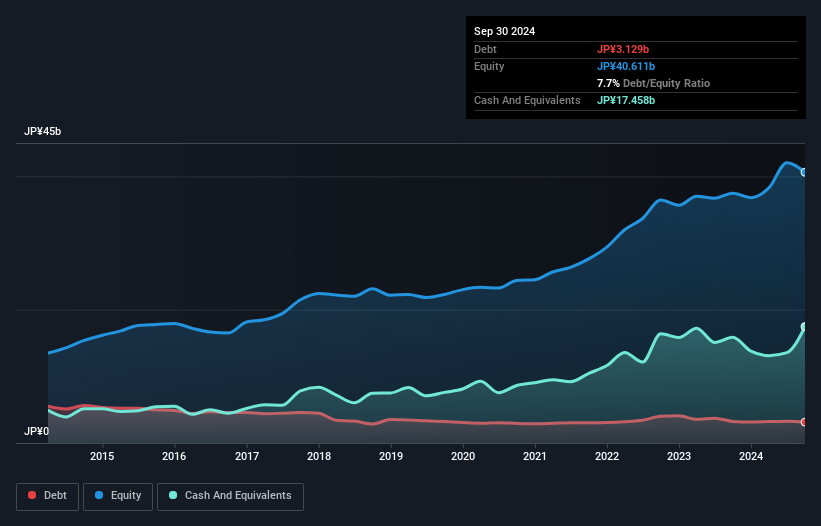

Yamaichi Electronics, a nimble player in the semiconductor space, has been making waves with its impressive growth trajectory. Over the past year, earnings surged by 56%, outpacing the industry's 7% rise. Its financial health is robust, boasting more cash than total debt and a debt-to-equity ratio that decreased from 14% to 8% over five years. The company also repurchased 360,900 shares for ¥999 million as part of its strategic buyback plan. Trading at nearly 62% below estimated fair value indicates potential undervaluation in the market's eyes. With high-quality earnings and solid coverage of interest payments (54x EBIT), Yamaichi seems well-positioned for continued success.

- Click here and access our complete health analysis report to understand the dynamics of Yamaichi ElectronicsLtd.

Understand Yamaichi ElectronicsLtd's track record by examining our Past report.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★☆

Overview: EnviTec Biogas AG is involved in the manufacturing and operation of biogas and biomethane plants across various countries including Germany, Italy, Great Britain, and others, with a market cap of €436.59 million.

Operations: EnviTec Biogas generates revenue primarily from the manufacturing and operation of biogas and biomethane plants across multiple countries. The company has a market cap of €436.59 million.

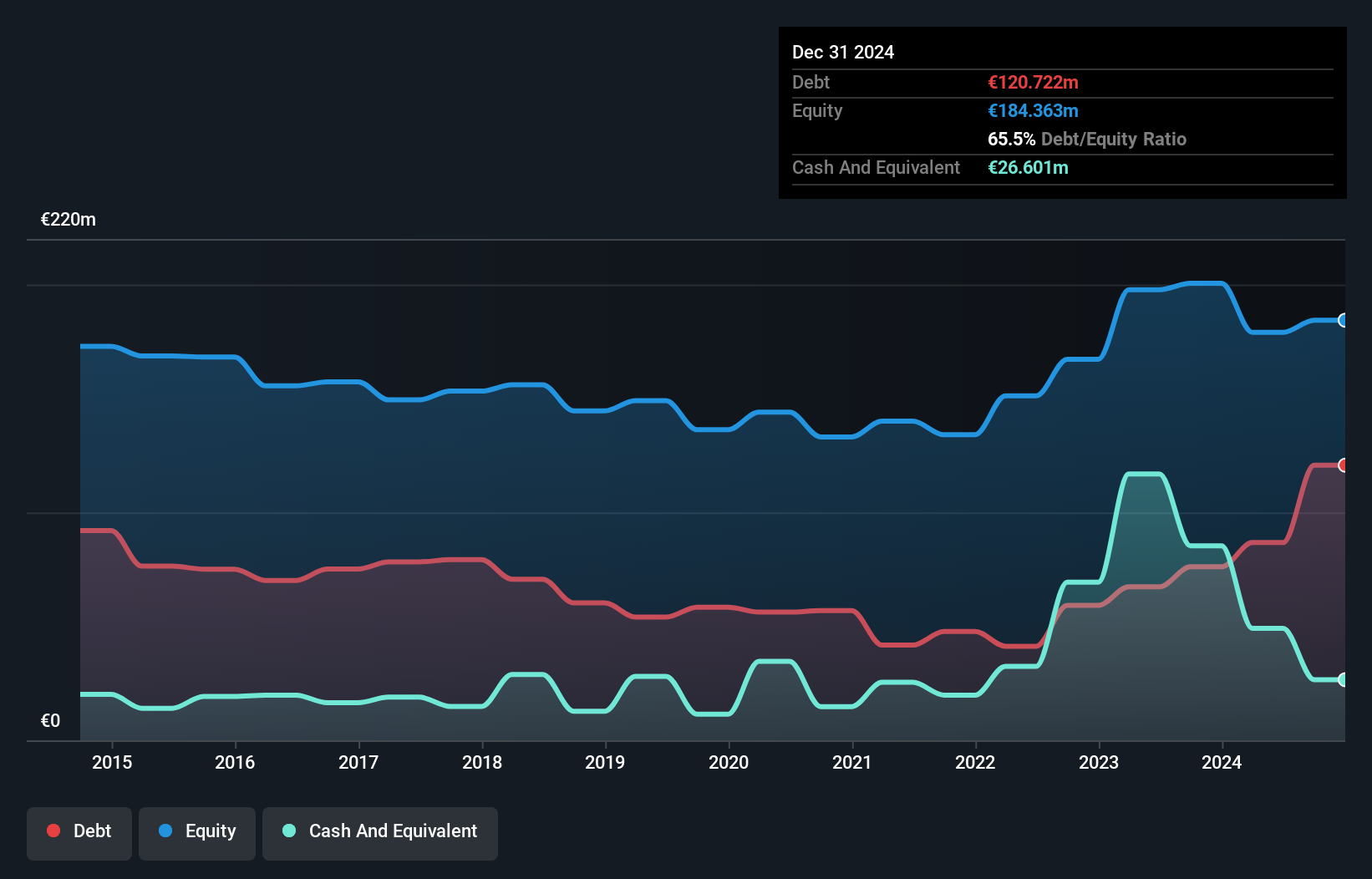

EnviTec Biogas, a notable player in the renewable energy sector, is trading at 59.5% below its estimated fair value, suggesting potential undervaluation. Despite a negative earnings growth of 16.5% last year, it outperformed the broader Oil and Gas industry average of 28.6%. The company's debt profile has shifted over five years, with a debt to equity ratio rising from 36.3% to 48.5%, yet its net debt to equity remains satisfactory at 21%. With high-quality past earnings and interest comfortably covered by profits, EnviTec presents an intriguing mix of opportunity and risk for investors exploring renewable energy investments.

- Click here to discover the nuances of EnviTec Biogas with our detailed analytical health report.

Assess EnviTec Biogas' past performance with our detailed historical performance reports.

Where To Now?

- Delve into our full catalog of 4667 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Greece, Estonia, and internationally.

Excellent balance sheet average dividend payer.