- Germany

- /

- Hospitality

- /

- XTRA:HTG

3 Growth Companies With High Insider Ownership And 28% Revenue Growth

Reviewed by Simply Wall St

As global markets reflect a mixed performance with U.S. stocks closing out a strong year despite recent fluctuations, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts for insights into future trends. Amidst this backdrop of cautious optimism and market volatility, growth companies with high insider ownership can offer unique opportunities; these firms often demonstrate robust alignment between management and shareholder interests, potentially driving sustainable revenue growth even in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Floridienne (ENXTBR:FLOB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Floridienne S.A. operates through its subsidiaries in the chemicals, gourmet food, and life sciences sectors both in Belgium and internationally, with a market cap of €670.95 million.

Operations: The company's revenue segments include €150.05 million from the Food sector, €39.25 million from the Chemicals Division, and €409.99 million from the Life Sciences Division.

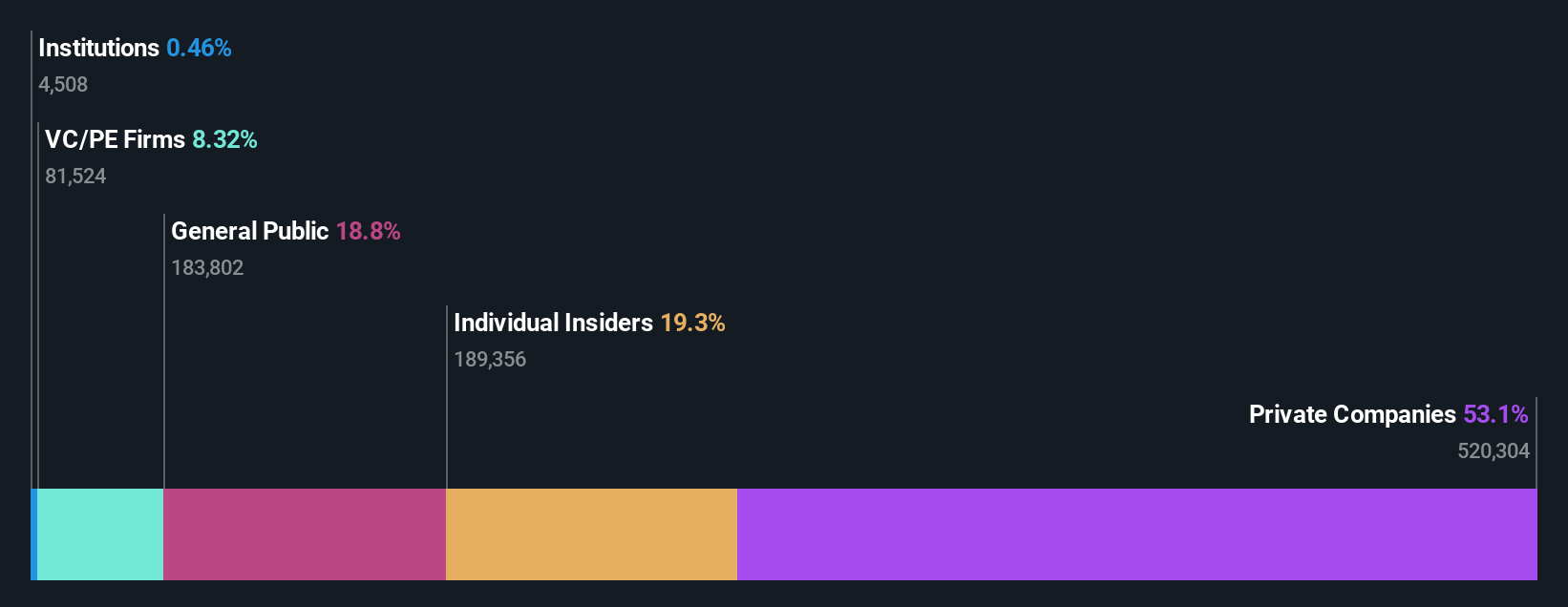

Insider Ownership: 19.3%

Revenue Growth Forecast: 13.7% p.a.

Floridienne's forecasted revenue growth of 13.7% annually surpasses the Belgian market average, while its earnings are expected to grow significantly at 48.2% per year, indicating strong potential for profit expansion. Despite these promising growth prospects, the company's profit margins have decreased from last year due to large one-off items impacting results. There's no recent insider trading activity reported over the past three months to suggest changes in insider confidence or ownership levels.

- Click here to discover the nuances of Floridienne with our detailed analytical future growth report.

- Our valuation report here indicates Floridienne may be overvalued.

Qingdao NovelBeam TechnologyLtd (SHSE:688677)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao NovelBeam Technology Co., Ltd. specializes in the research, development, production, and sales of medical endoscopic instruments and optical products globally, with a market cap of CN¥4.46 billion.

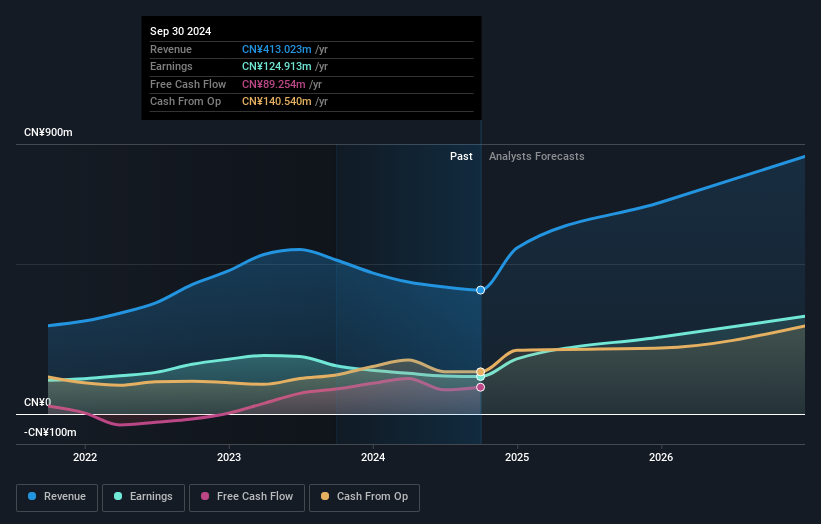

Operations: The company generates revenue of CN¥413.02 million from the sales and maintenance of endoscopes and optical related products.

Insider Ownership: 14.0%

Revenue Growth Forecast: 28.9% p.a.

Qingdao NovelBeam Technology Ltd. is poised for significant growth, with earnings projected to increase by 37.4% annually, outpacing the broader CN market's 25%. Revenue is also expected to grow robustly at 28.9% per year. Despite these promising forecasts, recent financials show a decline in sales and net income compared to last year. The company completed a share buyback of 737,000 shares for CNY 26.11 million but reported no insider trading activity over the past three months.

- Dive into the specifics of Qingdao NovelBeam TechnologyLtd here with our thorough growth forecast report.

- Our valuation report unveils the possibility Qingdao NovelBeam TechnologyLtd's shares may be trading at a premium.

HomeToGo (XTRA:HTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HomeToGo SE operates a marketplace for vacation rentals, connecting users searching for accommodations in Luxembourg and internationally, with a market cap of €242.16 million.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating €200.22 million.

Insider Ownership: 11.3%

Revenue Growth Forecast: 15.7% p.a.

HomeToGo is projected to grow its revenue by 15.7% annually, surpassing the German market's average growth rate. The company anticipates becoming profitable within three years, with earnings expected to rise significantly at 82.63% per year. Recent financials show third-quarter sales of €87.38 million, up from €73.86 million a year ago, and a reduced net loss over nine months compared to last year. Additionally, HomeToGo has been involved in share buybacks and potential acquisition discussions with Interhome Group.

- Click here and access our complete growth analysis report to understand the dynamics of HomeToGo.

- Insights from our recent valuation report point to the potential undervaluation of HomeToGo shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 1494 Fast Growing Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HomeToGo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HTG

HomeToGo

Operates a marketplace for vacation rentals that connects users searching for a place to stay in Luxembourg and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives