- Germany

- /

- Auto Components

- /

- XTRA:SFQ

3 Dividend Stocks To Consider Offering Up To 5.5% Yield

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks closing out a strong 2024 despite recent profit-taking and economic indicators showing varied signals, investors are increasingly looking toward dividend stocks as a potential source of steady income. In light of fluctuating indices and economic forecasts, selecting dividend-paying stocks with solid yields can be an effective strategy for those seeking stability and income in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.57% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

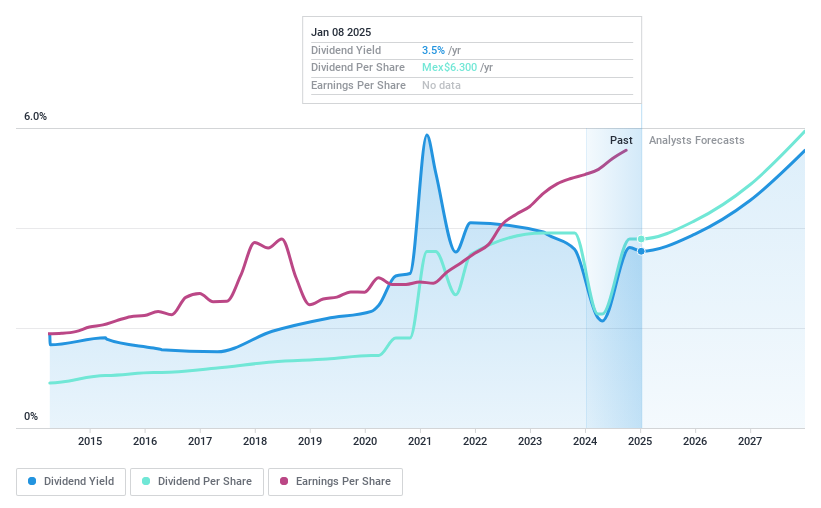

Arca Continental. de (BMV:AC *)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arca Continental, S.A.B. de C.V. is a company that produces, distributes, and sells soft drinks in Mexico, Peru, the United States, Argentina, and Ecuador with a market cap of MX$292.92 billion.

Operations: Arca Continental's revenue segments include the production, distribution, and sale of soft drinks across Mexico, Peru, the United States, Argentina, and Ecuador.

Dividend Yield: 3.6%

Arca Continental's recent earnings report shows solid growth, with third-quarter sales increasing to MXN 62.61 billion and net income rising to MXN 5.13 billion. Despite a below-market-average dividend yield of 3.56%, the company's dividends are well-covered by both earnings and cash flows, with payout ratios at 34.2% and 48.8%, respectively. However, its dividend history is unstable and has been volatile over the past decade despite some growth in payments during that period.

- Navigate through the intricacies of Arca Continental. de with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Arca Continental. de's current price could be quite moderate.

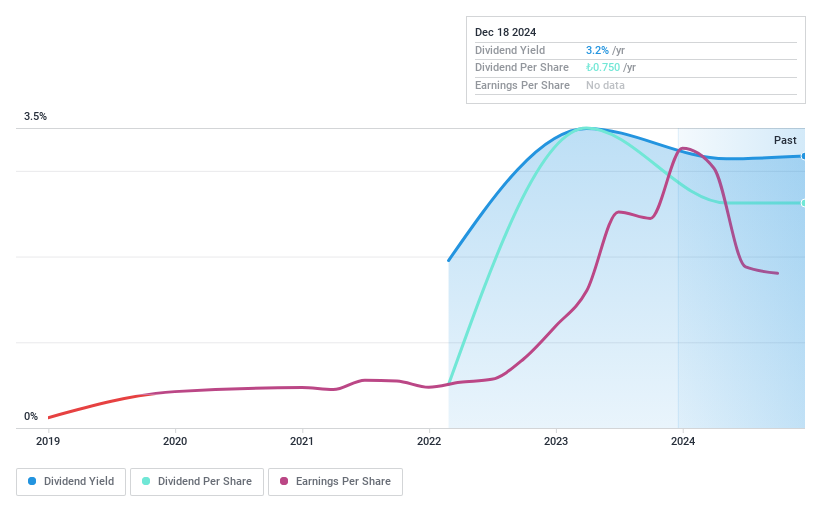

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi (IBSE:BOBET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi operates under the Bosphorus Concrete brand, focusing on the production, manufacturing, and sale of ready-made concrete and aggregates in Turkey, with a market cap of TRY9.17 billion.

Operations: The company's revenue is primarily derived from its cement segment, which generated TRY6.76 billion.

Dividend Yield: 3.1%

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi's dividends are well-covered by earnings and cash flows, with payout ratios of 41.2% and 26.6%, respectively, indicating sustainability. However, its dividend history is unstable, having been paid for only three years with volatility in payments. Despite a dividend yield of 3.11% being in the top quartile of the TR market, recent earnings show a decline with net income dropping to TRY 48.22 million from TRY 84.28 million year-over-year for Q3 2024.

- Unlock comprehensive insights into our analysis of Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi stock in this dividend report.

- In light of our recent valuation report, it seems possible that Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi is trading beyond its estimated value.

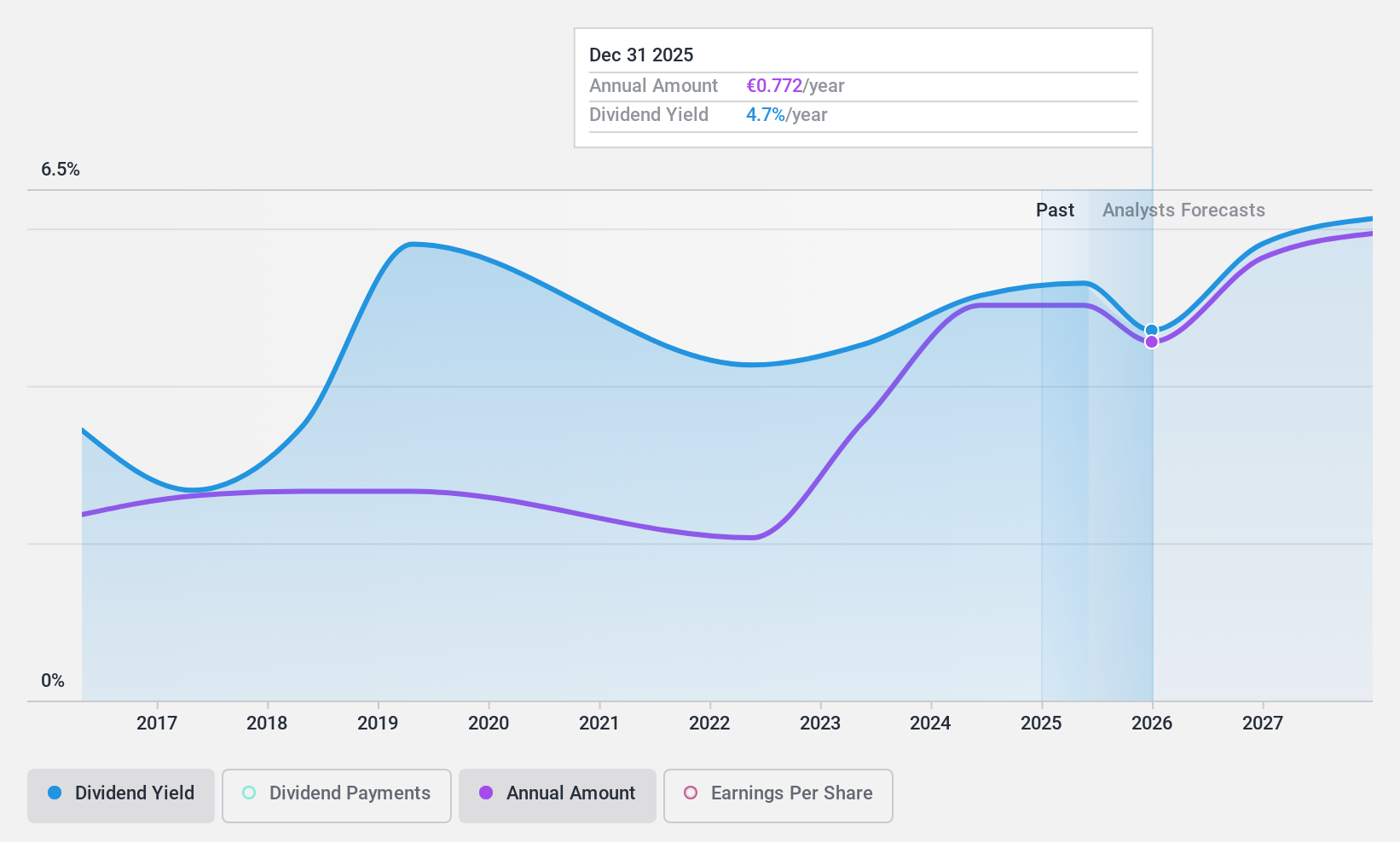

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market cap of €690 million.

Operations: SAF-Holland SE generates its revenue from three main segments: €798.85 million from the Americas, €256.11 million from Asia/Pacific (APAC)/China/India, and €914.68 million from Europe, the Middle East, and Africa (EMEA).

Dividend Yield: 5.6%

SAF-Holland's dividend is covered by earnings and cash flows, with payout ratios of 50% and 31.4%, respectively, suggesting sustainability. Despite a decade-long increase in dividends, the track record remains volatile with over 20% annual drops. The dividend yield of 5.59% ranks in the top quartile of the German market. Recent Q3 results show sales at €439.93 million and net income at €9.31 million, reflecting a decline from last year’s figures.

- Delve into the full analysis dividend report here for a deeper understanding of SAF-Holland.

- Our expertly prepared valuation report SAF-Holland implies its share price may be lower than expected.

Turning Ideas Into Actions

- Gain an insight into the universe of 1979 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SFQ

SAF-Holland

Manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives