3 Stocks Estimated To Be Trading At Discounts Ranging From 22.7% To 49.1%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks finishing another strong year despite recent economic indicators pointing towards challenges, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In such an environment, identifying undervalued stocks can be crucial, as these investments have the potential to offer significant returns if market conditions align with their fundamental strengths.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Camden National (NasdaqGS:CAC) | US$42.01 | US$83.84 | 49.9% |

| Brickability Group (AIM:BRCK) | £0.626 | £1.25 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.00 | CA$11.94 | 49.8% |

| Brunel International (ENXTAM:BRNL) | €9.84 | €19.64 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.73 | €5.44 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1452.00 | ¥2887.72 | 49.7% |

| Zhende Medical (SHSE:603301) | CN¥20.99 | CN¥41.91 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.14 | A$6.25 | 49.8% |

| Neosperience (BIT:NSP) | €0.572 | €1.14 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.92 | €5.81 | 49.8% |

Here's a peek at a few of the choices from the screener.

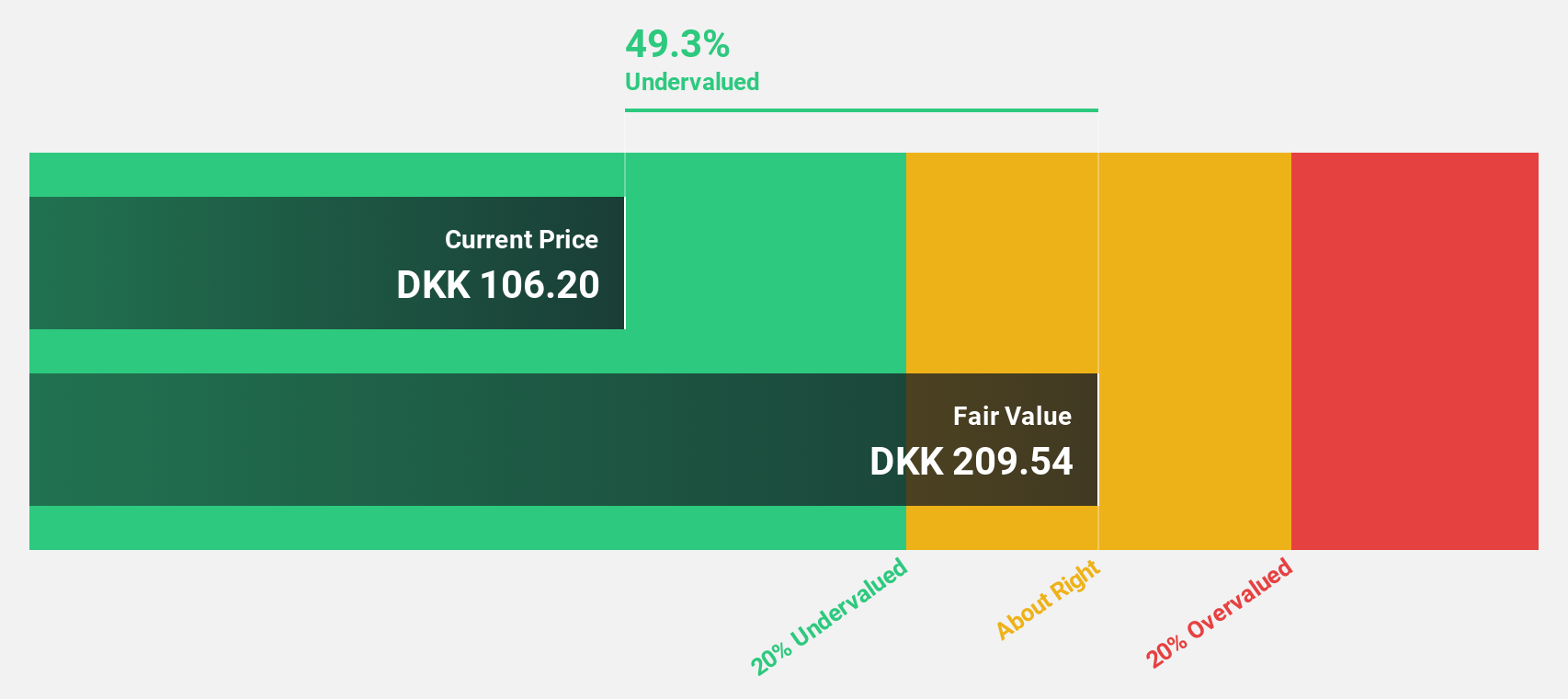

Vestas Wind Systems (CPSE:VWS)

Overview: Vestas Wind Systems A/S is involved in the design, manufacture, installation, and servicing of wind turbines across the United States, Denmark, and internationally with a market cap of DKK105.39 billion.

Operations: The company's revenue is derived from two main segments: Service, contributing €3.42 billion, and Power Solutions, which accounts for €12.51 billion.

Estimated Discount To Fair Value: 49.1%

Vestas Wind Systems appears undervalued based on cash flow analysis, trading over 20% below its estimated fair value of DKK205.06. Despite slower revenue growth forecasts at 9.3% annually, Vestas' earnings are expected to grow significantly at 35.7% per year, outpacing the Danish market. Recent large-scale orders across Europe and North America highlight robust demand for its wind turbines, potentially bolstering future cash flows and supporting a positive investment outlook amidst volatile share prices.

- The growth report we've compiled suggests that Vestas Wind Systems' future prospects could be on the up.

- Get an in-depth perspective on Vestas Wind Systems' balance sheet by reading our health report here.

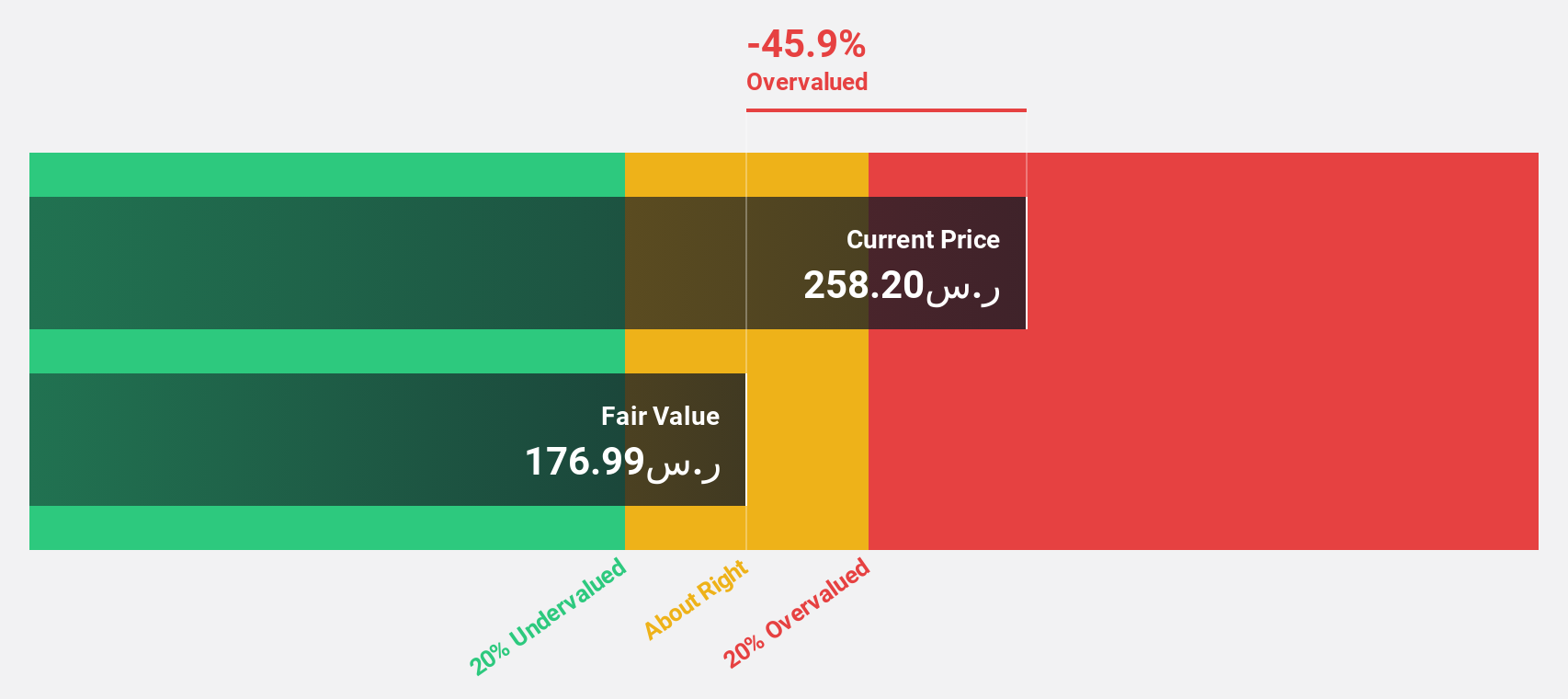

Dr. Sulaiman Al Habib Medical Services Group (SASE:4013)

Overview: Dr. Sulaiman Al Habib Medical Services Group operates hospitals, medical complexes, day surgery centers, and pharmaceutical facilities in Saudi Arabia and internationally with a market cap of SAR101.64 billion.

Operations: The company's revenue segments include SAR8.14 billion from hospitals and healthcare facilities, SAR2.22 billion from pharmacies, and SAR198 million from HMG Solutions.

Estimated Discount To Fair Value: 22.7%

Dr. Sulaiman Al Habib Medical Services Group is trading approximately 22.7% below its estimated fair value of SAR375.61, with a current price of SAR290.4, suggesting it may be undervalued based on cash flow analysis. The company's earnings and revenue are forecast to grow at 14.9% and 14.8% annually, respectively, outpacing the Saudi Arabian market averages despite high debt levels and significant non-cash earnings impacting quality assessments. Recent leadership changes could influence strategic direction positively over the long term.

- Our comprehensive growth report raises the possibility that Dr. Sulaiman Al Habib Medical Services Group is poised for substantial financial growth.

- Take a closer look at Dr. Sulaiman Al Habib Medical Services Group's balance sheet health here in our report.

adidas (XTRA:ADS)

Overview: adidas AG, along with its subsidiaries, is involved in the design, development, production, and marketing of athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America; it has a market capitalization of approximately €43.44 billion.

Operations: The company's revenue is derived from several key regions, including €3.34 billion from Greater China, €2.44 billion from Latin America, and €4.95 billion from North America.

Estimated Discount To Fair Value: 44.6%

Adidas is trading at €243.3, significantly below its estimated fair value of €439.09, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow robustly at 32.6% annually, surpassing the German market's growth rate of 20.1%. Recent financial results show improved profitability with third-quarter net income rising to €443 million from €259 million year-over-year, reflecting strong operational performance despite slower revenue growth projections.

- Upon reviewing our latest growth report, adidas' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of adidas.

Taking Advantage

- Gain an insight into the universe of 890 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, North America, Greater China, Latin America, Japan, and South Korea.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives