- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

Earnings are growing at EnviTec Biogas (ETR:ETG) but shareholders still don't like its prospects

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term EnviTec Biogas AG (ETR:ETG) shareholders have had that experience, with the share price dropping 49% in three years, versus a market return of about 51%. And more recent buyers are having a tough time too, with a drop of 35% in the last year. The falls have accelerated recently, with the share price down 44% in the last three months.

With the stock having lost 17% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, EnviTec Biogas actually managed to grow EPS by 22% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that, in three years, revenue has actually grown at a 14% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching EnviTec Biogas more closely, as sometimes stocks fall unfairly. This could present an opportunity.

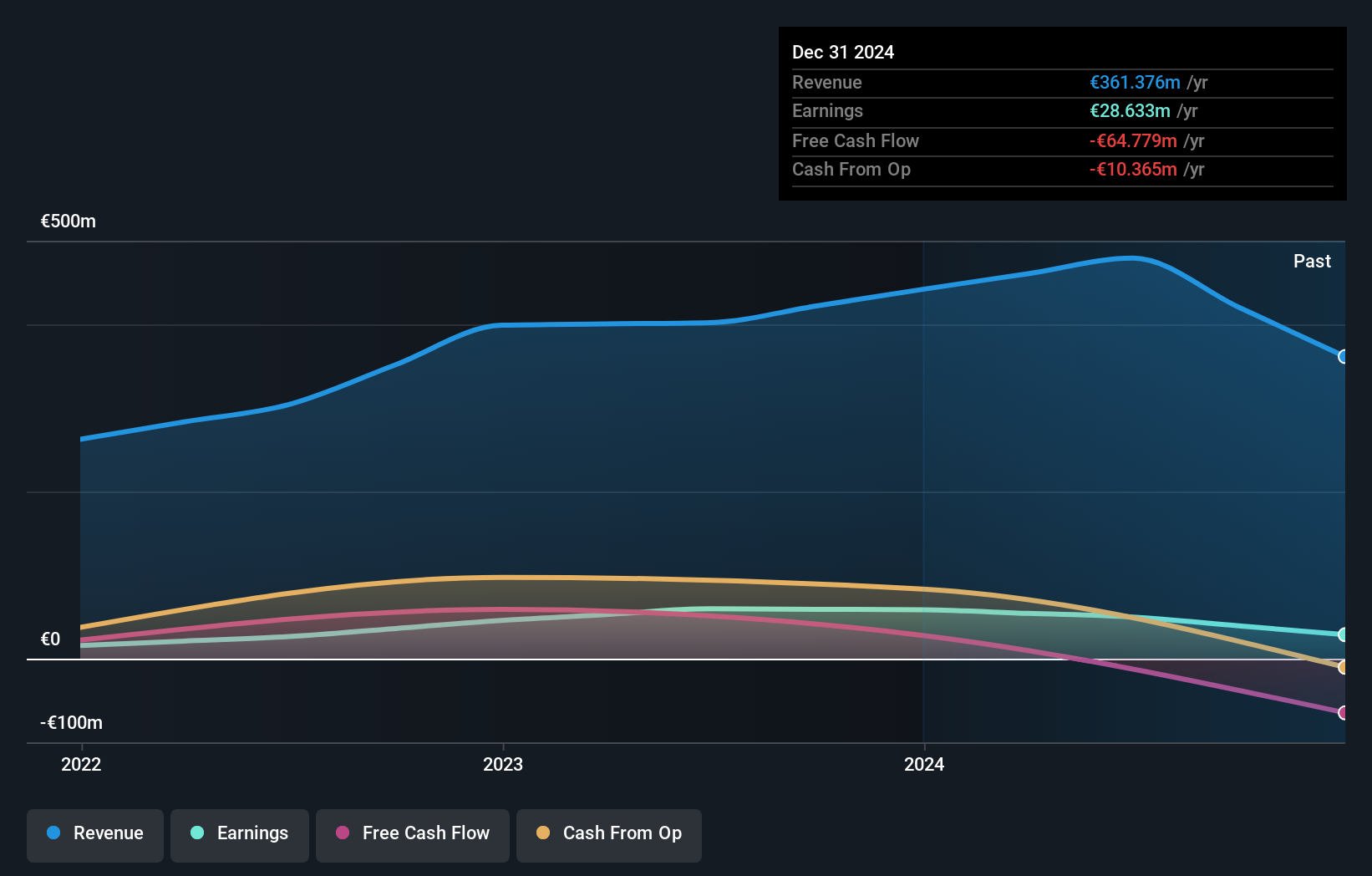

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, EnviTec Biogas' TSR for the last 3 years was -41%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 20% in the last year, EnviTec Biogas shareholders lost 33% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that EnviTec Biogas is showing 5 warning signs in our investment analysis , and 2 of those are significant...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Slovakia, Estonia, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)