- Germany

- /

- Capital Markets

- /

- DB:RTML

CAMERIT's (FRA:RTML) growing losses don't faze investors as the stock spikes 11% this past week

This week we saw the CAMERIT AG (FRA:RTML) share price climb by 11%. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 67% in that half decade.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for CAMERIT

We don't think CAMERIT's revenue of €24,941 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that CAMERIT will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. CAMERIT has already given some investors a taste of the bitter losses that high risk investing can cause.

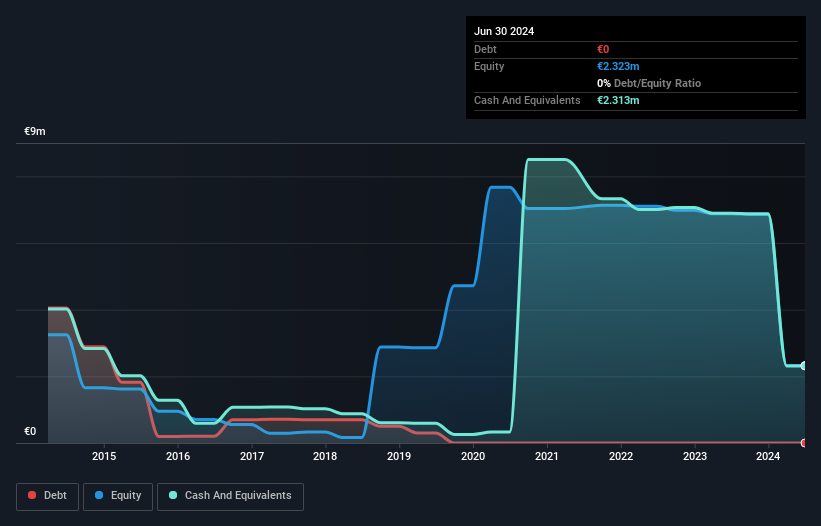

When it last reported its balance sheet in June 2024, CAMERIT could boast a strong position, with cash in excess of all liabilities of €2.3m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But since the share price has dropped 11% per year, over 5 years , it seems like the market might have been over-excited previously. You can click on the image below to see (in greater detail) how CAMERIT's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for CAMERIT the TSR over the last 5 years was 6.8%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that CAMERIT shareholders have received a total shareholder return of 32% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.3% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand CAMERIT better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with CAMERIT .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:RTML

CAMERIT

Hesse Newman Capital AG provides financial investment services in Germany.

Flawless balance sheet low.