As European markets experience a boost with the STOXX Europe 600 Index rising by 3.44% amid easing tariff concerns, investors are increasingly looking towards dividend stocks as a stable source of income in this fluctuating economic climate. In such an environment, identifying dividend stocks that offer consistent payouts and potential for growth can be a strategic approach for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.70% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.46% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.79% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.94% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.93% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.64% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.20% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.39% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. offers retail banking, wholesale banking, and asset management services across various regions including Spain, Mexico, Turkey, South America, Europe, the United States, and Asia with a market cap of €73.80 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A. generates revenue from several key regions: €12.03 billion from Mexico, €3.90 billion from Turkey, €4.33 billion from South America, and €9.22 billion from Spain (including Non-Core Real Estate), with an additional contribution of €1.48 billion from the rest of its business operations.

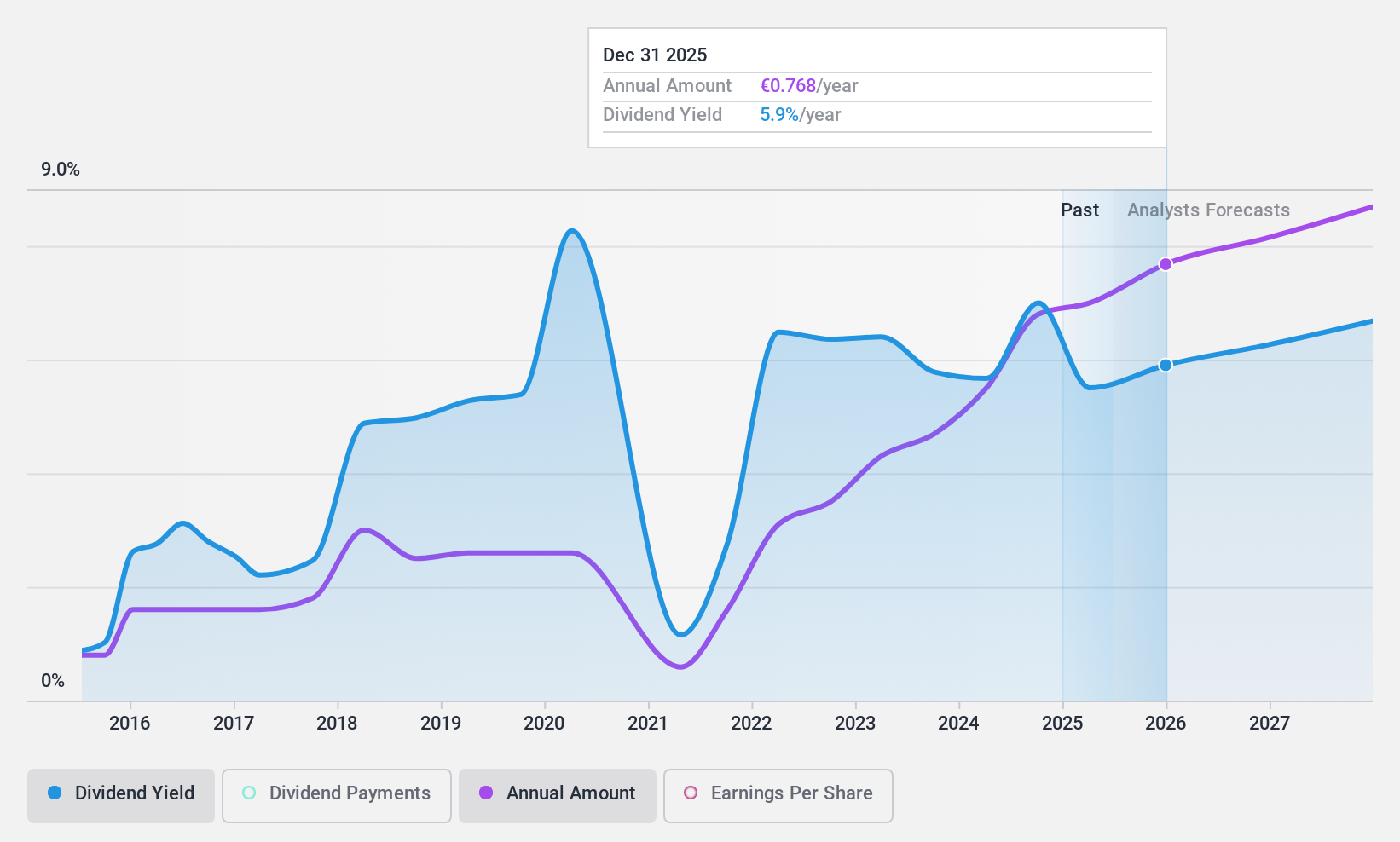

Dividend Yield: 5.5%

Banco Bilbao Vizcaya Argentaria offers a compelling dividend yield of 5.47%, placing it among the top 25% of Spanish dividend payers. Despite this attractive yield, BBVA's dividend history is marked by volatility, with past fluctuations exceeding 20%. The payout ratio stands at a manageable 39.7%, suggesting current dividends are well-covered by earnings. However, concerns arise from its high level of non-performing loans (3%) and low allowance for bad loans (83%), which could impact future financial stability and dividend reliability.

- Unlock comprehensive insights into our analysis of Banco Bilbao Vizcaya Argentaria stock in this dividend report.

- According our valuation report, there's an indication that Banco Bilbao Vizcaya Argentaria's share price might be on the cheaper side.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across several countries, including Germany, Italy, and the United States, with a market cap of €547.97 million.

Operations: EnviTec Biogas AG's revenue is primarily derived from the manufacturing and operation of biogas and biomethane plants across various international markets.

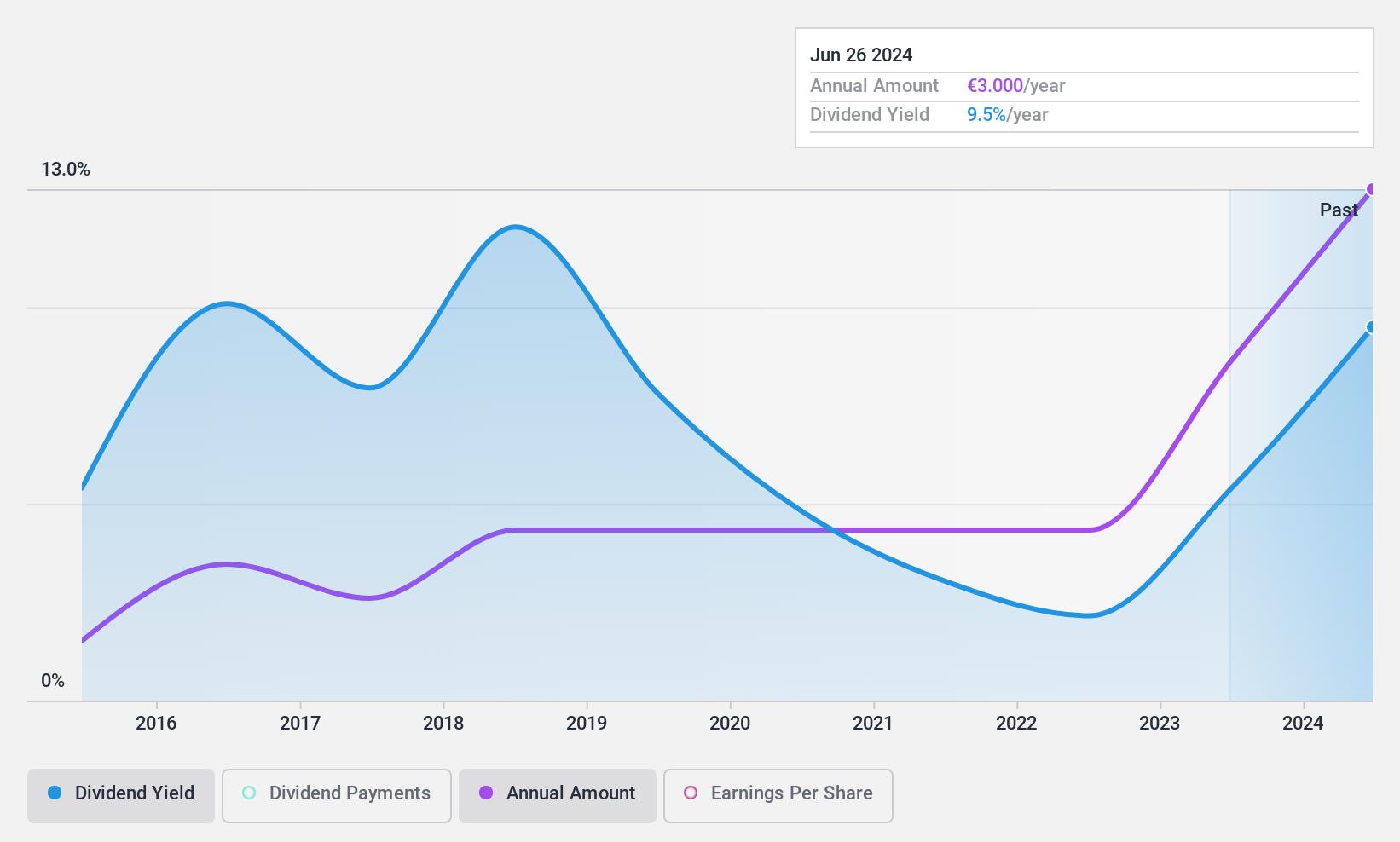

Dividend Yield: 8.1%

EnviTec Biogas provides an attractive dividend yield of 8.13%, ranking in the top 25% of German dividend payers. Despite a payout ratio of 76.2%, indicating coverage by earnings, its dividend track record is unstable with significant volatility over the past decade, including annual drops over 20%. While trading at a significant discount to its estimated fair value, insufficient data on cash flows raises concerns about long-term sustainability and reliability of dividends.

- Dive into the specifics of EnviTec Biogas here with our thorough dividend report.

- The valuation report we've compiled suggests that EnviTec Biogas' current price could be quite moderate.

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MLP SE, with a market cap of €913.76 million, provides financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE's revenue is primarily derived from Financial Consulting (€439.96 million), FERI (€264.32 million), Banking (€223.96 million), DOMCURA (€130.74 million), Deutschland.Immobilien (€47.66 million), Industrial Broker (€38.40 million), and Holding (€18.75 million).

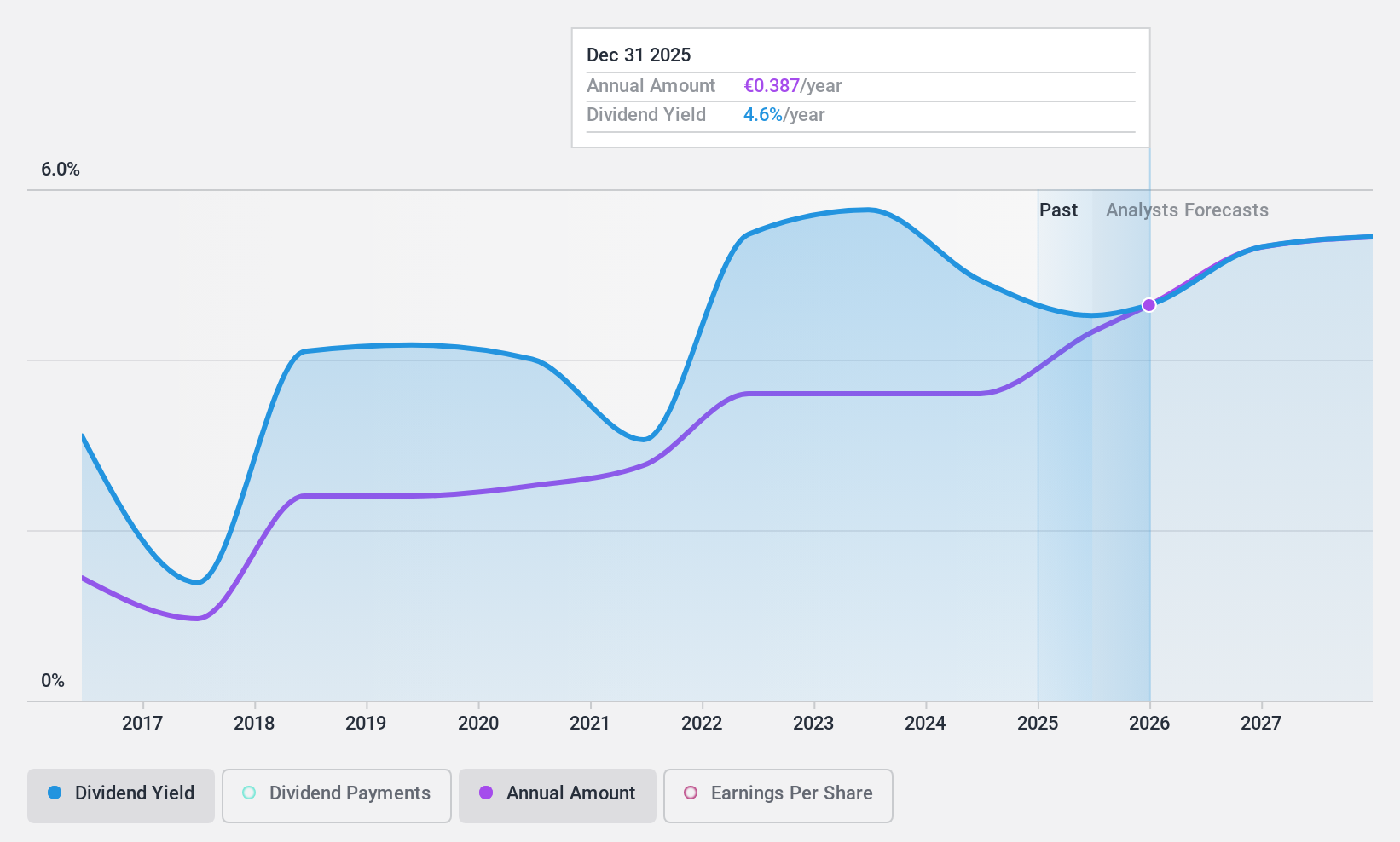

Dividend Yield: 4.3%

MLP's dividend is supported by a cash payout ratio of 28.5% and an earnings payout ratio of 56.8%, indicating strong coverage. However, the dividend yield of 4.3% falls short compared to top-tier German dividend payers, and its history shows volatility over the past decade despite recent increases. The company reported improved earnings with net income rising to €69.27 million in 2024, alongside announcing a €0.36 per share annual dividend for June 2025 payment.

- Get an in-depth perspective on MLP's performance by reading our dividend report here.

- The analysis detailed in our MLP valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Reveal the 236 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives