- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

European Hidden Treasures with Potential for April 2025

Reviewed by Simply Wall St

With European markets showing resilience amid easing trade tensions and positive movements in major indices like the STOXX Europe 600, investors are increasingly looking toward lesser-known opportunities that may benefit from these favorable conditions. In this environment, identifying stocks with strong fundamentals and potential for growth can be key to uncovering hidden treasures within Europe's diverse economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| BAUER | 78.29% | 4.31% | nan | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with communication impairments, with a market capitalization of SEK8.07 billion.

Operations: Dynavox Group generates revenue primarily from the sale of assistive technology products. The company has a market capitalization of SEK8.07 billion, reflecting its position in the industry.

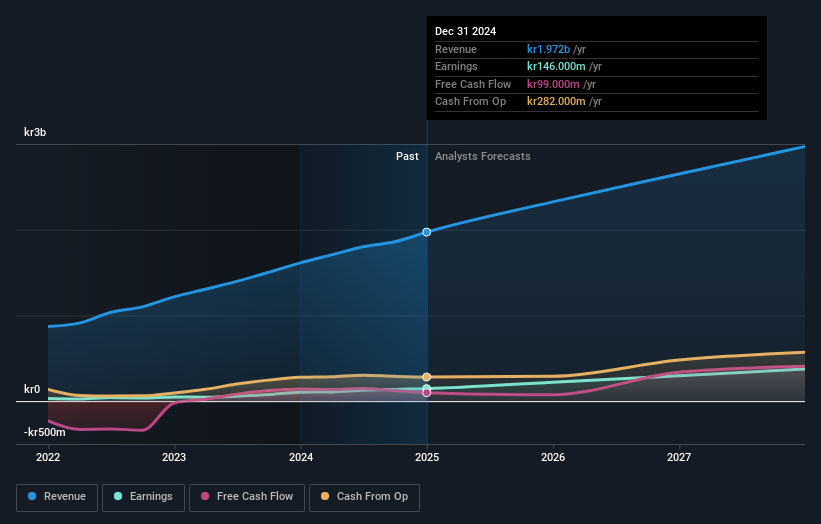

Dynavox Group, a smaller player in the tech space, has shown impressive growth with earnings increasing by 46.9% last year, outpacing the broader tech industry at 26.2%. The company reported Q1 2025 sales of SEK 581 million and net income of SEK 24 million, reflecting continued profitability despite a high net debt to equity ratio of 123.7%. Strategic moves like consolidating R&D in Stockholm and expanding internationally aim to tap into a large underserved market for assistive technology. However, reliance on North America for revenue and potential policy changes present risks that could impact future profitability.

Boryszew (WSE:BRS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Boryszew S.A. operates in the automotive, metals, and chemical products sectors both in Poland and internationally, with a market cap of PLN1.37 billion.

Operations: Boryszew S.A. generates revenue from the automotive, metals, and chemical products sectors across Poland and internationally. The company's net profit margin is a key financial metric to consider when analyzing its profitability.

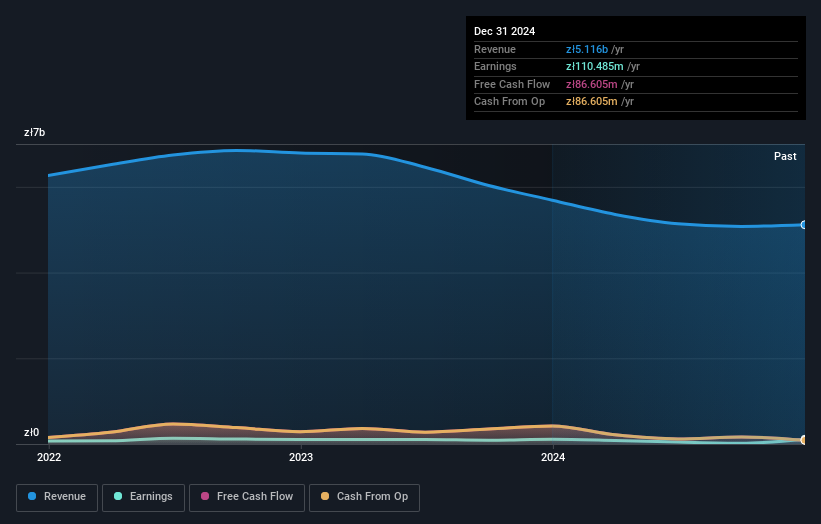

Boryszew, a small player in the Polish market, shows resilience with its earnings growth of 0.7%, outpacing the broader Metals and Mining sector's -15%. Its Price-To-Earnings ratio stands attractively at 12.4x, below the Polish market's average of 13x. Over five years, Boryszew has significantly reduced its debt to equity ratio from 97.1% to a more manageable 47.8%, indicating improved financial health. However, interest payments are not well covered by EBIT at just 1.8x coverage, which could be a point of concern for potential investors looking into this gem in Europe’s industrial landscape.

- Click here to discover the nuances of Boryszew with our detailed analytical health report.

Understand Boryszew's track record by examining our Past report.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €869.05 million, operates in Germany offering financial services to private, corporate, and institutional clients through its various subsidiaries.

Operations: MLP SE generates revenue from multiple segments, with Financial Consulting contributing €439.96 million and FERI adding €264.32 million. Other significant segments include Banking at €223.96 million and DOMCURA at €130.74 million. The company's net profit margin trends are not provided for analysis in the given data set, but the diverse revenue streams highlight its multifaceted financial services model in Germany.

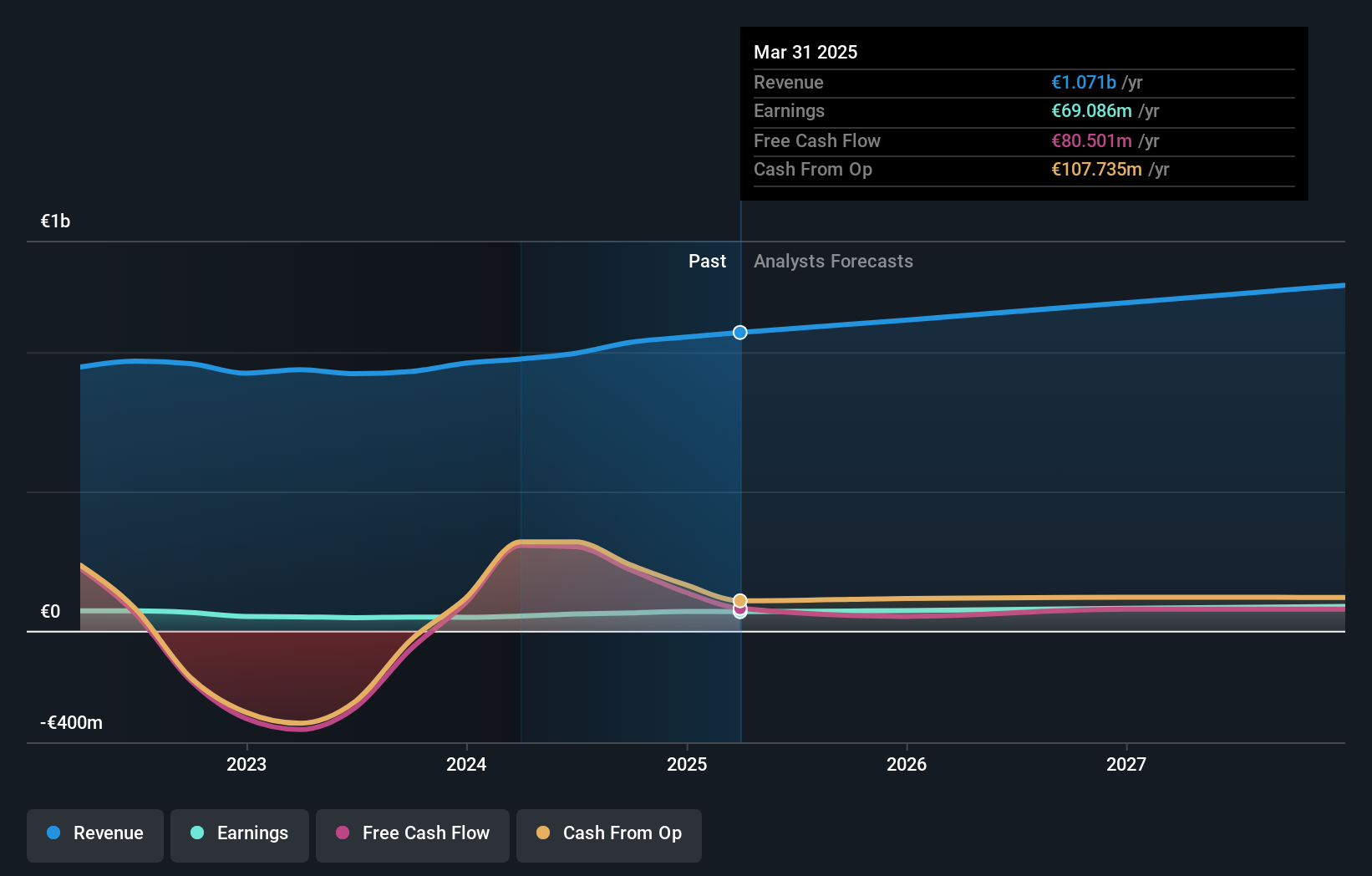

MLP's recent performance showcases its potential as a promising investment opportunity. The company reported earnings growth of 42.6% over the past year, significantly outpacing the Capital Markets industry's 18.6%. MLP's debt to equity ratio has risen from 0.4 to 11.2 over five years, yet it holds more cash than total debt, indicating strong financial health and well-covered interest payments with an EBIT coverage of four times. Trading at nearly 25% below estimated fair value, MLP offers good value with high-quality earnings and positive free cash flow, while its strategic expansion into digitalization and new business lines aims for sustained growth in profitability and revenue by leveraging technological advancements to enhance client services across Wealth, Life & Health, and Property & Casualty sectors.

Where To Now?

- Get an in-depth perspective on all 356 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dynavox Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for customers with impaired communication skills.

High growth potential with solid track record.

Market Insights

Community Narratives