Bayerische Motoren Werke And 2 Other German Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets face pressures from rising U.S. Treasury yields, the European stock indices have also experienced declines, with Germany's DAX index falling nearly 1% amid concerns over slower monetary policy easing by the Federal Reserve. In this context of economic uncertainty and fluctuating market conditions, dividend stocks can offer a measure of stability and income for investors seeking to navigate these challenges.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.82% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.89% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.97% | ★★★★★☆ |

| Mensch und Maschine Software (XTRA:MUM) | 3.09% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.09% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.31% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.31% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.68% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.23% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.76% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

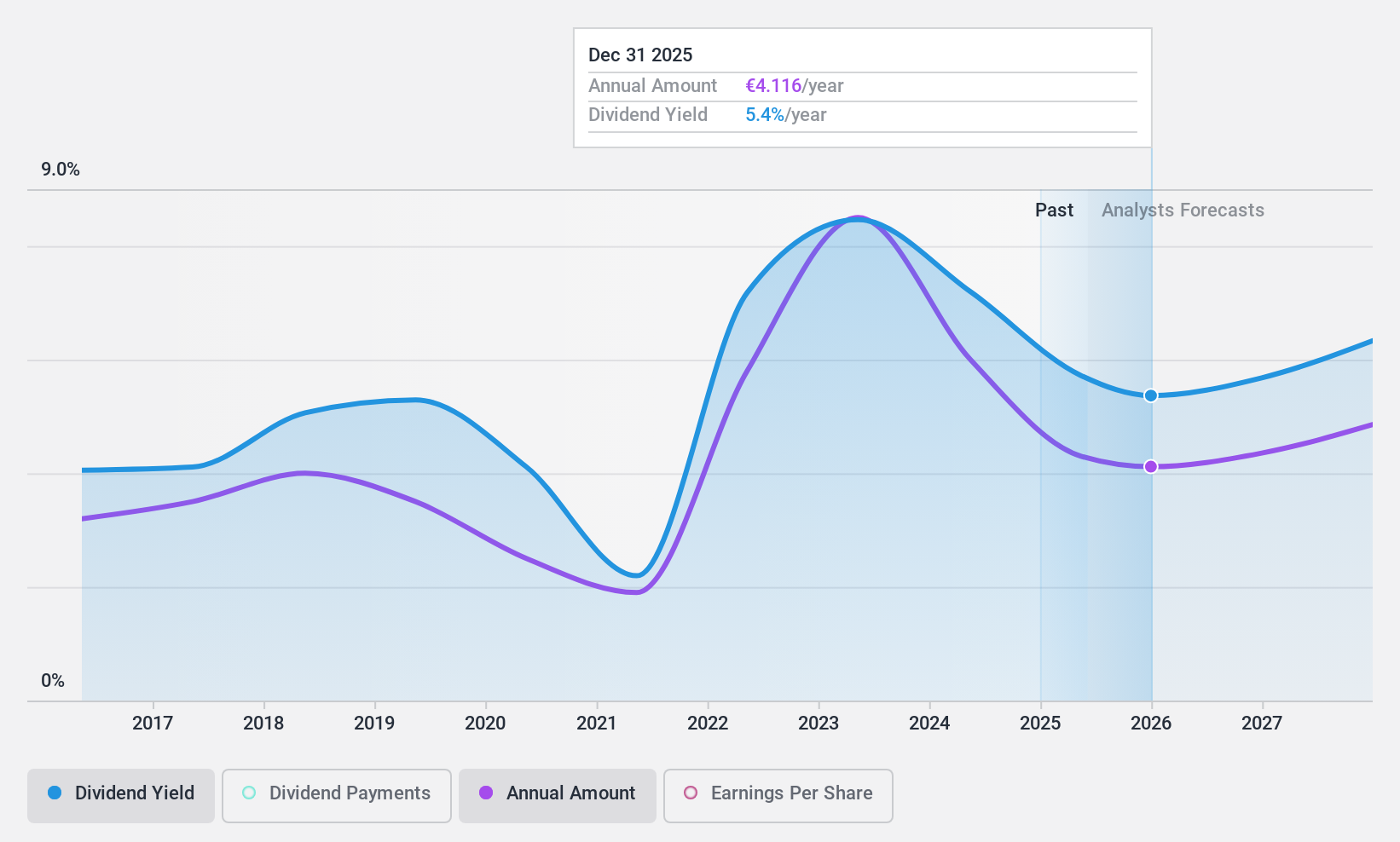

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles, motorcycles, and related spare parts and accessories globally with a market cap of €46.36 billion.

Operations: Bayerische Motoren Werke's revenue is derived from its Automotive segment at €132.39 billion, Motorcycles at €3.15 billion, and Financial Services at €37.87 billion.

Dividend Yield: 8.1%

BMW's dividend yield of 8.08% ranks in the top 25% of German dividend payers, though its sustainability is questionable due to a high cash payout ratio (5457.9%). While dividends have grown over the past decade, they remain volatile and unreliable. The company's financial position shows debt not well covered by operating cash flow, despite trading at 44.9% below fair value estimates. Recent delisting from OTC Equity may impact investor accessibility.

- Navigate through the intricacies of Bayerische Motoren Werke with our comprehensive dividend report here.

- Our valuation report unveils the possibility Bayerische Motoren Werke's shares may be trading at a discount.

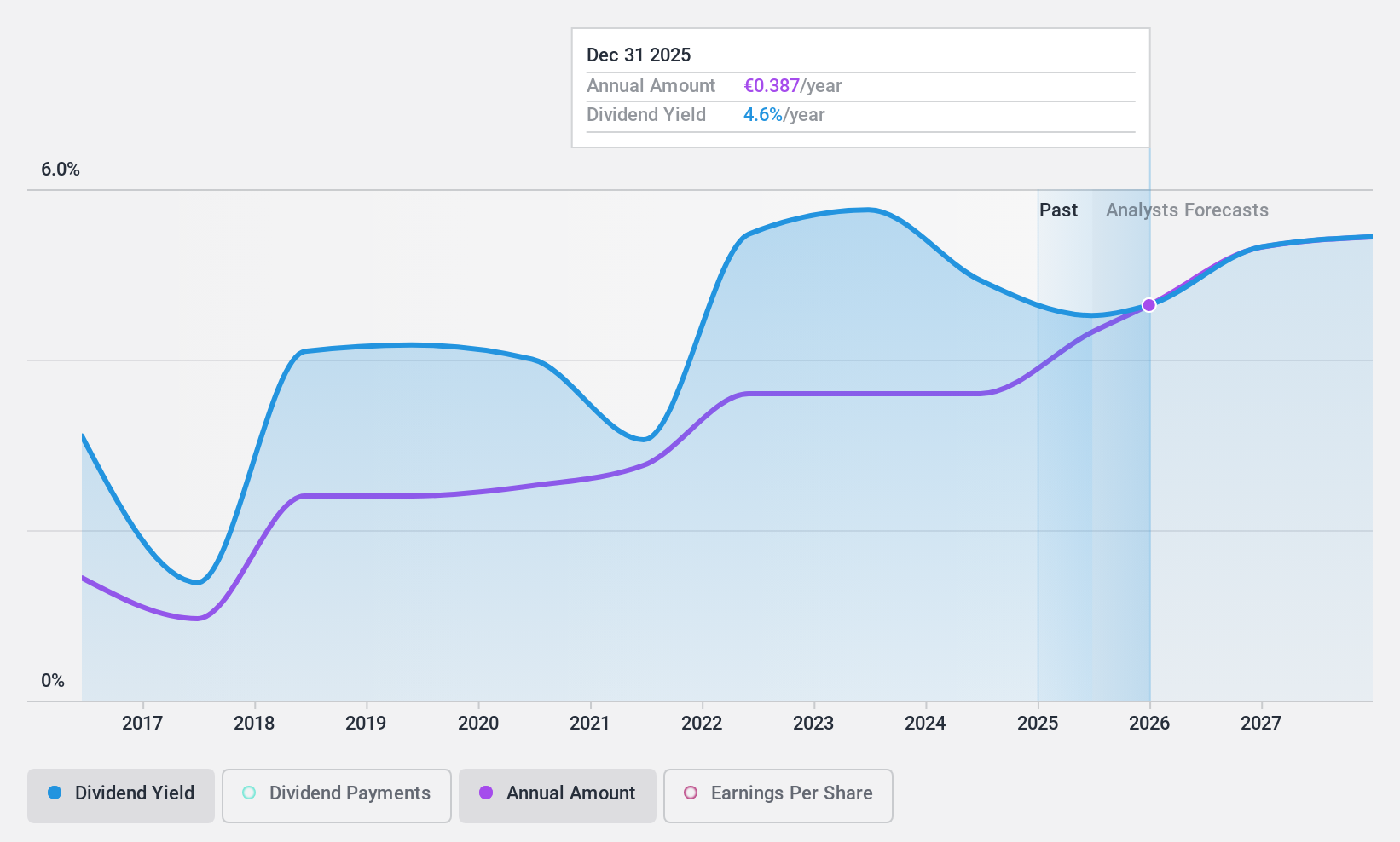

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €659.06 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue from several segments, including Financial Consulting (€429.61 million), FERI (€231.23 million), Banking (€206.97 million), DOMCURA (€129.26 million), and Deutschland.Immobilien (€51.61 million), along with contributions from Industrial Broker (€36.51 million) and Segment Adjustment (€16.17 million).

Dividend Yield: 5%

MLP offers a dividend yield of 4.98%, placing it among the top 25% of German dividend payers. Despite a volatile and unreliable dividend history, payments are well-covered by earnings and cash flows, with payout ratios of 54.2% and 11.1%, respectively. The company trades at good value, significantly below its estimated fair value. Recent guidance indicates improved earnings expectations for 2024, with EBIT forecasted between €85 million to €95 million due to strong performance-based compensation.

- Take a closer look at MLP's potential here in our dividend report.

- The analysis detailed in our MLP valuation report hints at an deflated share price compared to its estimated value.

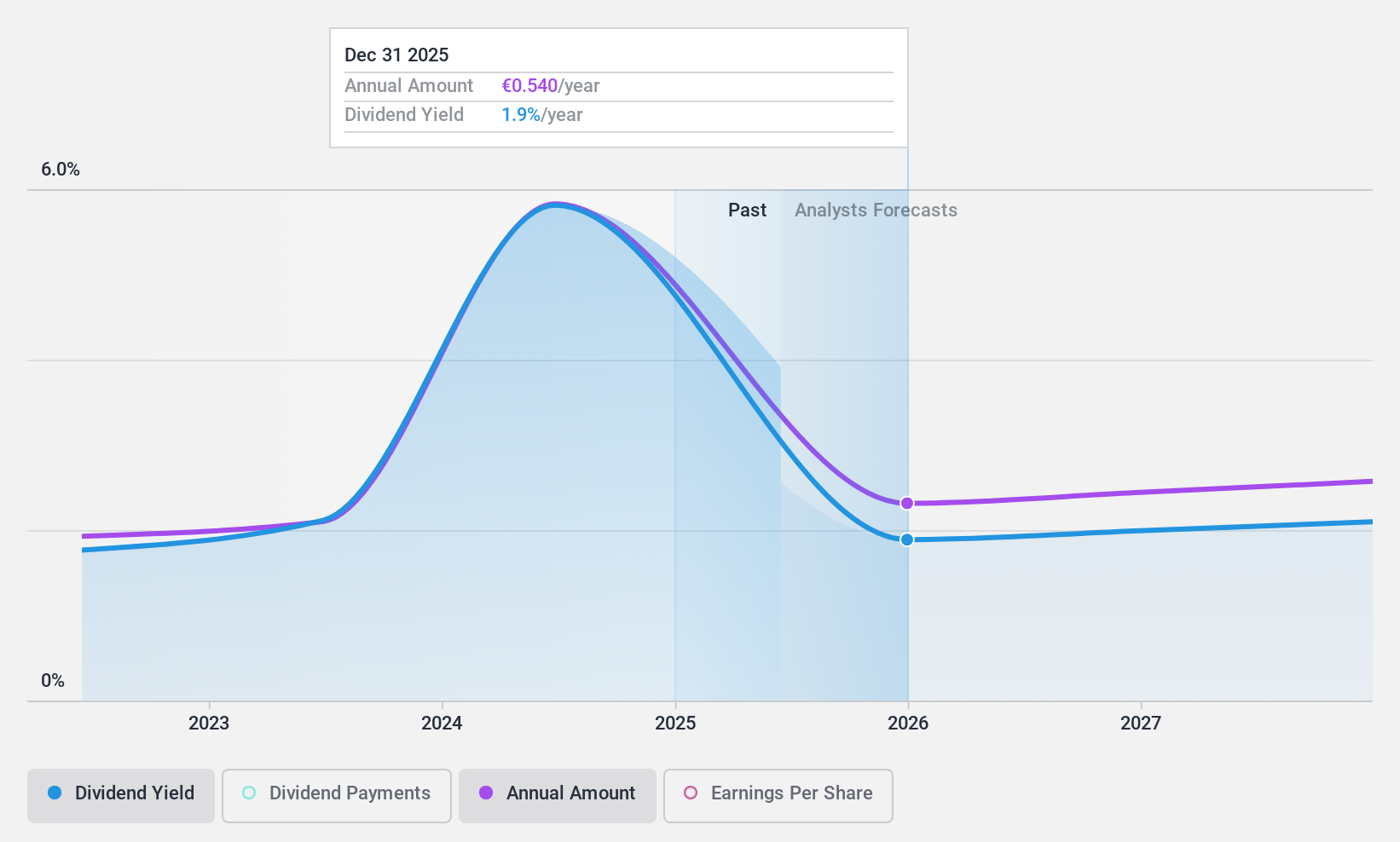

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and other healthcare products in Germany, with a market cap of €304.55 million.

Operations: PharmaSGP Holding SE generates revenue primarily from its pharmaceuticals segment, amounting to €109.76 million.

Dividend Yield: 5.4%

PharmaSGP Holding offers a dividend yield of 5.35%, ranking it in the top 25% of German dividend payers. Dividends are covered by earnings and cash flows, with payout ratios of 89.6% and 77.8%, respectively, despite only three years of payments and a less stable track record. Recent earnings growth is evident, with net income rising to €8.68 million for H1 2024 from €6.86 million in the previous year, supporting its dividend sustainability amidst high debt levels.

- Delve into the full analysis dividend report here for a deeper understanding of PharmaSGP Holding.

- Our comprehensive valuation report raises the possibility that PharmaSGP Holding is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Delve into our full catalog of 32 Top German Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayerische Motoren Werke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BMW

Bayerische Motoren Werke

Engages in the development, manufacture, and sale of automobiles and motorcycles, and spare parts and accessories worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives