- Germany

- /

- Capital Markets

- /

- XTRA:LQAG

Revenues Tell The Story For Laiqon AG (ETR:LQAG) As Its Stock Soars 27%

Laiqon AG (ETR:LQAG) shares have continued their recent momentum with a 27% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 2.3% isn't as attractive.

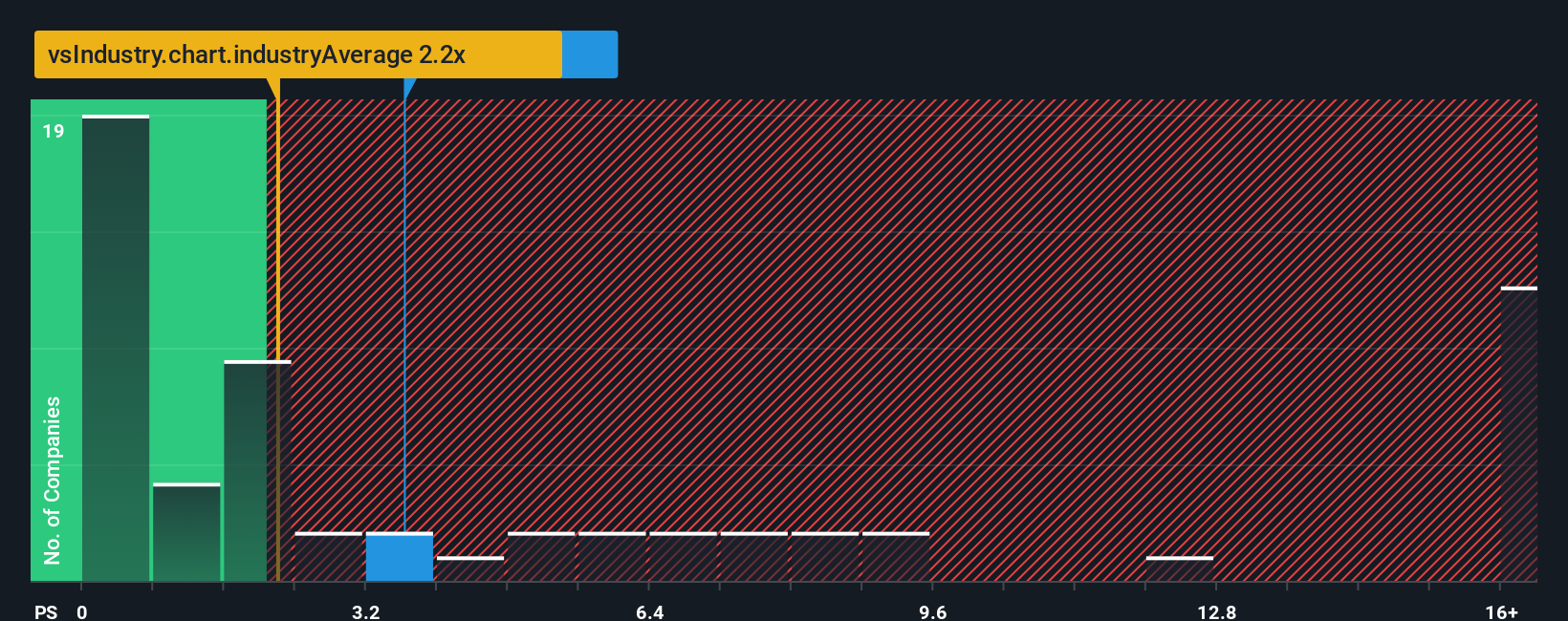

Since its price has surged higher, you could be forgiven for thinking Laiqon is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.6x, considering almost half the companies in Germany's Capital Markets industry have P/S ratios below 2.2x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Laiqon

What Does Laiqon's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Laiqon has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Laiqon will help you uncover what's on the horizon.How Is Laiqon's Revenue Growth Trending?

Laiqon's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 19% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 26% each year over the next three years. That's shaping up to be materially higher than the 1.2% each year growth forecast for the broader industry.

With this information, we can see why Laiqon is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Laiqon's P/S

The large bounce in Laiqon's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Laiqon's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Laiqon with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:LQAG

Laiqon

Develops, arranges, initiates, and markets investment products for private and institutional investors in Germany.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives