- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Undiscovered Gems in Europe to Explore March 2025

Reviewed by Simply Wall St

The European market has shown resilience, with the STOXX Europe 600 Index achieving its longest streak of weekly gains since August 2012, buoyed by encouraging company results and gains in defense stocks despite uncertainties surrounding U.S. trade policy. As investors navigate these dynamic conditions, identifying stocks that demonstrate strong fundamentals and adaptability to economic shifts can be key to uncovering potential opportunities in this evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Zalaris | 179.97% | 12.08% | 27.17% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA offers an AI-driven order-to-cash software as a service platform globally, with a market cap of €374.48 million.

Operations: Sidetrade generates revenue primarily from its software and programming segment, amounting to €47.82 million. The company operates with a focus on AI-powered solutions in the order-to-cash process.

Sidetrade, a nimble player in the tech space, has seen its earnings soar by 122% over the past year, outpacing the broader software industry. This growth is underscored by high-quality earnings and an impressive EBIT coverage of interest payments at 141 times. Despite a debt-to-equity ratio increase from 2.1 to 25.6 over five years, Sidetrade remains profitable with positive free cash flow and more cash than total debt. A recent alliance with Interpath aims to leverage AI for digital transformation in order-to-cash operations, promising further expansion across diverse markets while maintaining its leadership status in B2B payment solutions processing $6 trillion daily transactions.

- Take a closer look at Sidetrade's potential here in our health report.

Evaluate Sidetrade's historical performance by accessing our past performance report.

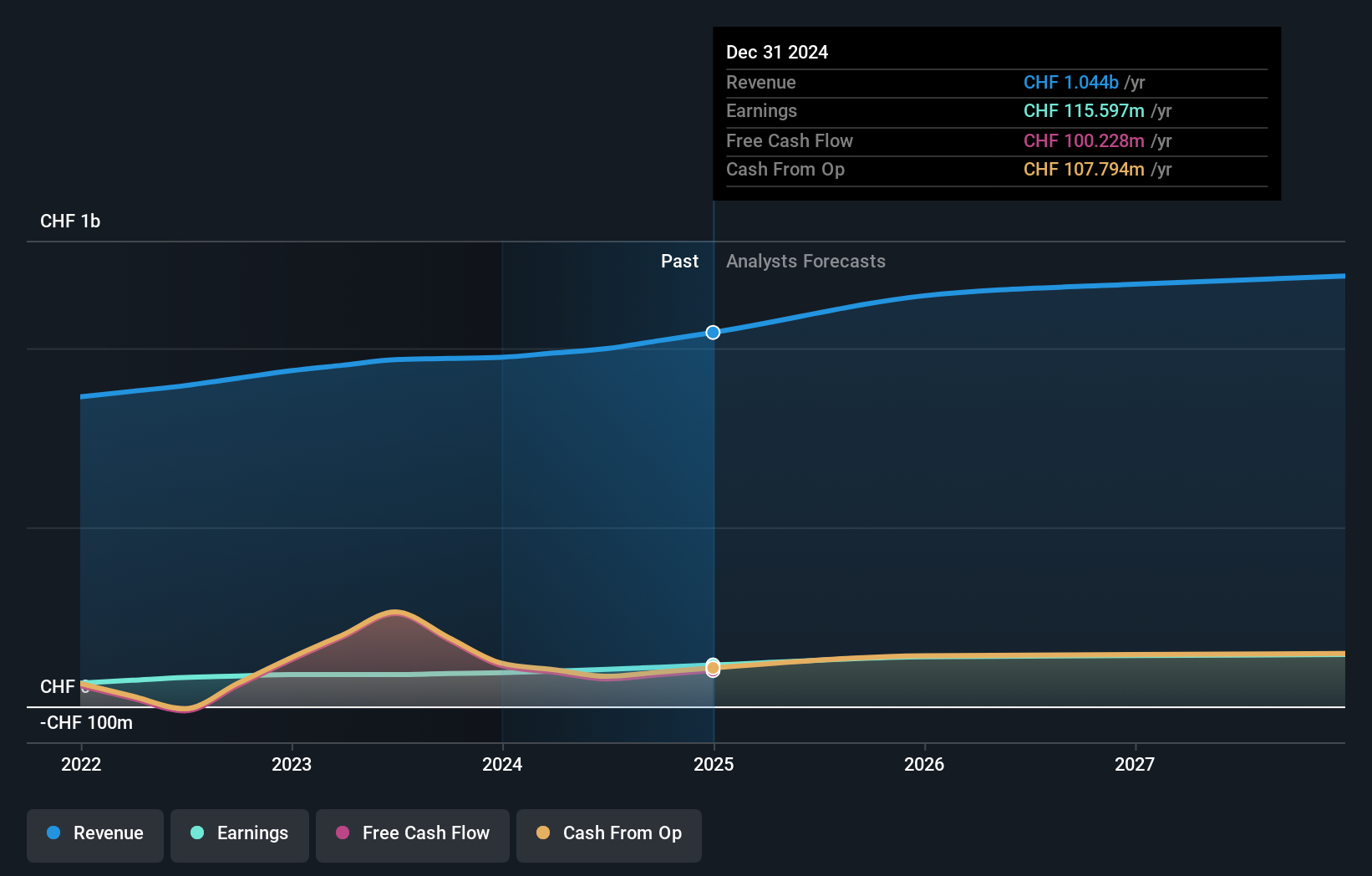

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.50 billion.

Operations: The company's revenue primarily comes from three regions: Europe, Middle East and Africa (CHF452.85 million), Americas (CHF352.67 million), and Asia-Pacific (CHF273.16 million).

Compagnie Financière Tradition, a financial services player, has seen its debt to equity ratio improve from 75.7% to 47.1% over the past five years, indicating better financial health. The company is trading at a discount of 7.3% below its estimated fair value, suggesting potential upside for investors. With earnings growth of 16.1% in the last year, it outpaced the Capital Markets industry average of 11%. Free cash flow remains positive and exceeds capital expenditures significantly; recent figures show free cash flow at A$259 million against capital expenditure of A$3 million as of June 2023.

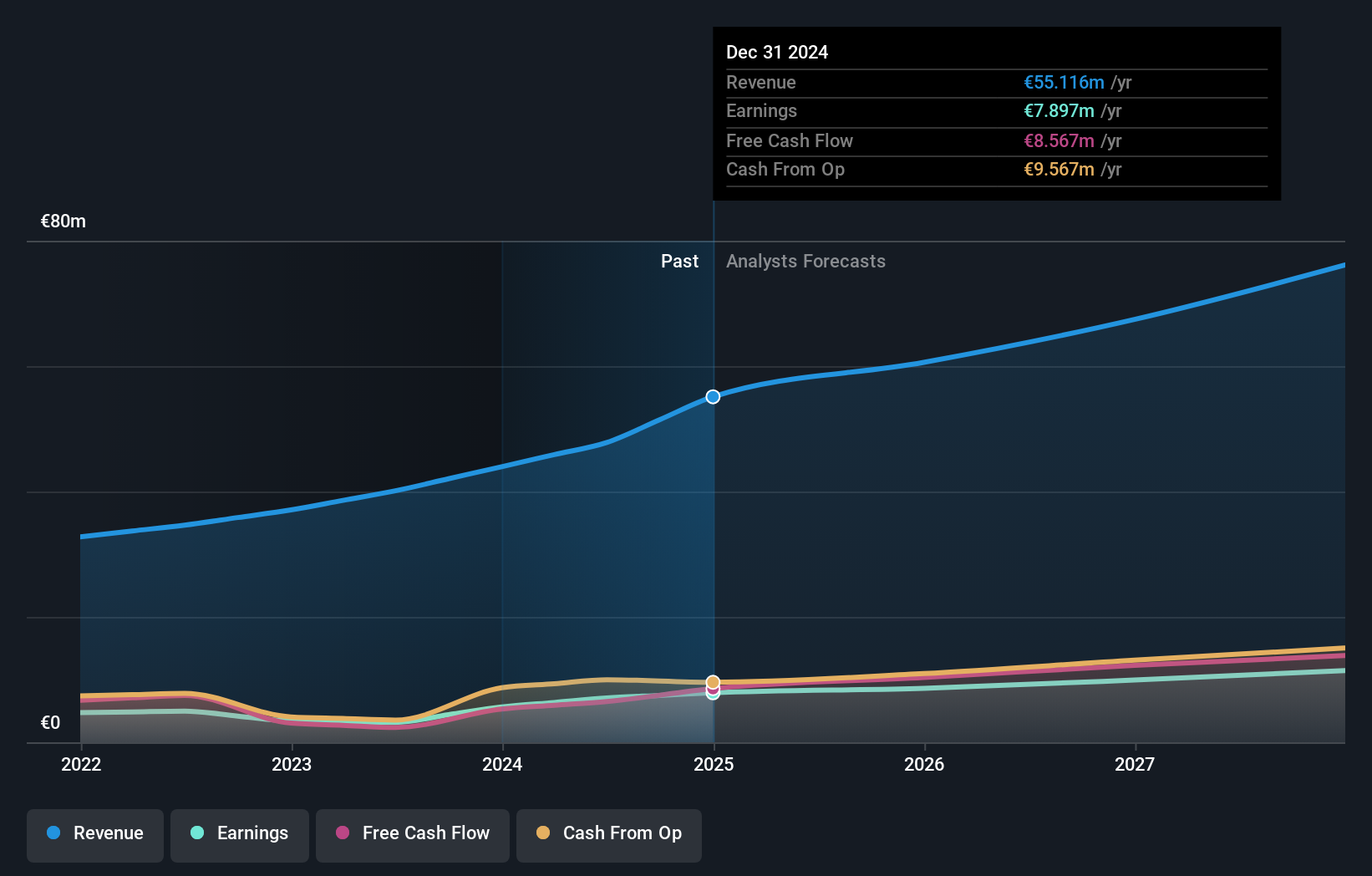

JDC Group (XTRA:JDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of approximately €309.64 million.

Operations: The company's revenue streams primarily include its Advisortech and Advisory segments, generating €184.73 million and €37.05 million, respectively. The Transfer segment shows a negative contribution of -€15.67 million to revenue.

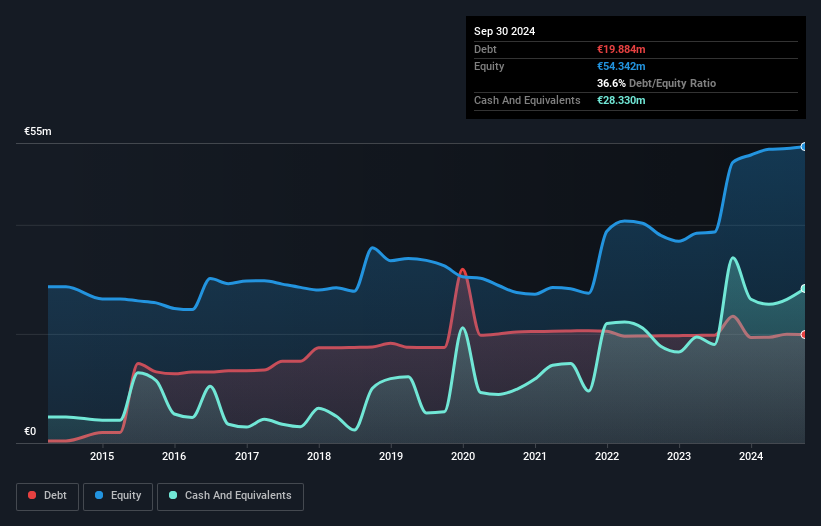

JDC Group, a financial services entity in Germany and Austria, is witnessing impressive growth with earnings soaring by 236% over the past year. Its debt to equity ratio has improved from 54% to 36.6% over five years, reflecting prudent financial management. The company is leveraging AI for enhanced operational efficiency and cost reduction, while also benefiting from broker market consolidation opportunities. Despite these positives, challenges such as competition from private equity-backed firms and economic uncertainties remain. With a current share price of €22.5 against an analyst target of €29.72, there appears to be room for potential upside based on future earnings expectations.

Where To Now?

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 356 more companies for you to explore.Click here to unveil our expertly curated list of 359 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives