- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

Should Strong Insider Ownership and Earnings Growth Forecasts Require Action From Hypoport (XTRA:HYQ) Investors?

Reviewed by Sasha Jovanovic

- Earlier this week, analysts highlighted Hypoport SE's strong forecasted annual earnings growth of 41.3% and significant insider ownership, drawing renewed investor interest as European equity markets reached record highs.

- This combination of high insider alignment and robust earnings expectations positioned Hypoport as an attractive opportunity for investors seeking growth with management commitment.

- We'll explore how optimistic analyst expectations for Hypoport's earnings growth could influence the company's investment narrative from here.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Hypoport Investment Narrative Recap

To be a Hypoport shareholder, an investor needs to believe in the ongoing digitalization of financial services and the company's capacity to capture market share in Germany’s real estate finance space. The recent focus on robust forecasted earnings growth and high insider ownership is unlikely to materially shift the most important short-term catalyst: housing sector stimulus and supportive government policies; however, it does little to temper the biggest risk, dependence on Germany’s volatile mortgage market for topline momentum. The most relevant recent announcement is Hypoport’s preliminary H1 2025 results, which showed double-digit revenue and net income growth year on year. This provides some evidence that the company can deliver on projected operational improvements, but whether this translates to sustained earnings expansion will continue to depend on constructive developments in German housing policy and demand. However, for investors, it’s worth keeping in mind that risks tied to falling transaction volumes could quickly come back into focus if...

Read the full narrative on Hypoport (it's free!)

Hypoport's outlook anticipates €852.8 million in revenue and €61.1 million in earnings by 2028. This scenario assumes a 12.7% annual revenue growth rate and a €43.9 million increase in earnings from the current €17.2 million.

Uncover how Hypoport's forecasts yield a €261.60 fair value, a 84% upside to its current price.

Exploring Other Perspectives

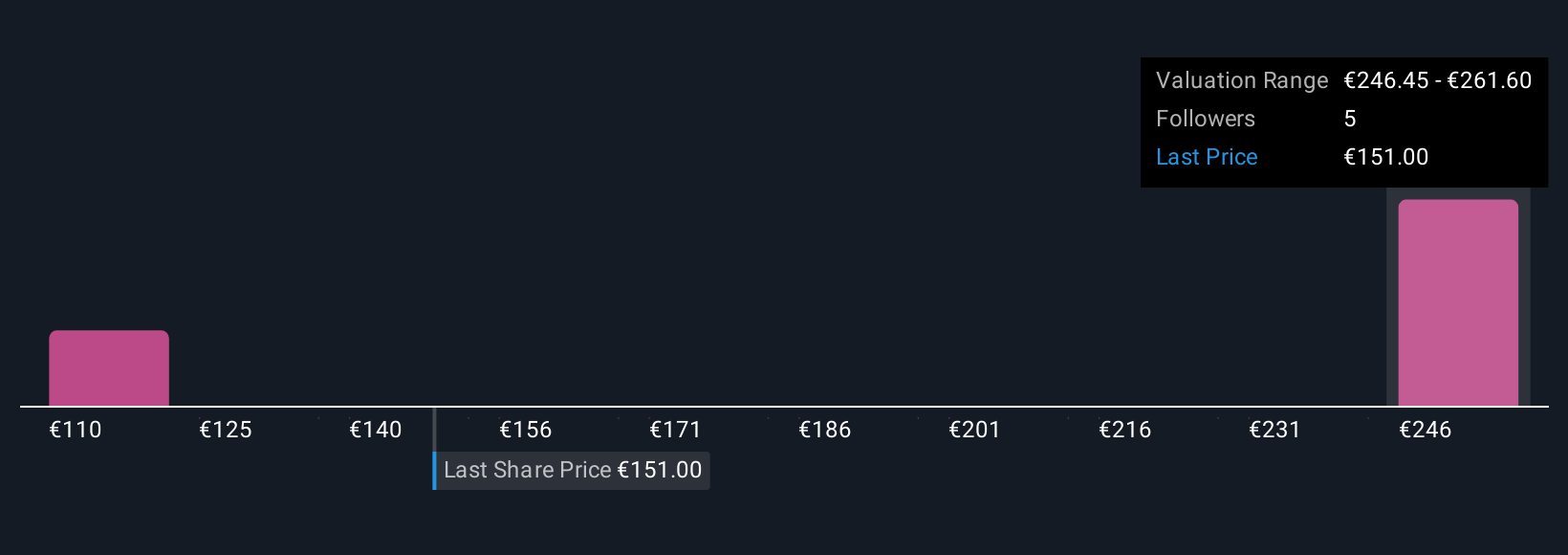

Simply Wall St Community members offered two fair value estimates for Hypoport, ranging from €109.35 to €261.60. With earnings growth forecasts attracting attention, opinions remain split given the company’s heavy exposure to Germany’s mortgage sector, be sure to consider different viewpoints before making up your mind.

Explore 2 other fair value estimates on Hypoport - why the stock might be worth 23% less than the current price!

Build Your Own Hypoport Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hypoport research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Hypoport research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hypoport's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives