- Germany

- /

- Capital Markets

- /

- XTRA:DBK

Deutsche Bank (XTRA:DBK): Evaluating the Current Valuation After Strong Share Price Swings

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 6.9% Overvalued

The most widely referenced valuation narrative currently regards Deutsche Bank as slightly overvalued, pricing the stock at a premium to its consensus fair value based on projected earnings and efficiency gains.

The bank's continued investment in digitalization and technology, combined with ongoing operational streamlining (such as branch closures and workforce reductions in the Private Bank), is unlocking cost savings and delivering improved efficiency. With €2.2 billion of targeted efficiency gains already secured, there is confidence in achieving further cost reductions through front-to-back process reengineering and digital transformation. This is supporting higher net margins and sustainable earnings improvement.

Want to know what is driving this valuation call? Bold forecasts on revenue and margins are the backbone of this narrative. Which analyst assumptions could make or break the fair value outlook? Find out what underpins these confident projections and why experts think the current share price is running slightly ahead of the fundamentals.

Result: Fair Value of €28.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing litigation and elevated credit losses, especially in U.S. commercial real estate, remain critical risks that could challenge Deutsche Bank’s optimistic outlook.

Find out about the key risks to this Deutsche Bank narrative.Another View: Is There a Disconnect?

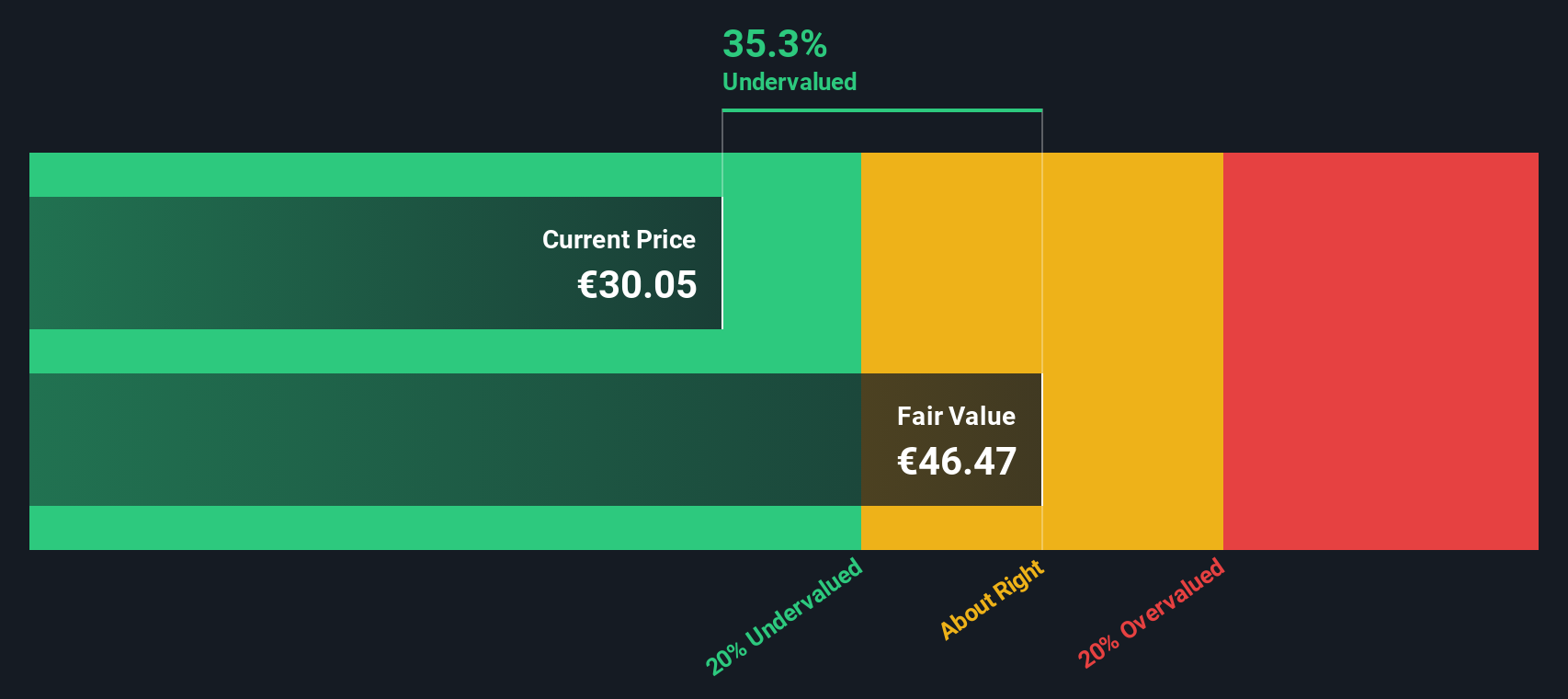

While the consensus view sees Deutsche Bank as slightly overvalued based on earnings prospects, our DCF model tells a different story. It suggests the shares may be undervalued in light of future cash flow potential. Which valuation approach holds up?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Deutsche Bank to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Deutsche Bank Narrative

If you are keen to dig deeper or question these perspectives, you have the tools to assemble your own view in just a few minutes. Do it your way

A great starting point for your Deutsche Bank research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Find tomorrow’s winners, steady income payers, and futuristic trends using hand-picked lists investors are talking about right now.

- Tap into the growth potential of promising up-and-comers by checking out our picks for penny stocks with strong financials in penny stocks with strong financials.

- Catch the next wave of innovation by targeting fast-moving breakthroughs in medicine and tech with our curated list of healthcare AI stocks in healthcare AI stocks.

- Secure recurring income and long-term stability when you review dividend stocks with yields above 3 percent in dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBK

Deutsche Bank

A stock corporation, provides corporate and investment banking, private clients, and asset management products and services in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives