With the business potentially at an important milestone, we thought we'd take a closer look at Coreo AG's (ETR:CORE) future prospects. Coreo AG operates as a real estate company in Germany. The company’s loss has recently broadened since it announced a €925k loss in the full financial year, compared to the latest trailing-twelve-month loss of €2.1m, moving it further away from breakeven. Many investors are wondering about the rate at which Coreo will turn a profit, with the big question being “when will the company breakeven?” Below we will provide a high-level summary of the industry analysts’ expectations for the company.

Check out our latest analysis for Coreo

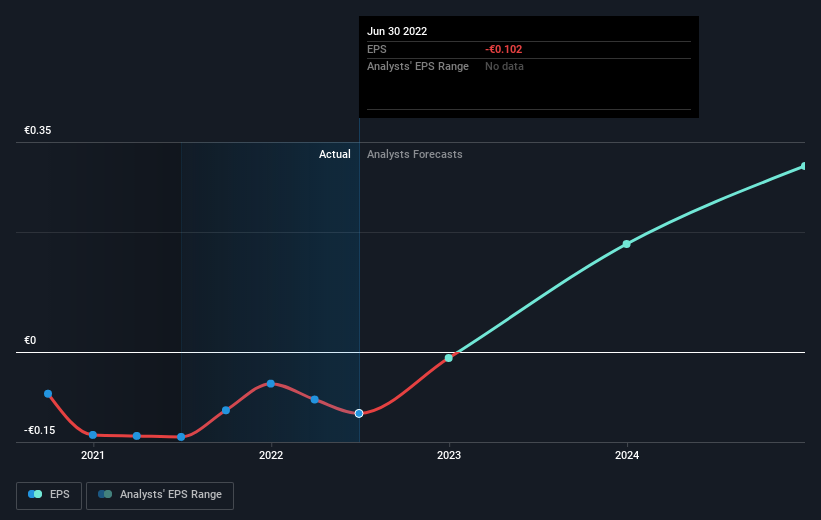

Coreo is bordering on breakeven, according to some German Capital Markets analysts. They anticipate the company to incur a final loss in 2022, before generating positive profits of €4.1m in 2023. So, the company is predicted to breakeven approximately a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2023? Working backwards from analyst estimates, it turns out that they expect the company to grow 110% year-on-year, on average, which is rather optimistic! Should the business grow at a slower rate, it will become profitable at a later date than expected.

Underlying developments driving Coreo's growth isn’t the focus of this broad overview, but, take into account that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

Before we wrap up, there’s one issue worth mentioning. Coreo currently has a debt-to-equity ratio of over 2x. Typically, debt shouldn’t exceed 40% of your equity, which in this case, the company has significantly overshot. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Coreo, so if you are interested in understanding the company at a deeper level, take a look at Coreo's company page on Simply Wall St. We've also put together a list of relevant factors you should further examine:

- Historical Track Record: What has Coreo's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Coreo's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:COR

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026