How Investors May Respond To adidas (XTRA:ADS) Entering Safety Footwear With GLO Partnership

Reviewed by Sasha Jovanovic

- In October 2025, adidas Brands B.V. and GLO, a Bunzl plc business unit, announced a long-term partnership to launch 'adidas pro work', a high-performance safety footwear line targeting professionals in construction, maintenance, and logistics, with the first models expected in the second quarter of 2026 through select distributors.

- This move marks adidas' entry into the safety footwear category, reflecting an effort to broaden its product portfolio and reach new market segments by combining protection, comfort, and brand-driven style.

- We'll explore how adidas' entry into safety footwear through its partnership with GLO could reshape its investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

adidas Investment Narrative Recap

To be an adidas shareholder today, you need to believe the company can leverage its innovation, global reach, and brand strength to drive recurring sales growth, while navigating rising U.S. import tariffs and competitive pressures in North America. The recent safety footwear partnership with GLO, while long-term in focus, is not expected to materially influence near-term catalysts or address the most pressing risk, margin pressure from higher sourcing costs and constrained pricing power in the U.S.

Among adidas’ recent announcements, the exclusive release of the limited-edition State Fair Superstar sneakers with Hibbett illustrates how the company continues to rely on brand collaborations and creative launches to engage core consumer segments. This approach supports the core catalyst of expanding premium offerings and driving sell-through in key markets, especially as new product lines like “adidas pro work” target a broader audience.

By contrast, investors should be aware that rising U.S. tariffs pose an ongoing threat to margins, especially if...

Read the full narrative on adidas (it's free!)

adidas' narrative projects €31.1 billion revenue and €2.5 billion earnings by 2028. This requires 8.2% yearly revenue growth and a €1.3 billion earnings increase from €1.2 billion today.

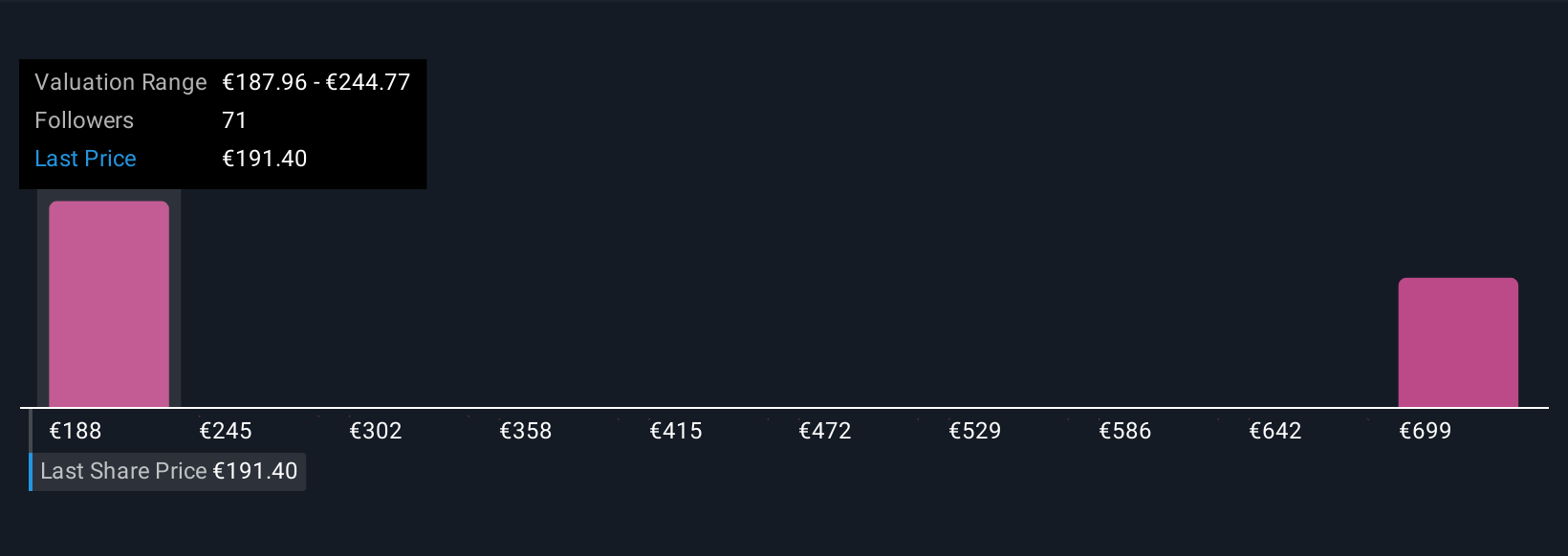

Uncover how adidas' forecasts yield a €237.35 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Ten independent fair value estimates from the Simply Wall St Community span a wide range from €160.60 to €752.79. With varied opinions on future growth, consider how ongoing tariff headwinds may affect adidas’ ability to achieve ambitious earnings forecasts and why differing views persist on earnings resilience.

Explore 10 other fair value estimates on adidas - why the stock might be worth over 4x more than the current price!

Build Your Own adidas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your adidas research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free adidas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate adidas' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, North America, Greater China, Latin America, Japan, and South Korea.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives