- Germany

- /

- Commercial Services

- /

- DB:ABA

Investors five-year losses continue as ALBA (FRA:ABA) dips a further 16% this week, earnings continue to decline

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held ALBA SE (FRA:ABA) for five years would be nursing their metaphorical wounds since the share price dropped 91% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 48% over the last twelve months. The falls have accelerated recently, with the share price down 21% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since ALBA has shed €11m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for ALBA

We don't think that ALBA's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over five years, ALBA grew its revenue at 1.6% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 14% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

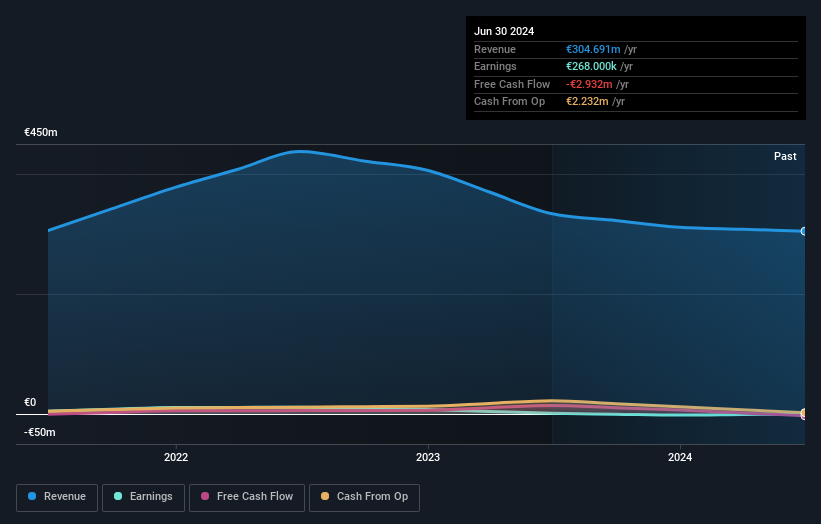

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, ALBA generated a TSR of -88%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

While the broader market gained around 10% in the last year, ALBA shareholders lost 48%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand ALBA better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with ALBA (including 1 which is a bit unpleasant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:ABA

Excellent balance sheet slight.

Market Insights

Community Narratives