In the midst of renewed uncertainty surrounding U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have felt the strain, with key indices like Germany's DAX and Italy's FTSE MIB experiencing notable declines. Despite these challenges, opportunities still exist for discerning investors to uncover potential in small-cap stocks that may be overlooked by larger market players. Identifying a good stock often involves looking beyond immediate market turbulence to find companies with strong fundamentals and growth potential that can weather economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Tivoli (CPSE:TIV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tivoli A/S operates in the entertainment industry in Denmark and has a market capitalization of DKK3.53 billion.

Operations: Tivoli A/S generates revenue primarily from its entertainment operations in Denmark. The company's financial performance reflects a focus on optimizing costs and enhancing profitability within the competitive entertainment sector.

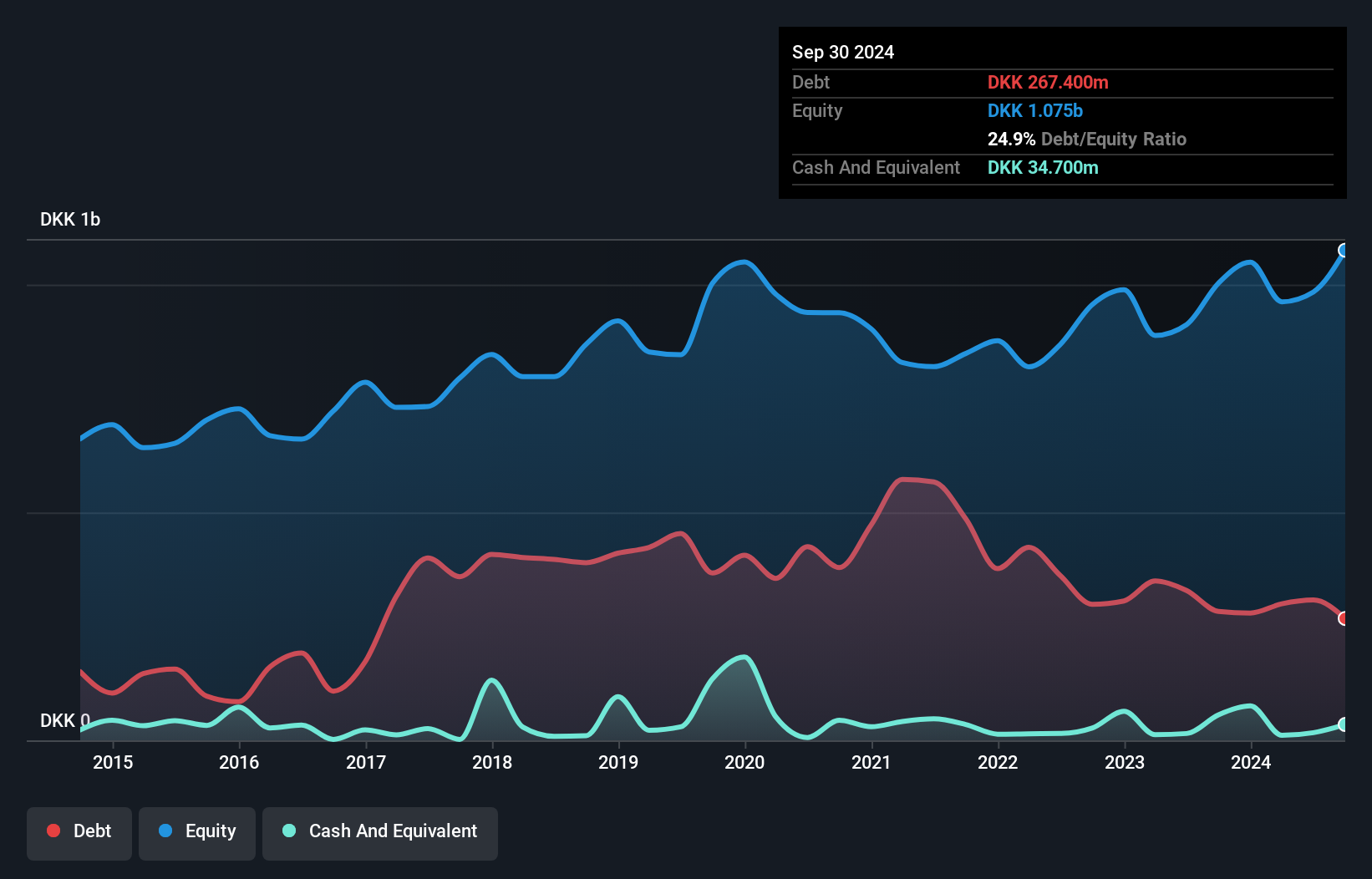

Tivoli, a vibrant player in the hospitality sector, has shown promising financial health with a net debt to equity ratio of 16.3%, deemed satisfactory. Over the past five years, this metric improved from 38.7% to 22.9%. Despite reporting a net loss of DKK 99.2 million for Q1 2025, Tivoli's annual sales grew to DKK 1.32 billion in 2024 from DKK 1.21 billion the previous year, reflecting robust performance and high-quality earnings growth of over 43% last year compared to industry averages. The company also announced a dividend increase and board changes at its recent AGM, signaling strategic shifts ahead.

- Take a closer look at Tivoli's potential here in our health report.

Examine Tivoli's past performance report to understand how it has performed in the past.

BAUER (HMSE:B5A0)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BAUER Aktiengesellschaft, along with its subsidiaries, specializes in services, equipment, and products for ground and groundwater across multiple regions including Germany, Europe, the Middle East, the Asia Pacific, Africa, and the Americas; it has a market cap of approximately €279.74 million.

Operations: BAUER generates revenue primarily from Geotechnical Solutions (€1.12 billion), Equipment (€685.09 million), and Resources (€233.69 million). The company's net profit margin reflects its financial performance, influenced by its diverse revenue streams across various regions.

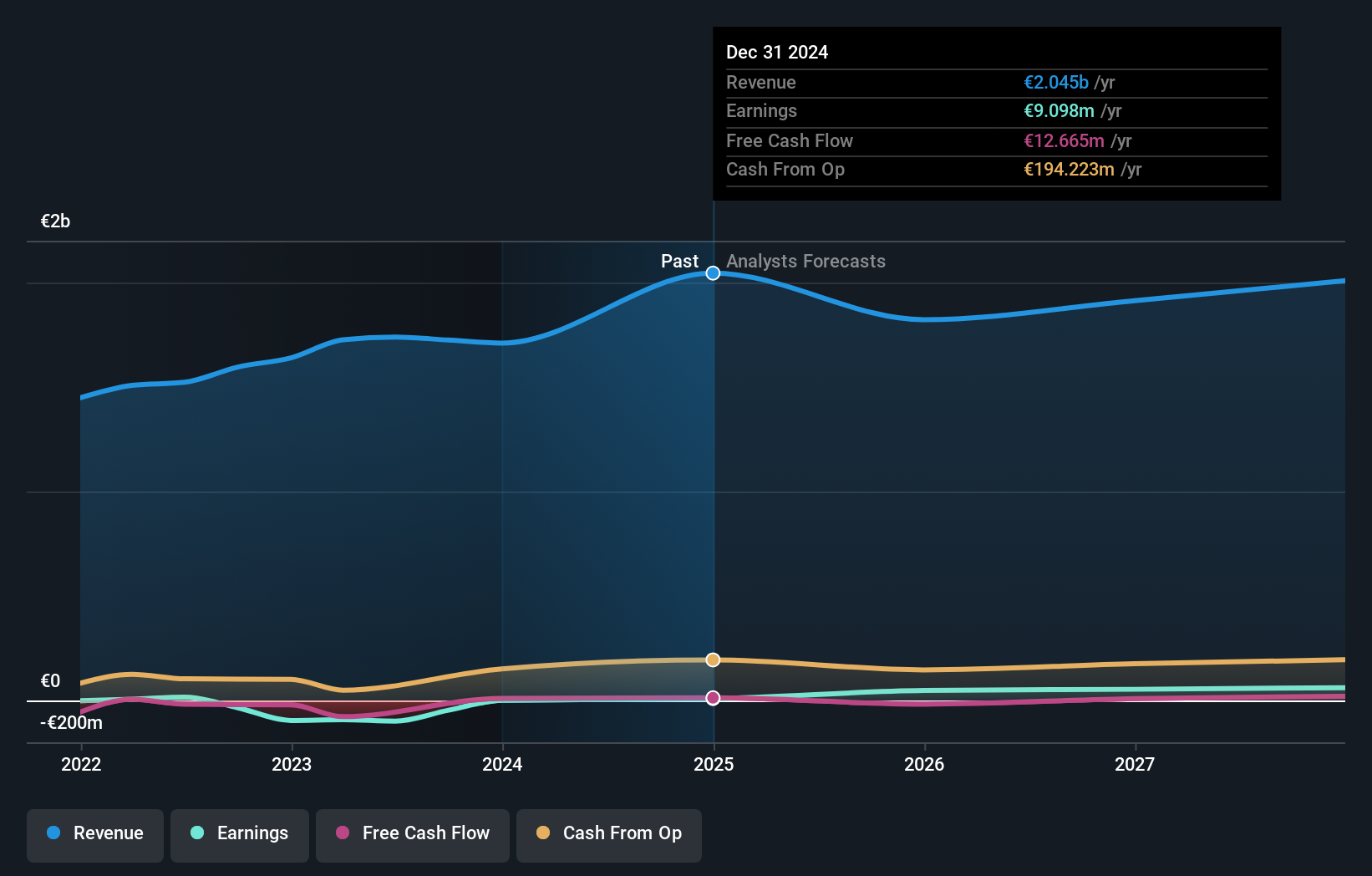

BAUER, a notable player in the construction sector, has shown impressive earnings growth of 989.6% over the past year, significantly outpacing the industry's 6%. Despite this surge, its financial position is mixed with a high net debt to equity ratio of 56.8%, though it has improved from 130.6% five years ago. The company's recent revenue hit €2.11 billion compared to €1.77 billion previously, while net income rose to €9.1 million from €0.835 million last year, aided by a one-off gain of €14.8 million which impacted its financial results for December 2024 positively.

- Dive into the specifics of BAUER here with our thorough health report.

Understand BAUER's track record by examining our Past report.

AB (WSE:ABE)

Simply Wall St Value Rating: ★★★★★★

Overview: AB S.A. is a company that, along with its subsidiaries, focuses on distributing IT products mainly across Poland, the Czech Republic, and Slovakia with a market capitalization of PLN1.67 billion.

Operations: The company's primary revenue stream is from wholesale trade, generating PLN14.65 billion, followed by retail trade at PLN163.80 million and production at PLN39.76 million.

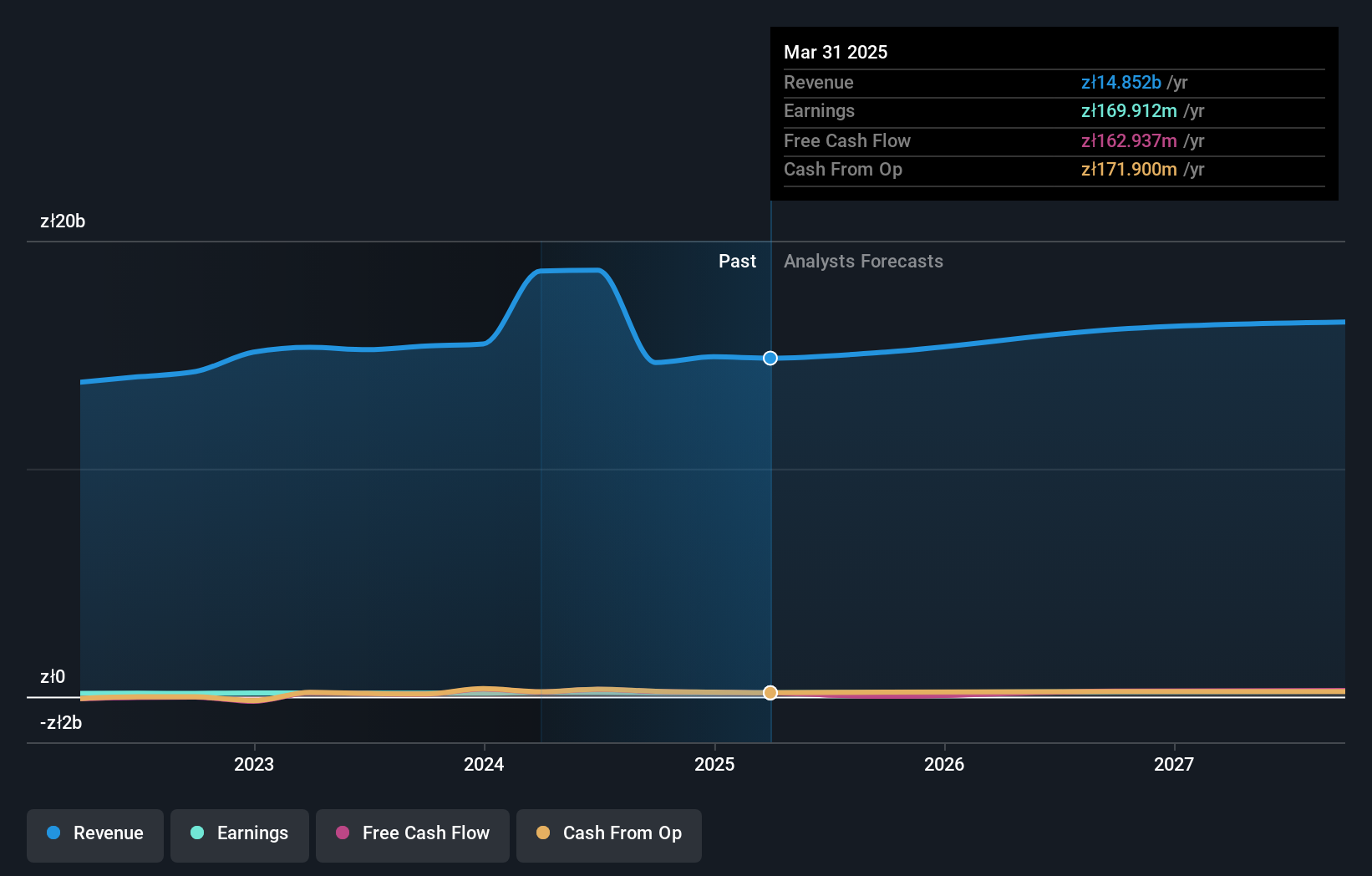

ABE's financials reveal a mixed bag, with its debt to equity ratio impressively dropping from 30.9% to 13.4% over five years, showcasing improved financial health. Despite a recent earnings dip of -10.7%, which lags behind the electronic industry average of 4.2%, ABE is trading at an attractive 42.5% below its fair value estimate, indicating potential upside for investors seeking undervalued opportunities. Interest payments are comfortably covered by EBIT at a multiple of 5.7x, suggesting robust operational efficiency and stability in meeting obligations while maintaining satisfactory net debt levels at just 0.4%.

- Navigate through the intricacies of AB with our comprehensive health report here.

Assess AB's past performance with our detailed historical performance reports.

Make It Happen

- Click this link to deep-dive into the 333 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ABE

AB

Distributes IT products primarily in Poland, the Czech Republic, and Slovakia.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)