- Germany

- /

- Construction

- /

- HMSE:B5A0

Undiscovered Gems in Europe to Explore This March 2025

Reviewed by Simply Wall St

As March 2025 unfolds, the European market is navigating a complex landscape marked by concerns over U.S. trade tariffs and uncertainty in monetary policy, with the pan-European STOXX Europe 600 Index seeing a slight decline amid these challenges. Despite this backdrop, investors are on the lookout for promising opportunities within small-cap stocks that can thrive even in uncertain times, focusing on companies with solid fundamentals and growth potential that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| FRoSTA | 6.15% | 4.78% | 14.67% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

BAUER (HMSE:B5A0)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BAUER Aktiengesellschaft, along with its subsidiaries, offers a range of services, equipment, and products focused on ground and groundwater across various regions including Germany, Europe, the Middle East, the Asia Pacific, Africa, and the Americas with a market capitalization of approximately €230.25 million.

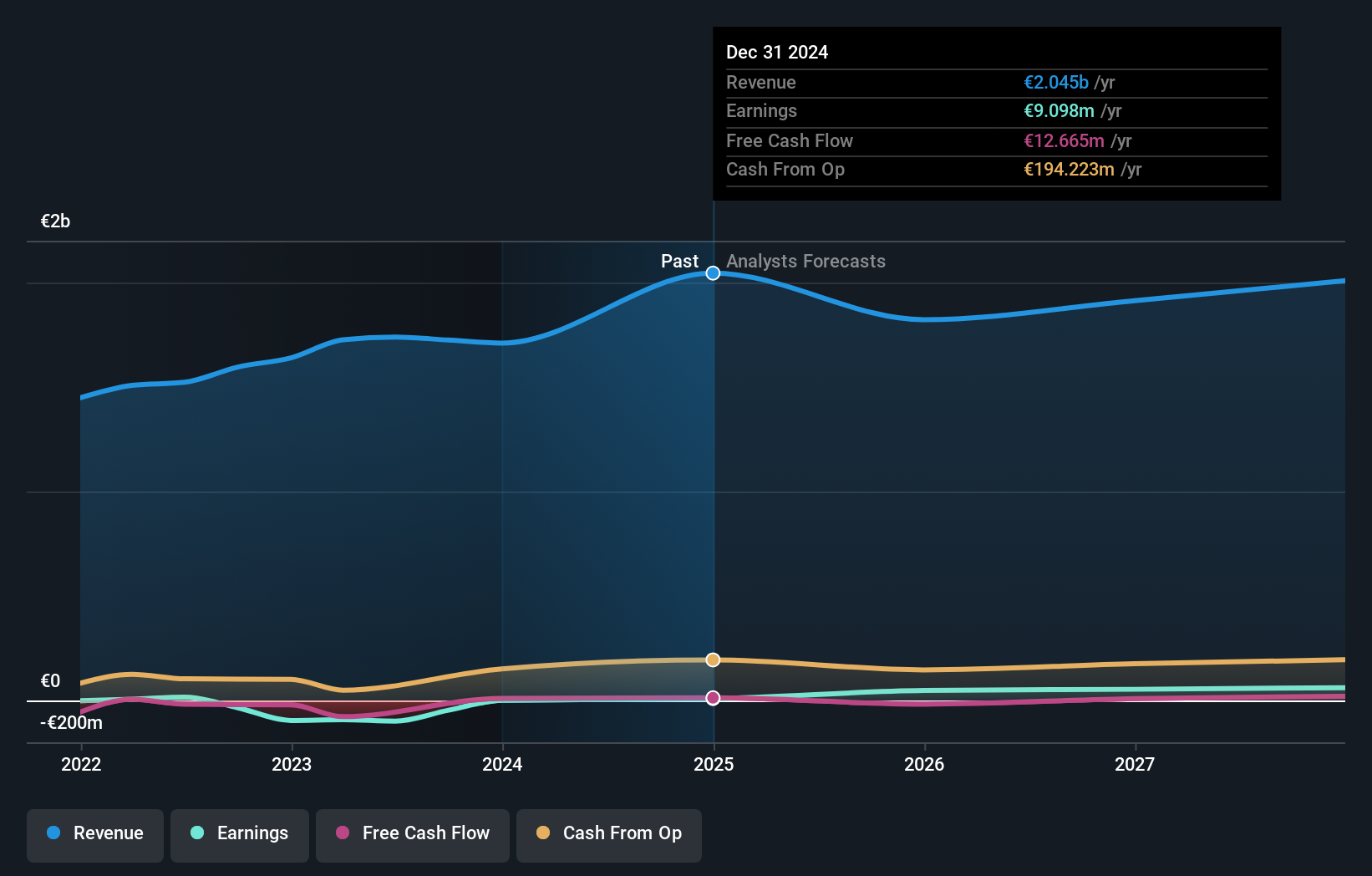

Operations: BAUER generates revenue primarily from its Geotechnical Solutions segment (€859.82 million) and Equipment segment (€593.92 million), with additional contributions from Resources (€248.52 million) and Corporate Services (€2.53 million).

B5A0, a nimble player in the construction sector, has recently turned profitable, showcasing a promising turnaround. Trading at 34.9% below its estimated fair value suggests potential undervaluation. However, with a high net debt to equity ratio of 62.7%, financial leverage remains significant despite reducing from 130.9% over five years. Interest payments are not well covered by earnings, with EBIT covering only twice the interest obligations—below the preferred three times coverage level. The company presented at notable events like Bio360 Expo and Pfahl-Symposium this year, hinting at active industry engagement and future growth prospects in Europe’s construction landscape.

- Delve into the full analysis health report here for a deeper understanding of BAUER.

Examine BAUER's past performance report to understand how it has performed in the past.

Kernel Holding (WSE:KER)

Simply Wall St Value Rating: ★★★★★★

Overview: Kernel Holding S.A. operates a diversified agricultural business across various international markets, including India, Hong Kong, China, Singapore, Switzerland, the Netherlands, Ukraine, and Spain; it has a market capitalization of PLN6.33 billion.

Operations: Kernel Holding generates revenue primarily from its Infrastructure and Trading segment at $2.22 billion, followed by Oilseed Processing at $1.91 billion, and Farming at $560.08 million. The company incurs a reconciliation adjustment of -$753.37 million in its financial statements.

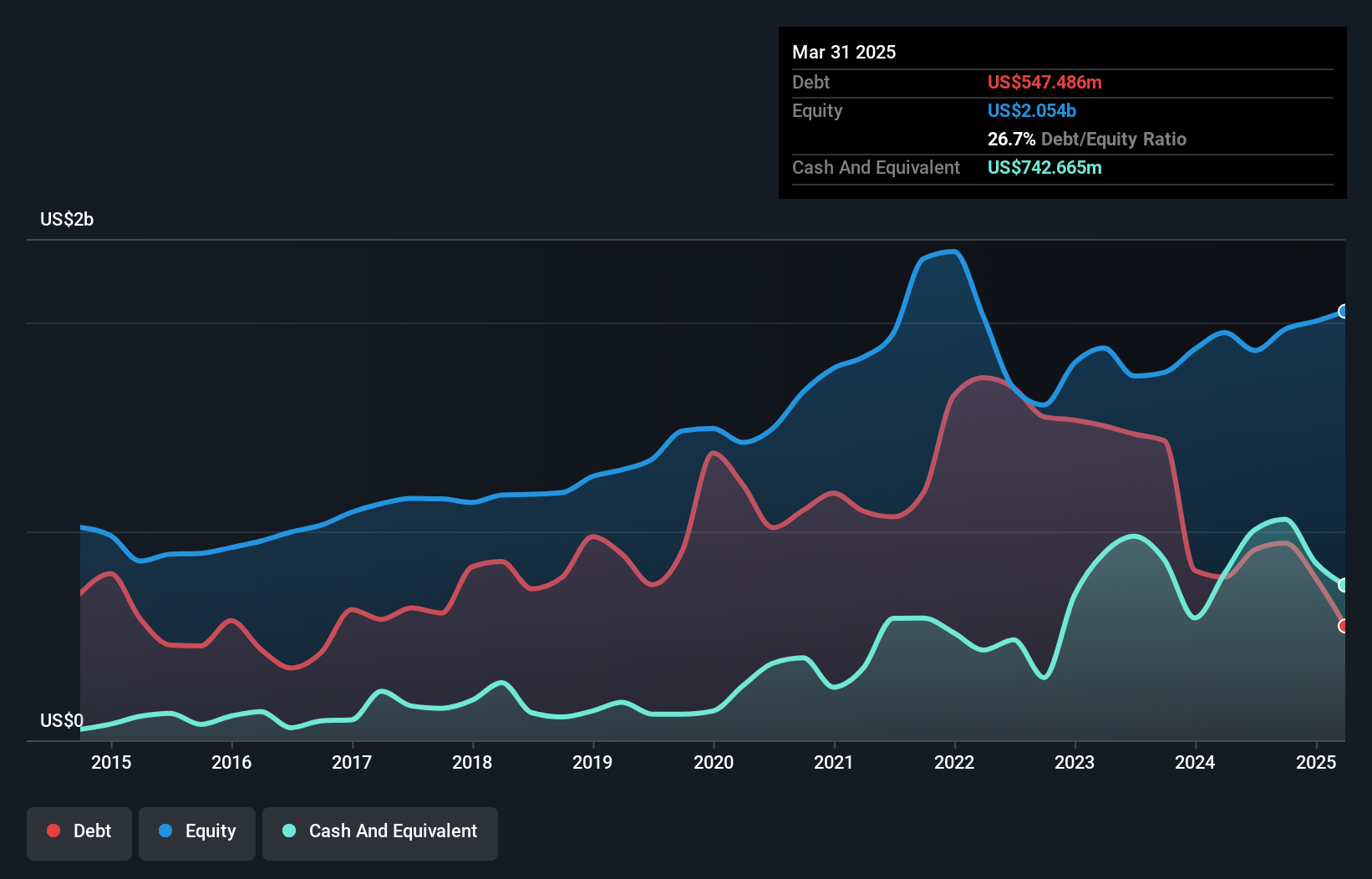

Kernel Holding, a smaller player in the European market, has shown impressive earnings growth of 626.4% over the past year, which is significantly higher than the food industry average of 28.7%. Despite a large one-off loss of US$141 million affecting recent results, their interest payments are comfortably covered by EBIT at 11.4 times. The company has reduced its debt to equity ratio from 92.1% to 38.7% over five years and holds more cash than total debt, indicating financial prudence. With a price-to-earnings ratio of 6.8x below Poland's market average of 12.5x, Kernel seems undervalued relative to its peers.

- Click here and access our complete health analysis report to understand the dynamics of Kernel Holding.

Gain insights into Kernel Holding's historical performance by reviewing our past performance report.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★☆

Overview: EnviTec Biogas AG is engaged in the manufacturing and operation of biogas and biomethane plants across multiple countries including Germany, Italy, and the United States, with a market capitalization of €481.14 million.

Operations: EnviTec Biogas generates revenue primarily from the construction and operation of biogas and biomethane plants. The company focuses on diverse geographical markets, including Germany, Italy, and the United States. It operates with a market capitalization of €481.14 million.

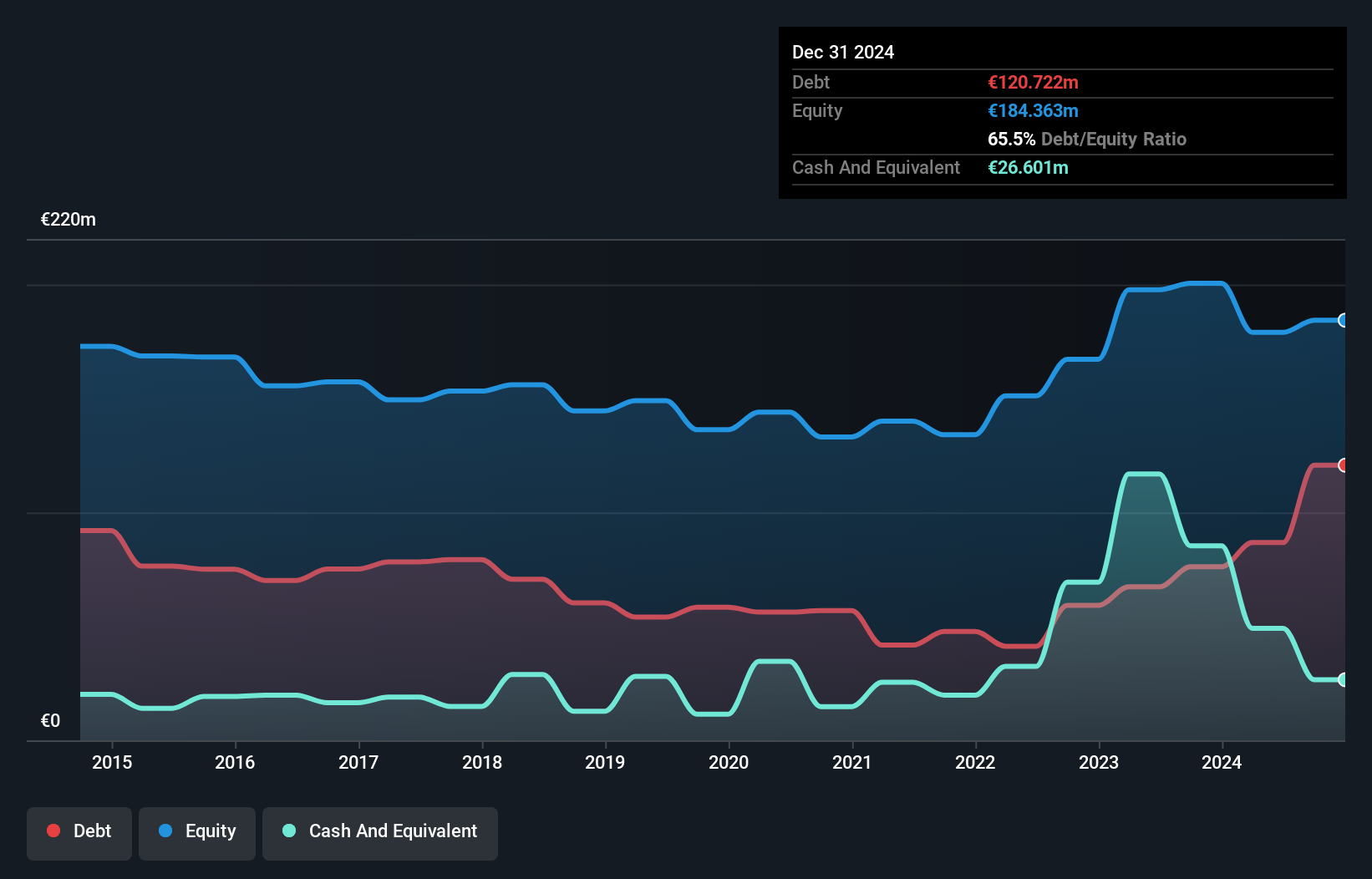

EnviTec Biogas, a smaller player in the energy sector, is trading at 54.9% below its estimated fair value, offering potential for investors seeking undervalued opportunities. Despite facing challenges with a negative earnings growth of -16.5% over the past year, it outperformed the industry average of -26.1%. The company's debt to equity ratio rose from 36.3% to 48.5% over five years, indicating increased leverage but still maintaining a satisfactory net debt to equity ratio of 21%. Additionally, EnviTec's ability to cover interest payments comfortably suggests financial stability amidst its current challenges.

Taking Advantage

- Navigate through the entire inventory of 357 European Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAUER might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HMSE:B5A0

BAUER

Provides services, equipment, and products related to ground and groundwater in Germany, Europe, the Middle East, the Asia Pacific, the Americas., and Africa.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives