RENK Group AG's (FRA:R3NK) P/S Is Still On The Mark Following 39% Share Price Bounce

Despite an already strong run, RENK Group AG (FRA:R3NK) shares have been powering on, with a gain of 39% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 93% in the last year.

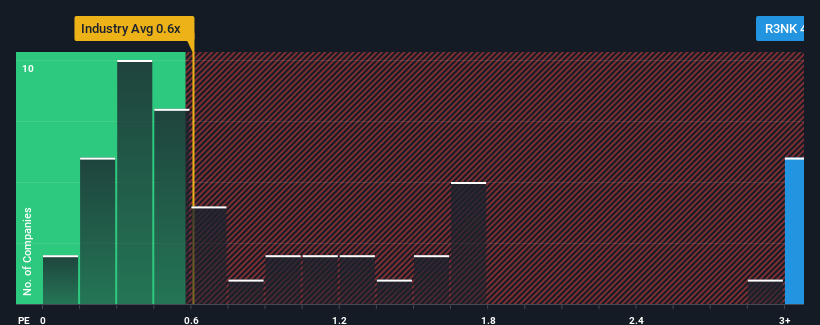

After such a large jump in price, you could be forgiven for thinking RENK Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.8x, considering almost half the companies in Germany's Machinery industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

We've discovered 2 warning signs about RENK Group. View them for free.Check out our latest analysis for RENK Group

What Does RENK Group's P/S Mean For Shareholders?

RENK Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on RENK Group will help you uncover what's on the horizon.How Is RENK Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as RENK Group's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow revenue by 63% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 17% per year over the next three years. That's shaping up to be materially higher than the 11% per year growth forecast for the broader industry.

In light of this, it's understandable that RENK Group's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to RENK Group's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of RENK Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for RENK Group (1 shouldn't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives