As Europe shows signs of economic recovery, with Germany's DAX index recently gaining 2.39%, investors are cautiously optimistic about the region's financial health. In this context, exploring dividend stocks in Germany could be particularly interesting, as these stocks often provide potential income stability amidst market fluctuations.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.38% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.76% | ★★★★★★ |

| Talanx (XTRA:TLX) | 3.31% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.08% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 5.78% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.31% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 7.09% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.21% | ★★★★★☆ |

| Bayerische Motoren Werke (XTRA:BMW) | 5.62% | ★★★★★☆ |

| K+S (XTRA:SDF) | 5.14% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

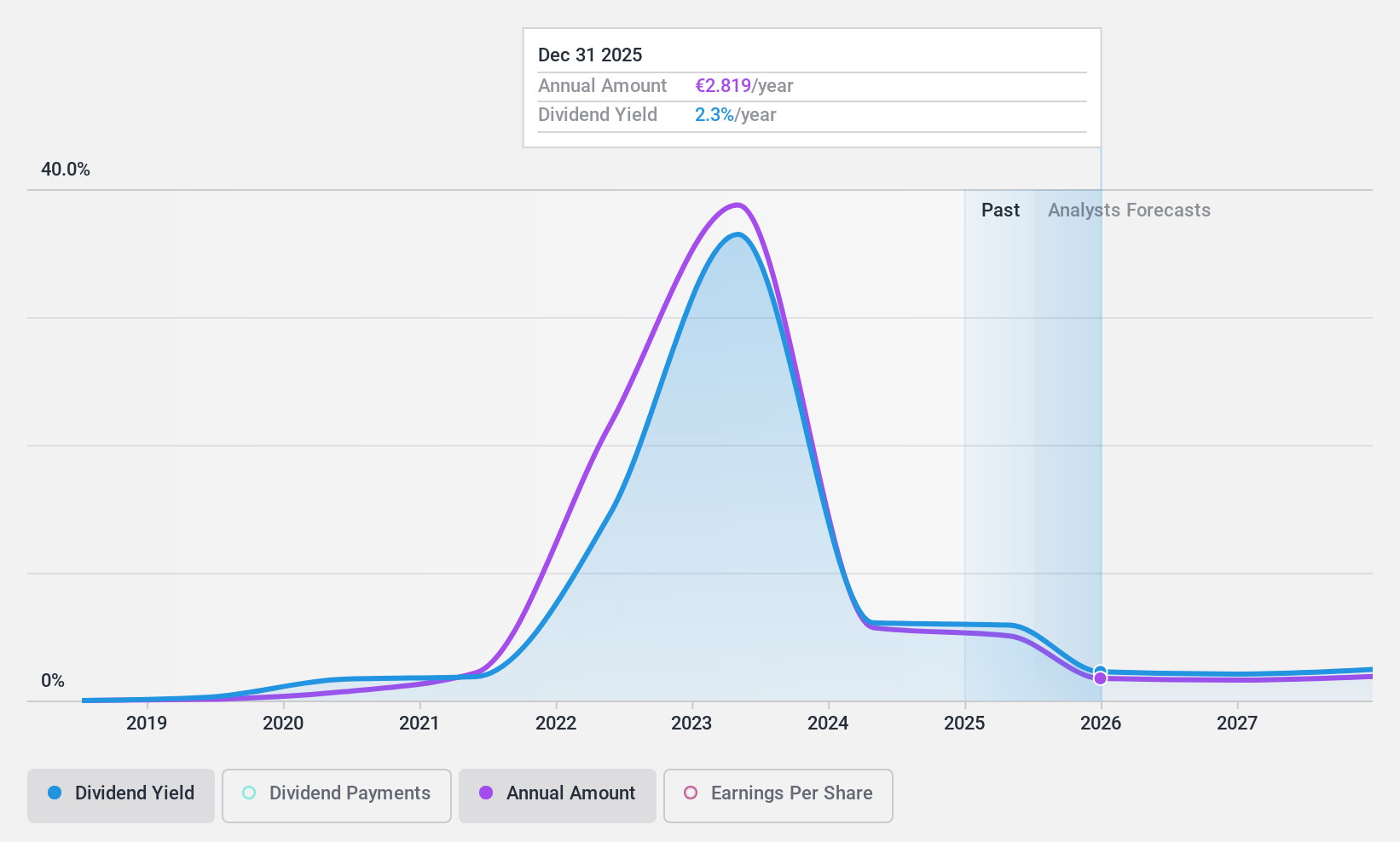

Hapag-Lloyd (XTRA:HLAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hapag-Lloyd Aktiengesellschaft operates globally as a liner shipping company, with a market capitalization of approximately €29.40 billion.

Operations: Hapag-Lloyd generates €17.76 billion from liner shipping and €0.19 billion from terminal and infrastructure activities.

Dividend Yield: 5.5%

Hapag-Lloyd, despite a significant drop in sales from EUR 34.54 billion to EUR 17.93 billion and net income from EUR 17.03 billion to EUR 2.94 billion in 2023, maintains a dividend of EUR 9.25 per share totaling EUR 1.6 billion for the year, reflecting a payout ratio of 55.4% covered by earnings and a cash payout ratio of 49.8%. However, the company's dividends have shown volatility over the past five years with an unreliable growth pattern, posing concerns about sustainability despite being in the top quartile for dividend yield among German stocks at 5.53%.

- Click to explore a detailed breakdown of our findings in Hapag-Lloyd's dividend report.

- Upon reviewing our latest valuation report, Hapag-Lloyd's share price might be too optimistic.

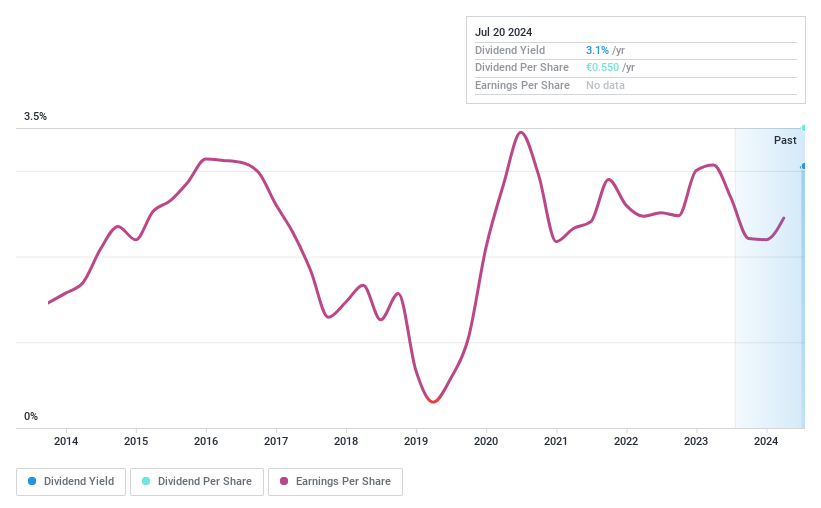

USU Software (XTRA:OSP2)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: USU Software AG operates in Germany and globally, offering software and service solutions for IT and customer service management, with a market capitalization of approximately €183.67 million.

Operations: USU Software AG generates revenue through its Product Business and Service Business segments, totaling €90.33 million and €41.75 million respectively.

Dividend Yield: 3%

USU Software AG's dividend sustainability is questionable with a payout ratio of 104.2% and cash payout ratio at 88.9%, indicating dividends are not well-covered by earnings or free cash flow. Despite this, dividends have grown consistently over the past decade and remain stable. The company reported a decline in net income from EUR 7.58 million to EUR 5.28 million in 2023, alongside plans to delist due to the high costs of regulatory compliance outweighing the benefits of being publicly traded, which could impact future dividend reliability and investor accessibility.

- Click here to discover the nuances of USU Software with our detailed analytical dividend report.

- Our valuation report unveils the possibility USU Software's shares may be trading at a premium.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG specializes in car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market capitalization of approximately €531.28 million.

Operations: WashTec AG generates €378.85 million in revenue from Europe, €102.89 million from North America, and €19.17 million from the Asia Pacific region.

Dividend Yield: 5.5%

WashTec AG, while offering a competitive dividend yield of 5.54%, faces challenges with its dividend sustainability due to a high payout ratio of 105.3%. Despite this, dividends have grown over the past decade. Recent financials show modest year-on-year growth with full-year sales reaching €489.47 million and net income at €27.97 million. However, quarterly comparisons reveal a dip in sales and net income, underscoring potential volatility in earnings which could impact future dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of WashTec.

- Upon reviewing our latest valuation report, WashTec's share price might be too pessimistic.

Turning Ideas Into Actions

- Investigate our full lineup of 27 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:OSP2

USU Software

Provides software and service solutions for information technology (IT) and customer service management in Germany and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives