Singulus Technologies AG (ETR:SNG) Might Not Be As Mispriced As It Looks After Plunging 25%

The Singulus Technologies AG (ETR:SNG) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

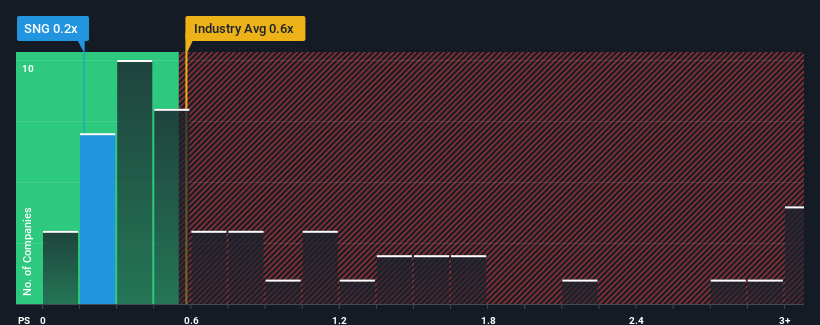

Although its price has dipped substantially, it's still not a stretch to say that Singulus Technologies' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Machinery industry in Germany, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Singulus Technologies

What Does Singulus Technologies' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Singulus Technologies' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Singulus Technologies.How Is Singulus Technologies' Revenue Growth Trending?

Singulus Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 146% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 30% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 4.4% each year, which is noticeably less attractive.

In light of this, it's curious that Singulus Technologies' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Singulus Technologies looks to be in line with the rest of the Machinery industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Singulus Technologies' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 4 warning signs we've spotted with Singulus Technologies (including 2 which are potentially serious).

If you're unsure about the strength of Singulus Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SNG

Singulus Technologies

Develops and assembles machines and systems for thin-film coating and surface treatment processes worldwide.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)