- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

February 2025's Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, investors are keenly observing how these factors influence stock valuations. Despite recent declines in major indexes like the S&P 500, opportunities may exist for discerning investors to identify stocks that appear undervalued relative to their estimated worth. In such a market environment, a good stock might be one that demonstrates strong fundamentals and resilience amidst external pressures, offering potential value as broader economic conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIP (TSE:2379) | ¥2275.00 | ¥4529.30 | 49.8% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | US$29.57 | US$58.94 | 49.8% |

| Biotage (OM:BIOT) | SEK138.70 | SEK273.61 | 49.3% |

| People & Technology (KOSDAQ:A137400) | ₩41400.00 | ₩81928.41 | 49.5% |

| Solum (KOSE:A248070) | ₩17570.00 | ₩34836.48 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.19 | CN¥29.99 | 49.3% |

| Canatu Oyj (HLSE:CANATU) | €12.50 | €24.79 | 49.6% |

| RENK Group (DB:R3NK) | €24.94 | €49.37 | 49.5% |

| Marcus & Millichap (NYSE:MMI) | US$37.27 | US$73.76 | 49.5% |

| Kyndryl Holdings (NYSE:KD) | US$41.54 | US$82.14 | 49.4% |

Let's dive into some prime choices out of the screener.

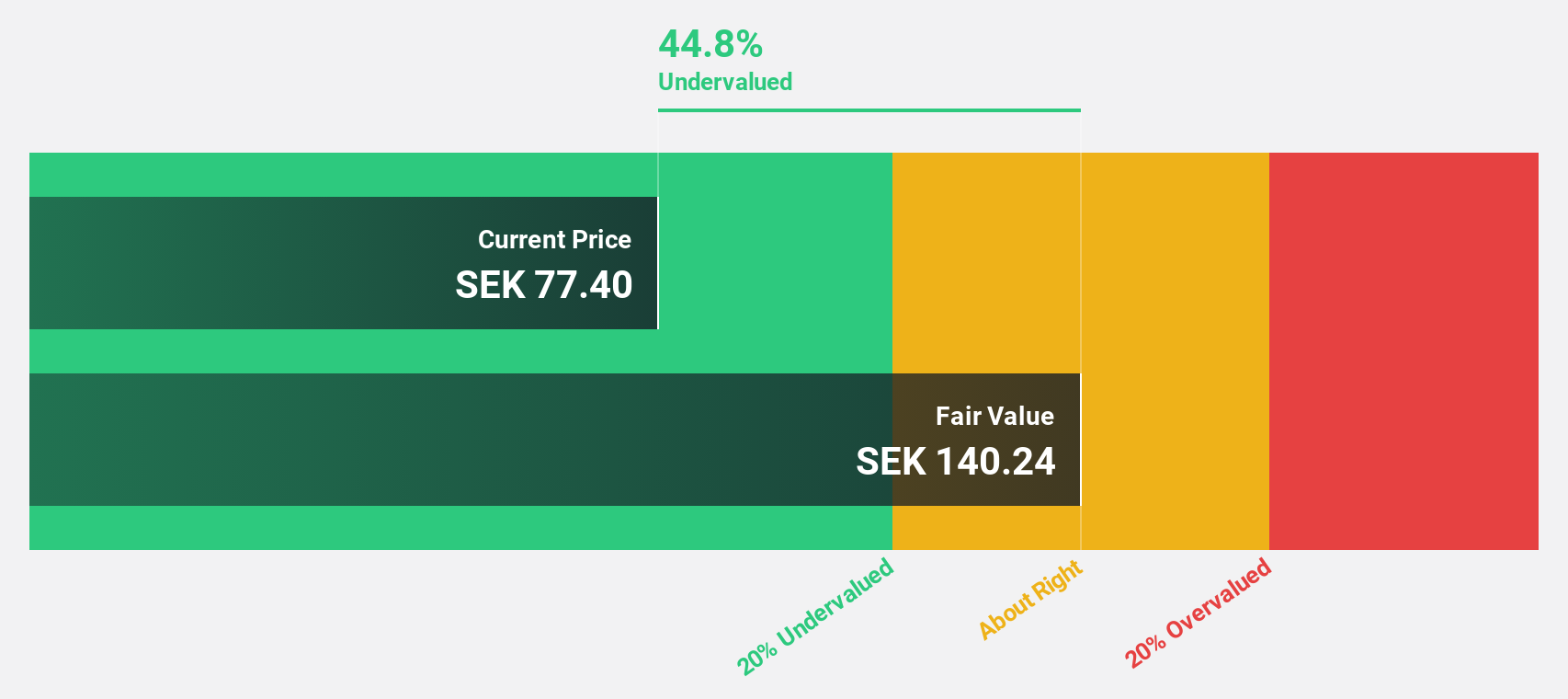

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, Asia, Oceania, and India with a market cap of approximately SEK284.22 billion.

Operations: Ericsson's revenue is derived from three main segments: Networks (SEK158.21 billion), Enterprise (SEK24.86 billion), and Cloud Software and Services (SEK62.64 billion).

Estimated Discount To Fair Value: 46%

Telefonaktiebolaget LM Ericsson is trading significantly below its estimated fair value, presenting a potential opportunity for investors focused on cash flows. Despite one-off items affecting results, the company's earnings are expected to grow substantially over the next three years, outpacing the Swedish market. Recent product announcements highlight Ericsson's innovation in energy-efficient and scalable network solutions, potentially enhancing future cash flows. However, revenue growth remains modest at 1.8% annually compared to broader market expectations.

- The growth report we've compiled suggests that Telefonaktiebolaget LM Ericsson's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Telefonaktiebolaget LM Ericsson.

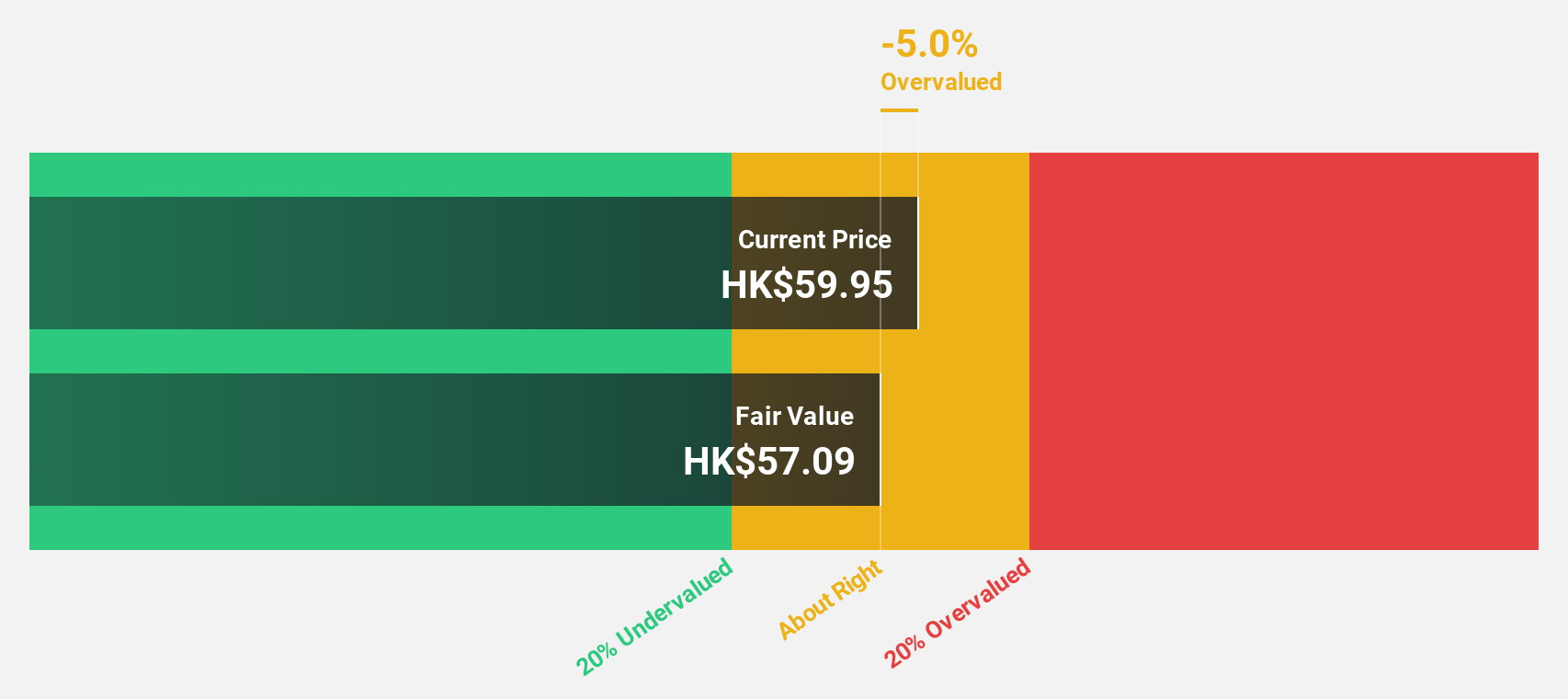

Xiaomi (SEHK:1810)

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market cap of approximately HK$1.05 trillion.

Operations: The company's revenue segments include Smartphones at CN¥184.68 billion, Internet Services generating CN¥32.66 billion, and IoT and Lifestyle Products contributing CN¥93.58 billion.

Estimated Discount To Fair Value: 15.6%

Xiaomi Corporation is trading at HK$41.65, below its estimated fair value of HK$49.37, suggesting it may be undervalued based on cash flows. The company reported strong earnings growth, with net income rising to CNY 5.35 billion in Q3 2024 from CNY 4.87 billion a year ago, and sales increasing significantly over the same period. Despite a low forecasted return on equity of 15.7%, Xiaomi's earnings are expected to grow faster than the Hong Kong market average over the next three years.

- Our comprehensive growth report raises the possibility that Xiaomi is poised for substantial financial growth.

- Navigate through the intricacies of Xiaomi with our comprehensive financial health report here.

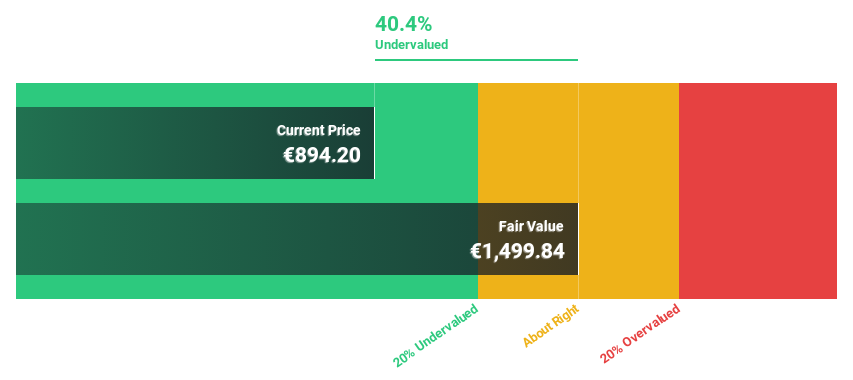

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a global provider of mobility and security technologies, with a market cap of €32.87 billion.

Operations: The company's revenue is derived from its mobility and security technology segments, contributing to its global operations.

Estimated Discount To Fair Value: 49.2%

Rheinmetall is trading at €757, significantly below its estimated fair value of €1490.62, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow at 30.5% annually, outpacing the German market's growth rate of 19.2%. Additionally, revenue is expected to increase by 22% annually, surpassing the market average of 5.8%. Recent strategic alliances further bolster Rheinmetall's position in advanced military simulation technologies.

- Our earnings growth report unveils the potential for significant increases in Rheinmetall's future results.

- Click here to discover the nuances of Rheinmetall with our detailed financial health report.

Where To Now?

- Access the full spectrum of 906 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives