- Germany

- /

- Aerospace & Defense

- /

- XTRA:OHB

News Flash: 3 Analysts Think OHB SE (ETR:OHB) Earnings Are Under Threat

The latest analyst coverage could presage a bad day for OHB SE (ETR:OHB), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

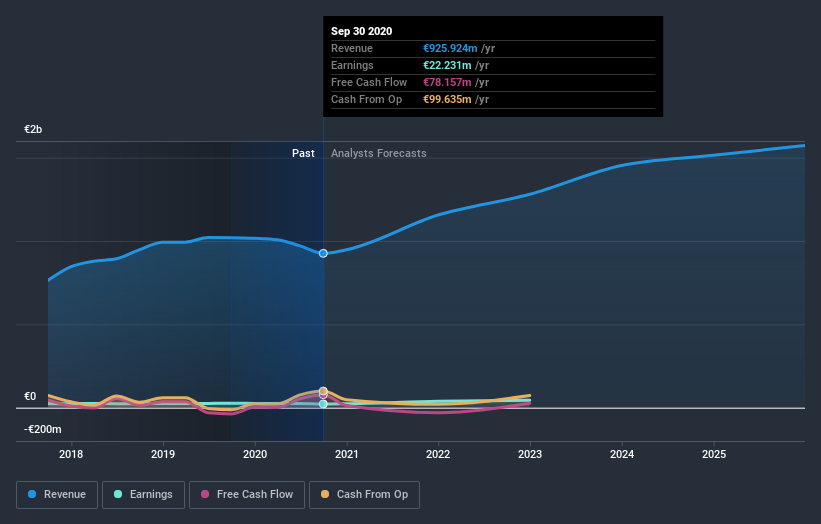

After the downgrade, the three analysts covering OHB are now predicting revenues of €1.1b in 2021. If met, this would reflect a decent 19% improvement in sales compared to the last 12 months. Per-share earnings are expected to bounce 38% to €1.76. Previously, the analysts had been modelling revenues of €1.3b and earnings per share (EPS) of €2.10 in 2021. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a considerable drop in earnings per share numbers as well.

View our latest analysis for OHB

Analysts made no major changes to their price target of €43.67, suggesting the downgrades are not expected to have a long-term impact on OHB's valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on OHB, with the most bullish analyst valuing it at €49.00 and the most bearish at €42.00 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting OHB is an easy business to forecast or the underlying assumptions are obvious.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting OHB's growth to accelerate, with the forecast 19% growth ranking favourably alongside historical growth of 8.2% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.7% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that OHB is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on OHB after the downgrade.

Worse, OHB is labouring under a substantial debt burden, which - if today's forecasts prove accurate - the forecast downgrade could potentially exacerbate. You can learn more about our debt analysis for free on our platform here.

You can also see our analysis of OHB's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

When trading OHB or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:OHB

OHB

Operates as a space and technology company in Germany, rest of Europe, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives